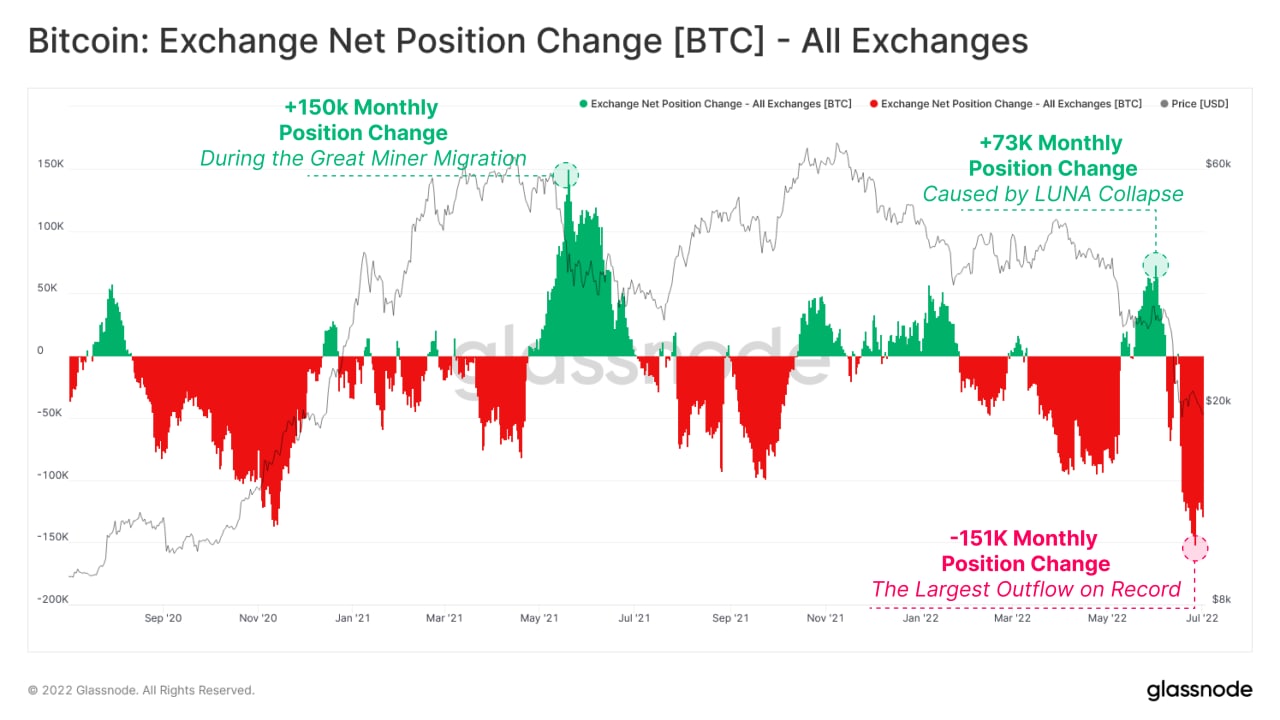

Roughly 49 days in the past, the variety of bitcoin held on trade was round 2.503 million, in keeping with statistics recorded by cryptoquant.com. Since then, $4.76 billion value of bitcoin has been faraway from centralized crypto exchanges, as there’s 2.275 million held on buying and selling platforms right now. Glassnode reported on July 5, that regardless of bitcoin’s “weak price-action by way of June, bitcoin has been withdrawn from exchanges on the most aggressive charge in historical past.”

