Watch This Episode On YouTube or Rumble

Hear To This Episode Right here:

“Fed Watch” is the macro podcast for Bitcoiners. Every episode we talk about present occasions in macro from throughout the globe, with an emphasis on central banks and currencies.

On this episode, Christian Keroles and I cowl developments in Japan, with regard to yield curve management (YCC); within the U.S., with regard to progress and inflation forecasts; and in Europe, regarding the concern about fragmentation. On the finish of the episode, we have fun the a hundredth episode of “Fed Watch” by reviewing among the friends and calls we now have made all through the present’s historical past.

Massive Bother In Japan

The financial troubles in Japan are legendary at this level. They’ve suffered by means of a number of misplaced many years of low progress and low inflation, addressed by the most effective financial coverage instruments of the day, by among the finest consultants in economics (perhaps that was the error). None of it has labored, however let’s take a minute to overview how we bought right here.

Japan entered their recession/despair in 1991 after their large asset bubble burst. Since that point, Japanese financial progress has been averaging roughly 1% per 12 months, with low unemployment and really low dynamism. It isn’t damaging gross home product (GDP) progress, but it surely’s the naked minimal to have an financial pulse.

To handle these points, Japan grew to become the primary main central financial institution to launch quantitative easing (QE) in 2001. That is the place the central financial institution, Financial institution of Japan (BOJ), would purchase authorities securities from the banks in an try and appropriate any steadiness sheet issues, clearing the way in which for these banks to lend (aka print cash).

That first try at QE failed miserably, and actually, brought about progress to fall from 1.1% to 1%. The Japanese had been satisfied by Western economists, like Paul Krugman, who claimed the BOJ failed as a result of they’d not “credibly promise[d] to be irresponsible.” They need to change the inflation/progress expectations of the folks by surprising them into inflationary fear.

Spherical two of financial coverage in 2013 was dubbed “QQE” (quantitative and qualitative easing). On this technique, the BOJ would trigger “shock and awe” at their profligacy, shopping for not solely authorities securities, however different belongings like exchange-traded funds (ETFs) on the Tokyo Inventory Trade. After all, this failed, too.

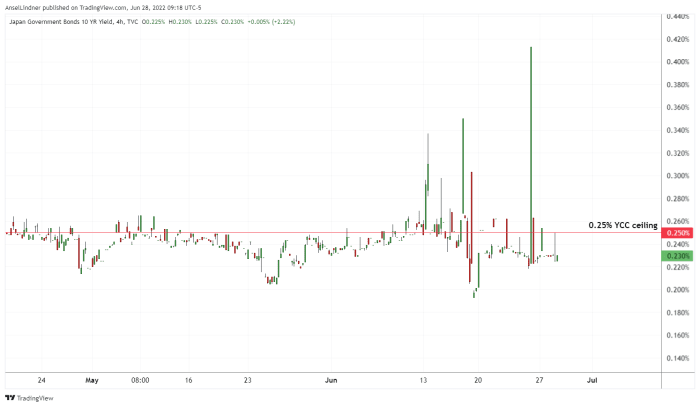

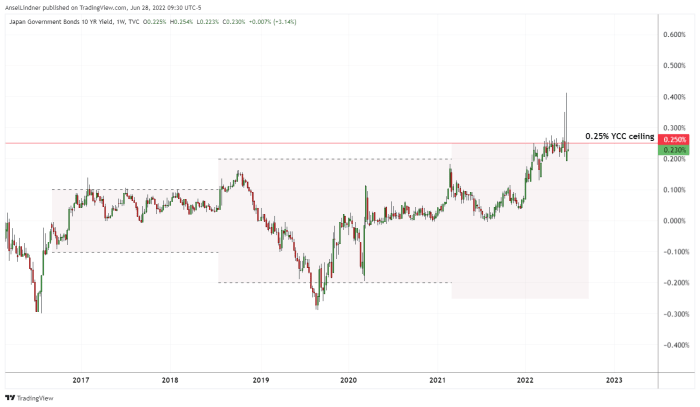

Spherical three was the addition of YCC in 2016, the place the BOJ would peg the yield on the 10-year Japanese Authorities Bond (JGB) to a variety of plus or minus 10 foundation factors. In 2018, that vary was expanded to plus or minus 20 foundation factors, and in 2021 to plus or minus 25 foundation factors, the place we’re immediately.

