That is an opinion editorial by Kudzai Kutukwa, a passionate monetary inclusion advocate who was acknowledged by Quick Firm journal as one among South Africa’s top-20 younger entrepreneurs below 30.

Our society right now is suffering from a belief drawback. The establishments that govern our world are constructed on belief whereas they’ve now confirmed to be untrustworthy. On February 11, 2009, Satoshi Nakamoto posted a thread stating,

“I’ve developed a brand new open supply P2P e-cash system known as Bitcoin. It is fully decentralized, with no central server or trusted events, as a result of every little thing relies on crypto proof as a substitute of belief. […] The foundation drawback with standard forex is all of the belief that is required to make it work. The central financial institution should be trusted to not debase the forex, however the historical past of fiat currencies is filled with breaches of that belief. Banks should be trusted to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with barely a fraction in reserve.”

By growing a decentralized financial system that made trusted third events (the banking system) out of date, Nakamoto additionally chipped away on the supply of their energy: the cash printer. It’s the cash printer that made it attainable for a small clique of central bankers to centralize and seize management of the worldwide financial system. Although waning, they proceed to wield this energy to this present day.

The highest-down, centralized decision-making construction isn’t distinctive to central banking, nevertheless it pervades all spectra of the political establishments that govern our society right now. The World Financial Discussion board (WEF), the Financial institution of Worldwide Settlements, the Worldwide Financial Fund (IMF), the U.S. Federal Reserve, the European Central Financial institution and the United Nations are however a couple of examples of the central planners of our day answerable for setting coverage suggestions and regulatory frameworks that vary from rates of interest to carbon emissions. Whereas, for essentially the most half, these organizations are credible and reliable, most of the time, the coverage suggestions they make create extra hurt than good when carried out on the neighborhood degree. A current instance of this could be Sri Lanka, which isn’t solely bankrupt, however can be experiencing hyperinflation and shortages of primary necessities equivalent to meals, gas and drugs.

Whereas this financial collapse was attributable to quite a few elements; one of many greatest elements behind Sri Lanka’s demise is its assist for “the present factor,” i.e., prioritizing ESG compliance over meals manufacturing. The megazord acronym “ESG” is the brainchild of the U.N. and stands for environmental, social and governance. It’s meant to be a set of funding standards that information firms and governments to “additional develop sustainable investments.” Sri Lanka has an distinctive ESG rating of 98 that trumps that of each Sweden (96) and the US (51). With the intention to obtain their ESG-inspired, virtue-signaling purpose of being the primary “natural nation,” the federal government abruptly banned using chemical fertilizers in April 2021. This led to a dramatic drop in yields throughout the board and by the point the federal government realized their blunder and tried reversing course in November 2021, the harm had already been carried out.

(Source)

In line with environmental activist Michael Shellenberger,

“[O]ne-third of Sri Lanka’s farm lands had been dormant in 2021 as a result of fertilizer ban. Over 90% of Sri Lanka’s farmers had used chemical fertilizers earlier than they had been banned. After they had been banned, an astonishing 85% skilled crop losses. The numbers are surprising. After the fertilizer ban, rice manufacturing fell 20% and costs skyrocketed 50 p.c in simply six months. Sri Lanka needed to import $450 million price of rice regardless of having been self-sufficient within the grain simply months earlier. The value of carrots and tomatoes rose five-fold. Whereas there are simply two million farmers in Sri Lanka, 15 million of the nation’s 22 million persons are instantly or not directly depending on farming.”

The larger query is, how on Earth did Sri Lanka discover itself in such a self-inflicted mess? Effectively, the brief reply is: They had been ill-advised by the likes of the WEF to go down this path of defending the surroundings on the expense of severely compromising their meals safety. ESG has formally collapsed its first nation, similar to the IMF structural adjustment applications did within the Nineteen Eighties and Nineteen Nineties.

