The very first thing to be noted for clarity is that everything in the cryptocurrency world at this time is federally taxed in fiat currency like the USD because the IRS recognizes cryptocurrency as property as of 2014.

Firstly, what are the categories of cryptocurrency income?

- Capital assets (income from investing activities like buying, selling, and trading)

- Ordinary Income (earning cryptocurrency from work like mining, staking, and interest rewards)

Detailed bookkeeping is absolutely necessary so that taxable events may be accounted for accurately. Here is a list of taxable events:

- Selling cryptocurrency for USD

- Trade one cryptocurrency for another (e.g. Bitcoin for Ethereum)

- Using cryptocurrency to buy goods and services

- Earning cryptocurrency (e.g. as a miner or stakeholder)

With this in mind, it’s helpful to pull together all of your transaction activity across accounts into one platform. CoinLedger is an excellent platform that allows you to search and link your exchange and wallet accounts and observe all of your history in one place.

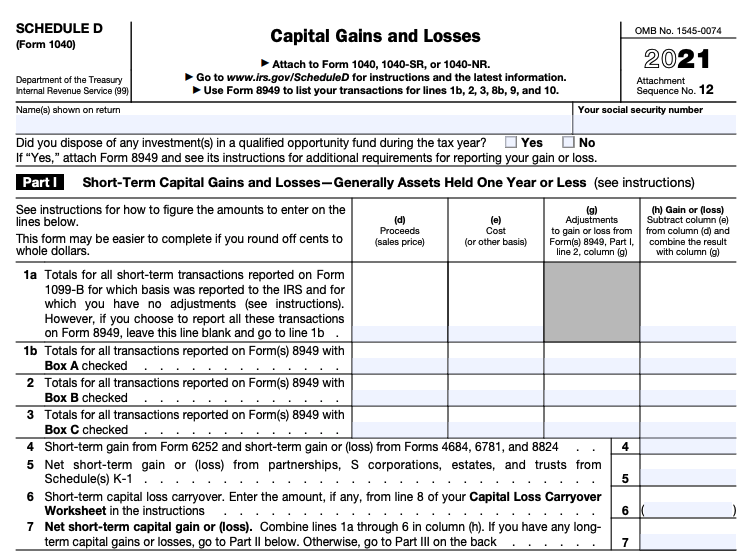

For capital assets, you can report each and every one of your trades, gains, and losses, in IRS Form 8949. Once this form is filled out, you may send it to your trusted tax professional or online tax-filing platform like TurboTax, TaxAct, or H&R Block.

Ordinary income from all of your crypto-related payments are more nuanced and could be classified as self-employment income (Section C), interest rewards (Schedule 1), or other depending on the situation. If you’re wondering where your earnings are most accurately classified, reach out to help@cryptotrader.tax for further guidance from knowledgeable representatives.

With crypto being an alternative form of currency, some may sweat a bit pondering how they might account for it during tax season. All things are converted and handled to USD for this regulation. Keeping this in mind, after reporting all of the details in the forms mentioned above, the rest should be facilitated as usual through your normal tax processes. Best to your earnings and reporting!