Bitcoin Reserves on Exchanges Decline From an Aggressive Variety of Withdrawals

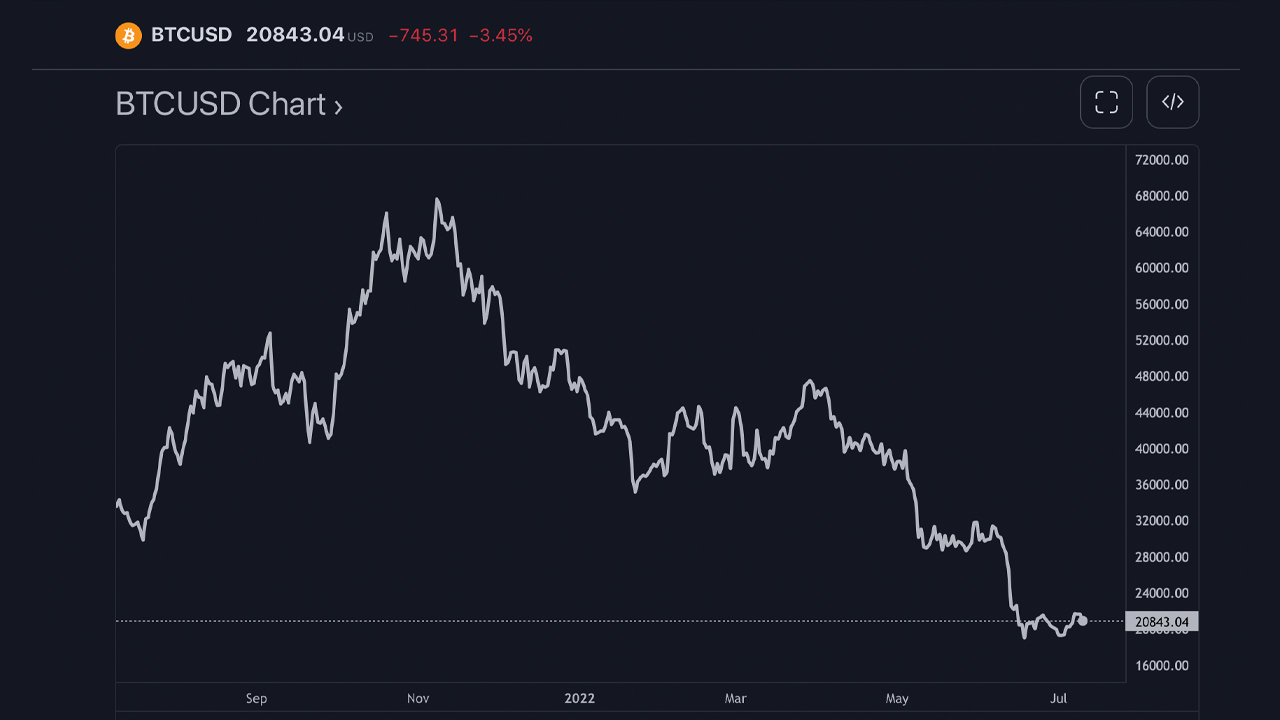

At 2:00 p.m. (ET) on Sunday afternoon, bitcoin’s (BTC) 24-hour value vary has been between $21,888 to $20,710 per unit, in keeping with coingecko.com’s market statistics. Presently, BTC is down 69% decrease than the all-time excessive recorded on November 10, 2021, when the main crypto asset reached $69K per unit.

A big portion of BTC’s losses happened over the last month as statistics point out that 30.4% of bitcoin’s drop in USD worth occurred in the course of the 30-day interval. Whereas costs have been gloomy, there’s additionally been vital liquidations and crypto trade operations halting withdrawals. This has arguably injected plenty of worry into the crypto economic system and despite the fact that costs are low, plenty of bitcoin moved off exchanges.

5 days in the past, the analytics crew from Glassnode reported on July 5, that “bitcoin has locked in one of many worst month-to-month value performances in historical past, with costs buying and selling down -37.9% in June. Bitcoin has seen a near-complete expulsion of market vacationers, leaving the resolve of HODLers because the final line standing,” the agency defined final Tuesday.

Glassnode additional detailed how there was an enormous quantity of BTC faraway from centralized buying and selling platforms in June. “Regardless of weak price-action by way of June, bitcoin has been withdrawn from exchanges on the most aggressive charge in historical past,” Glassnode stated. “Whole trade outflows in June peak at -151K BTC/month, with Shrimp and Whales as fundamental receivers,” the analytics crew added.

Bitcoin.com Information reported on Could 22, 2022, that the variety of bitcoin held on exchanges has been dropping decrease and hitting lows not seen since 2020. On the time, there was 2.503 million BTC on exchanges in keeping with cryptoquant.com metrics. As we speak, that quantity is 9.109% decrease than the Could 22 statistics as cryptoquant.com information reveals 2.275 million BTC is at present held on exchanges.

The worth of the BTC on exchanges in Could was round $73.7 billion, and on July 10, 2022, the worth of the bitcoin on exchanges is round $47.5 billion. Knowledge from Bituniverse, Peckshield, chain.data, and etherscan point out that Coinbase is the most important trade by way of BTC reserves.

The stats from Bituniverse reveals Coinbase holds 853,530 BTC and the second-largest trade by way of BTC reserves is Binance with 340,410 BTC. Between Coinbase and Binance, each exchanges command greater than 52% of the bitcoin held on crypto exchanges right now.

Tags on this story

What do you concentrate on the variety of bitcoin leaving exchanges over the past 30 days? Tell us your ideas about this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist dwelling in Florida. Redman has been an energetic member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 5,700 articles for Bitcoin.com Information concerning the disruptive protocols rising right now.

Picture Credit: Shutterstock, Pixabay, Wiki Commons