In a 2016 article, penned in collaboration with the WEF, economist Joseph Stiglitz showered reward on Sri Lanka’s general financial growth and wrote, “Given its training ranges, Sri Lanka could possibly transfer instantly into extra technologically superior sectors, high-productivity natural farming, and higher-end tourism.”

It’s this very prescription that has failed dismally and the folks of Sri Lanka at the moment are going through the dire penalties of financial destruction, not “consultants” like Joseph Stiglitz. What is usually recommended as an answer for the devastation attributable to horrible concepts? Extra horrendous concepts from the establishments that brought on the preliminary drawback. In April 2022, as the federal government was negotiating with the IMF for a bailout, the United Nations Improvement Programme doubled down by recommending that the Sri Lankan authorities ought to turn out to be a candidate for a “debt for nature swap” that will unlock debt reduction in trade for investing a hard and fast sum on nature conservation. Moreover, in Could 2022, Sri Lanka signed onto a inexperienced finance taxonomy with the Worldwide Finance Company that, amongst different issues, features a dedication to natural fertilizers. It seems that they’re decided to carry the road in assist of “the present factor.”

Regardless of the obvious failure of those insurance policies in Sri Lanka, the Dutch authorities additionally threw their hat into the ring and is actively pursuing comparable insurance policies. The Dutch authorities is aiming for a 50% discount in general nitrogen greenhouse gasoline emissions by 2030. A 25 billion euro Nitrogen Fund was set as much as assist farmers (voluntarily) stop, relocate or downsize their enterprise and make them extra “nature pleasant” (e.g. natural farming similar to in Sri Lanka). The Dutch Minister for Nitrogen and Nature Coverage, Ms. Christianne van der Wal, indicated that she expects about one-third of the Netherlands’ 50,000 farms to vanish by 2030 on account of the plans and went on to level out that expropriation of farms was on the desk as a measure of final resort ought to the farmers refuse to cooperate. Is that this the half the place they may own nothing and be happy?

(Source)

Moreover, so as to adjust to this draconian emissions goal decreed by the federal government, at the least 30% of all cows, chickens and pigs should be culled. This has sparked protests by farmers who object to those inexperienced dictates. These protests are paying homage to the Canadian Trucker protests earlier this 12 months, and we now have now seen farmers from Spain, Italy, Germany and Poland staging comparable protests in a present of solidarity with their Dutch counterparts.

Along with being the second largest exporter of meals on the earth after the U.S., the Netherlands can be the biggest exporter of meat throughout the EU. Ought to the Dutch central planners have their means, it’s seemingly the Netherlands will be a part of Sri Lanka on the checklist of nations destroyed by “the present factor.” Equally, in an effort to chop emissions by half by 2030, each the U.S. and U.Okay. at the moment have completely different variations of “pay farmers to not farm” schemes in place. 35,000 acres of rice fields in California will stay unused, whereas within the U.Okay., dairy and meat farmers are being inspired to retire in trade for a one-time cost of as much as 100,000 kilos. The Canadian authorities additionally intends to implement comparable insurance policies in an effort to cut back nitrogen greenhouse gasses by 30% by the 12 months 2030. To not be outdone, the New Zealand authorities unveiled plans to tax livestock for belching and flatulence, which they hope will scale back emissions. Such is the infinite knowledge of the central planners working the world right now.

On the floor, ESG virtue-signaling could appear to be overzealous makes an attempt by governments to do obeisance to “the present factor” in assembly their emissions targets, however these insurance policies do seem to be deliberate makes an attempt to massively shrink the farming sector whereas nationalizing agricultural land within the course of. In line with the U.N., there’s a looming meals disaster across the nook. In a current report, the World Meals Program warned that 670 million folks on common might be on the verge of hunger by the top of the last decade. If that is true, why are governments world wide hindering the work of farmers?