The YCC Battle

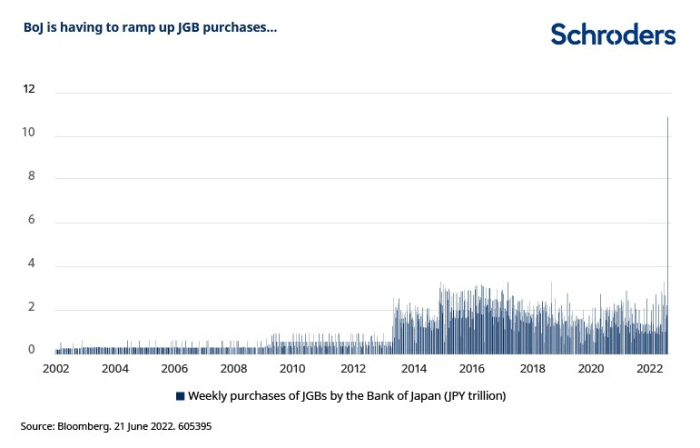

Because the world is now coping with huge worth will increase resulting from an financial hurricane, the federal government bond yield curve in Japan is urgent upward, testing the BOJ’s resolve. As of now, the ceiling has been breached a number of instances, but it surely hasn’t utterly burst by means of.

The BOJ now owns greater than 50% of all authorities bonds, on prime of their large share of ETFs on their inventory alternate. At this charge, your entire Japanese economic system will quickly be owned by the BOJ.

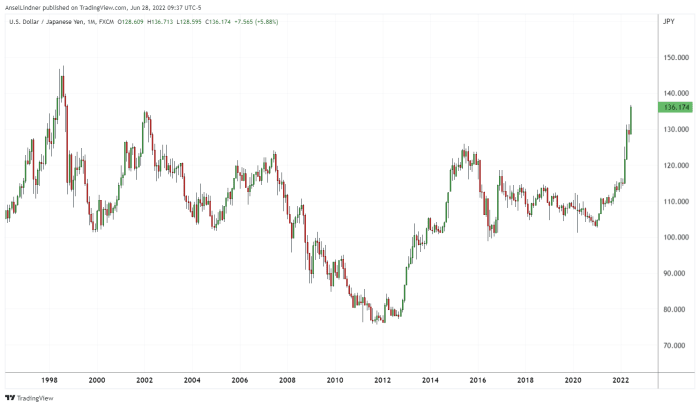

The yen can also be crashing in opposition to the U.S. greenback. Under is the alternate charge for what number of yen to a U.S. greenback.

Federal Reserve DSGE Forecasts

Federal Reserve Chairman Jerome Powell went in entrance of Congress this week and stated {that a} U.S. recession was not his “base case,” regardless of almost all financial indicators crashing within the final month.

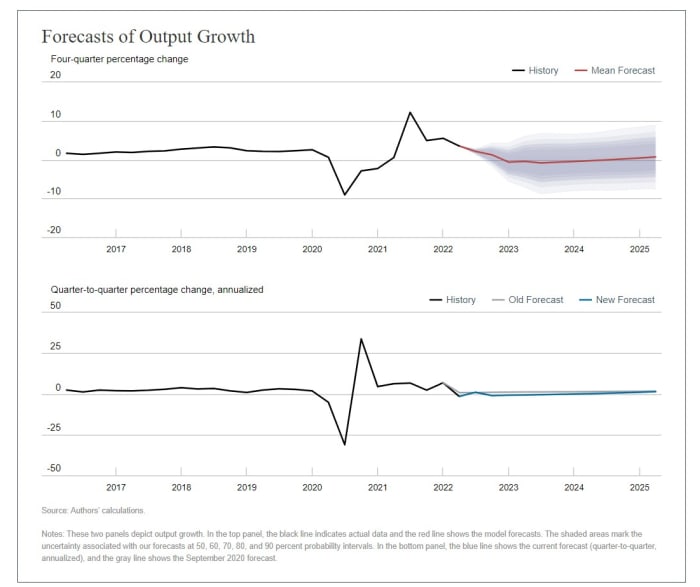

Right here, we check out the Fed’s personal dynamic stochastic normal equilibrium (DSGE) mannequin.

