The Worldwide Financial Fund’s (IMF) Director of Financial and Capital Markets, Tobias Adrian, warned that extra crypto tasks may fail, notably stablecoins.

The feedback made for unwelcome information as traders, nonetheless uncooked from the Terra implosion and subsequent liquidity drain, proceed to carry hope that the worst is over.

Talking to Yahoo Finance, Adrian mentioned that if a recession arises, he expects cryptocurrencies and different risk-on property to come back underneath additional promote strain, giving strategy to extra ache forward.

Crypto stablecoins underneath the highlight

Increasing additional, the IMF Director mentioned the knock-on impact of an financial downturn may see the failure of “coin choices,” as he singled out algorithmic stablecoins as notably weak.

“There might be additional failures of a number of the coin choices — particularly, a number of the algorithmic stablecoins which have been hit most exhausting, and there are others that would fail.”

Algorithmic stablecoins obtain value stability by an automatic course of that mints extra tokens when the worth will increase above the peg, and burns tokens when the worth falls under the peg.

Present vital algorithmic stablecoins in operation are USDD on Tron, USDN on the Close to Protocol, and Ethereum’s Frax, which is a component algorithmic half collateralized.

Nonetheless, collateralized stablecoin choices are additionally in danger, in keeping with Adrian. Specifically, Tether, which Adrian mentioned is weak “as a result of they’re not backed one to 1.”

“[Some fiat-backed stablecoins] are backed by considerably dangerous property…it’s actually a vulnerability that a number of the stablecoins are usually not totally backed by cash-like property.”

Tether was ordered by the New York Lawyer Common to submit necessary quarterly studies on its reserve holdings in February 2021. Subsequent studies confirmed reserves have been composed of serious illiquid property, comparable to “business papers,” elevating doubts over the corporate’s capability to fulfill its obligations.

Since then, Tether has lowered its business paper holdings by $5 billion to $3.5 billion.

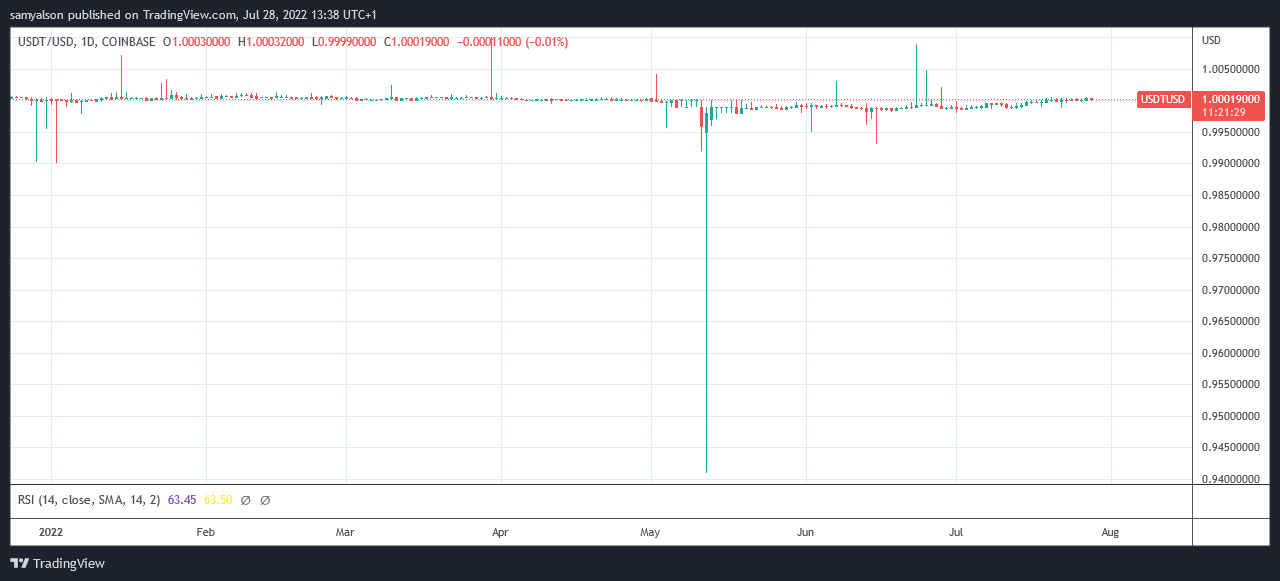

Tether dropped considerably under its $1 value peg throughout the Terra collapse, going as little as $0.94. On the time, Bitfinex CTO Paolo Ardoino performed down the importance of the drop, saying the peg was not damaged as holders may at all times redeem instantly from the corporate for face worth.

What recession?

Beforehand, a recession was outlined as two consecutive quarters of adverse GDP development. Nonetheless, policymakers have redefined the time period as a ” holistic take a look at the information – together with the labor market, client and enterprise spending, industrial manufacturing, and incomes.”

The transfer was broadly mocked as an incredulous play by the present U.S. administration. Political Commentator Glenn Beck known as this a weak ploy to win a shedding argument whereas additionally bringing in a number of different political scorching potatoes.

Underneath Biden alone, the Left has tried to redefine girl, fetus, home terrorist, revolt, voter suppression, unlawful alien, anti-police, and now recession. What a method! If you lose an argument, simply change the DICTIONARY!

— Glenn Beck (@glennbeck) July 27, 2022

On July 28, the Bureau of Financial Evaluation mentioned U.S. GDP for the second quarter had shrunk by 0.9%, marking the second successive quarter of financial contraction.

Regardless of denials of a recession from the present administration, crypto traders could be prudent to heed Adrian’s phrases.

Get an Edge on the Crypto Market 👇

Turn into a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Value snapshots

Extra context

Be a part of now for $19/month Discover all advantages