Whereas the WEF central planners are actively selling “climate-smart” farming strategies to make the total change to net-zero, nature-positive meals techniques by 2030, the disaster in Sri Lanka is proof that it’s a path that seemingly ends in catastrophe. Whereas this strategy works for smaller communities, as of right now, natural farming alone isn’t sufficient to maintain large-scale farming. A full change to natural farming would require extra land use — one thing the Dutch don’t have quite a lot of — and thus, extra agricultural inputs to match present manufacturing ranges required to feed giant city populations. Sarcastically, natural farming is unsustainable each economically and environmentally. For instance, a everlasting transition to natural manufacturing in Sri Lanka would scale back yields of each main crop; about 30% for coconut, 50% for tea, 50% for corn and 35% for rice. Why any sane authorities would embark on such a radical experiment is thoughts boggling.

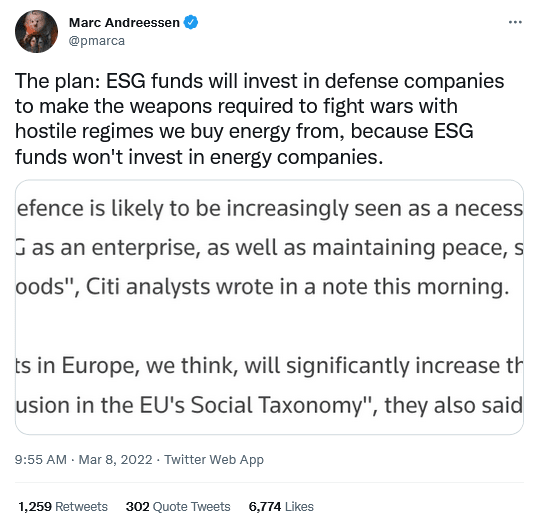

In line with Bloomberg, ESG is the quickest rising asset administration class, which at the moment has $35 trillion belongings below administration and is anticipated to exceed $50 trillion by 2025. Regardless of sounding altruistic on the floor, ESG is definitely a political metric that’s used to not directly management personal corporations by central planners by influencing the path of capital flows to investments that they deem “sustainable.”

It’s a mechanism to additional centralize capital markets within the arms of the central planners who get to select winners and losers primarily based on adherence to a subjective and opaque standards, as a substitute of on the premise of worth created. ESG is analogous to feudalism, in that an elite group of central planners and their cantillionaire cronies allocate capital to causes that additional enrich themselves within the identify of “social good.” This state of affairs is in stark distinction to Bitcoin which upends this dynamic by guaranteeing inalienable property rights to all contributors throughout the community, not simply to an elite few. In the identical means that the Chinese language Communist Occasion’s social credit score system scores a person primarily based on their allegiance to the state, company corporations in addition to nation-states pledge their fealty to woke institutional traders and the Davos elite with their ESG scores.

ESG is a mirror picture of our fiat financial system that distorts value indicators throughout the financial system, making it nearly inconceivable to precisely measure which financial actions are creating essentially the most worth. Identical to the fiat system, ESG adherence additionally encourages misallocation of capital assets and disrupts significant productiveness. Ernst & Younger additionally level out that ESG isn’t solely complicated and opaque, however can be weak to rampant greenwashing. With this in thoughts, it’s astonishing that sovereign states are jostling over one another to acquire increased ESG scores by implementing insurance policies which might be self-destructive. How can an unjust financial system produce a simply society? Or as Jeff Sales space places it in “The Worth Of Tomorrow,” “How is it attainable to resolve local weather change from an financial system that requires inflation?” Any nation or firm that destroys its productive capability will collapse irrespective of how excessive their ESG rating is.

(Source)

In his traditional essay, “The Use of Data in Society,” famend Austrian economist Friedrich Hayek wrote,

“The financial drawback of society is thus not merely an issue of find out how to allocate ‘given’ assets—if ‘given’ is taken to imply given to a single thoughts which intentionally solves the issue set by these ‘knowledge.’ It’s moderately an issue of find out how to safe the very best use of assets recognized to any of the members of society, for ends whose relative significance solely these people know. Or, to place it briefly, it’s a drawback of the utilization of information which isn’t given to anybody in its totality.”