The New York Fed DSGE mannequin has been used to forecast the economic system since 2011, and its forecasts have been made public repeatedly since 2014.

The present model of the New York Fed DSGE mannequin is a closed economic system, consultant agent, rational expectations mannequin (though we deviate from rational expectations in modeling the influence of latest coverage modifications, corresponding to common inflation concentrating on, on the economic system). The mannequin is medium scale, in that it includes a number of mixture variables corresponding to consumption and funding, but it surely’s not as detailed as different, bigger fashions.

As you’ll be able to see under, the mannequin is predicting 2022’s This fall to This fall GDP to be damaging, in addition to the 2023 GDP. That checks with my very own estimation and expectation that the U.S. will expertise a chronic however slight recession, whereas the remainder of the world experiences a deeper recession.

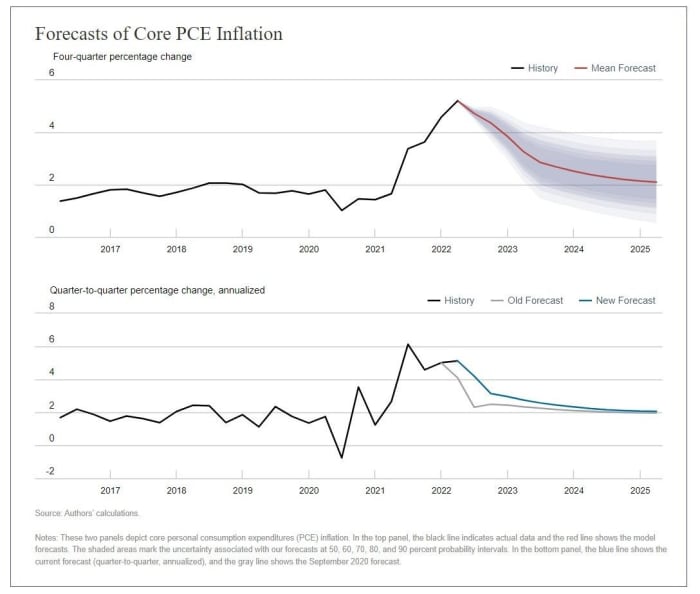

Within the under chart, I level out the return to the submit–International Monetary Disaster (GFC) norm of low progress and low inflation, a norm shared by Japan by the way in which.

European Anti-Fragmentation Cracks

Solely per week after we confirmed watchers, listeners and readers of “Fed Watch” European Central Financial institution (ECB) President Christine Lagarde’s frustration on the repeated anti-fragmentation questions, EU heavyweight, Dutch Prime Minister Mark Rutte, comes by means of like a bull in a china store.

I learn elements of an article from Bloomberg the place Rutte claims it is as much as Italy, not the ECB, to comprise credit score spreads.

What is the large fear about fragmentation anyway? The European Financial Union (EMU, aka eurozone) is a financial union with out a fiscal union. The ECB coverage should serve completely different international locations with completely different quantities of indebtedness. Which means ECB coverage on rates of interest will have an effect on every nation throughout the union otherwise, and extra indebted international locations like Italy, Greece and Spain will undergo a larger burden of rising charges.

The fear is that these credit score spreads will result in one other European debt disaster 2.0 and even perhaps political fractures as properly. International locations may very well be compelled to go away the eurozone or the European Union over this concern.

A Look Again On 100 Episodes

The final a part of this episode was spent wanting again at among the predictions and nice calls we have made. It did not go in response to my plan, nevertheless, and we bought misplaced within the weeds. General, we had been capable of spotlight the success of our distinctive theories put ahead by this present within the Bitcoin house:

- A robust greenback

- Bitcoin and USD stablecoin dominance

- The U.S.’s relative decentralization makes the nation a greater match for bitcoin

- Bearishness on China and Europe

We additionally spotlight some particular calls which have been spot on, which you will need to take heed to the episode to listen to.

I needed to focus on these items to point out the success of our contrarian views, regardless of being unpopular amongst Bitcoiners. This present is a crucial voice within the Bitcoin scene as a result of we’re prodding and poking the narratives to seek out the reality of the worldwide financial system.

Charts for this episode might be discovered right here.

That does it for this week. Because of the watchers and listeners. If you happen to get pleasure from this content material, please subscribe, overview and share!

It is a visitor submit by Ansel Lindner. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.