Central planners aren’t omniscient and due to this fact can not precisely steer a whole financial system that’s composed of infinite advanced systemic interactions that every require specialised information. Data which isn’t resident in any single particular person or establishment. Regardless of this apparent reality, a handful of central planners are slowly collapsing meals manufacturing with their insurance policies that don’t issue within the unintended penalties of their choices.

As a totally decentralized system, Bitcoin is the antithesis of central planning. It didn’t simply turn out to be the beacon of a extra simply monetary system nevertheless it represents a extra superior governance mannequin. Because of proof of labor, all of the nodes are in a position to arrive on the identical reality independently with out a government’s coordination. The true embodiment of guidelines with out rulers.

Our present monetary system is fueled by credit score enlargement and consumption. Such a system requires exponential development to maintain itself. The top result’s that the cash provide continues to broaden and cash steadily loses its skill to coordinate financial actions effectively. Worth indicators are mutilated within the course of, thus erecting an financial Tower of Babel.

ESG is an assault vector that features management of capital markets by this limitless manipulation of cash. The financial insurance policies which might be being pursued globally by central planners are at odds with technological features that will lead to decrease costs of products over time. As a substitute, society is being stored on the treadmill of ever-increasing costs that require extra consumption and extra manufacturing advert infinitum so as to shield a credit-based system that will in any other case implode.

Political metrics like ESG don’t maintain sway over Bitcoin as a result of it’s a financial system that’s anchored in goal reality. This opens up the room for capital allocation primarily based solely on financial potential and worth created — versus “woke” capital allocation. De-growth methods, top-down centralized administration of assets and management of capital allocation by way of ESG are options (not bugs) of the present monetary system. Nations like Sri Lanka are prime examples of the destruction ESG has brought on.

The assaults clothed as ESG which might be being meted out towards farmers are strikingly comparable to those who are often directed at bitcoin miners. As essentially the most safe pc community on the earth, Bitcoin is censorship resistant and doesn’t bow to the tyrannical whims of central planners who’ve intentions of weaponizing the monetary system towards protesters. Not like the Dutch farmland that’s susceptible to being confiscated, bitcoin can’t be confiscated by way of laws; it’s cash that you simply really personal. It’s because of this that the vitality utilization of bitcoin mining has been incessantly attacked by ESG evangelists by coordinated media campaigns that painting bitcoin mining as an existential menace to the surroundings. This has resulted in some jurisdictions, just like the EU, contemplating banning proof-of-work mining, like how the Dutch authorities is attempting to eliminate a few of its farmers. The reality is, bitcoin mining’s vitality combine has the best penetration of renewables of any trade on the earth, plus it monetizes stranded vitality that will have in any other case been wasted. A reality the ESG warriors conveniently ignore.

The time has come for the creation of bitcoin round economies and for us to assist our farmers so as to shield our meals techniques from Malthusian central planners. As a substitute of bowing to their zero-sum worldview, commerce teams just like the Beef Initiative ought to turn out to be the norm. These bitcoin-based commodity markets and/or exchanges may also play a giant position in offering farmers with entry to international markets in a frictionless method. As well as, orange-pilling nation states is now extra vital than ever for 2 main causes: First, it should give nations options for elevating capital, just like the volcano bonds, that aren’t tied to “woke” capital with diabolical strings connected. Second, it should produce examples of the prosperity a nation with sound cash can obtain. Samson Mow and JAN3 are doing nice work on this entrance, however there’s room for extra to affix.

In conclusion, ought to present developments of kowtowing to ESG by governments proceed, Sri Lanka will find yourself being a harbinger of bigger issues to return within the months forward.

This can be a visitor publish by Kudzai Kutukwa. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc. or Bitcoin Journal.