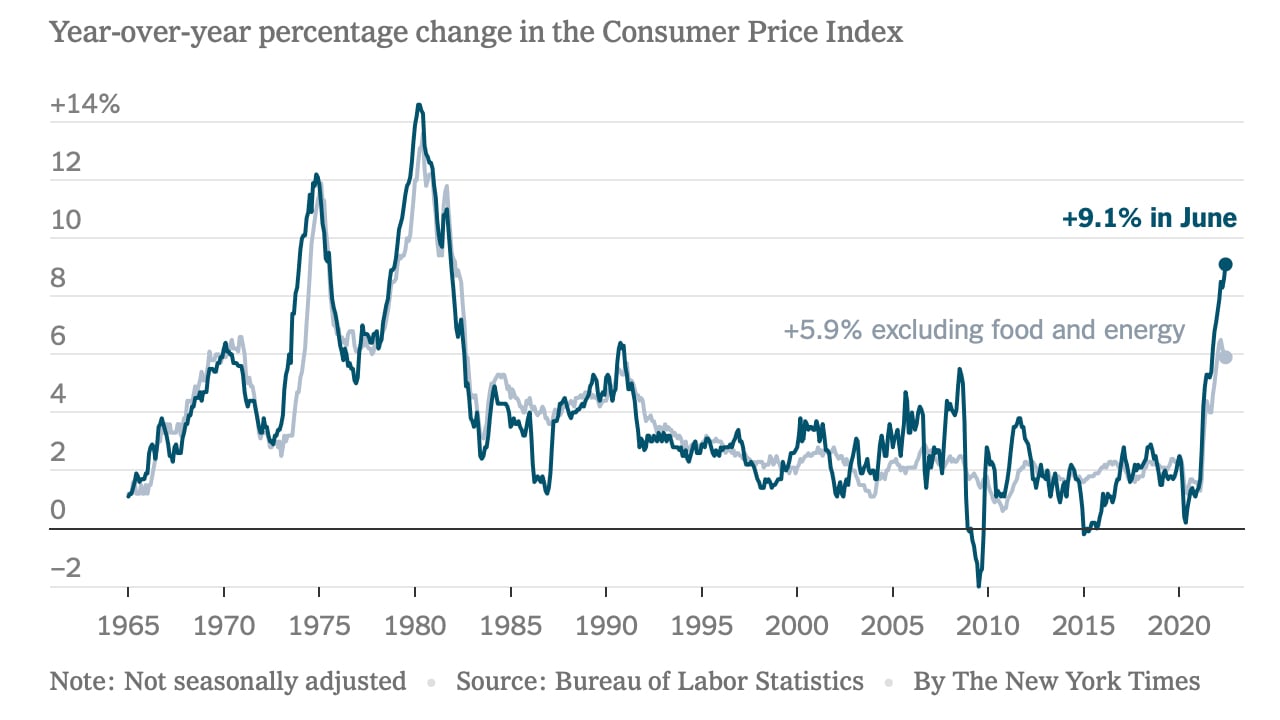

Based on the newest Bureau of Labor Statistics Client Value Index (CPI) report, U.S. inflation stays scorching sizzling because it has risen on the quickest yearly price since 1981. June’s CPI knowledge mirrored a 9.1% year-over-year improve, although a variety of bureaucrats and economists thought Could’s CPI knowledge can be the document peak.

US Inflation Continues to Print Perpetual New Highs

Inflation continues to climb increased in America because the CPI numbers for June present one other month-to-month improve. “Over the past 12 months, the all objects index elevated 9.1 p.c earlier than seasonal adjustment,” the Bureau of Labor Statistics report notes. “The rise was broad-based, with the indexes for gasoline, shelter, and meals being the biggest contributors.” The inflation improve in June was one more record-setting spike because it rose on the quickest tempo since November 1981.

After the CPI report was printed, U.S. president Joe Biden’s administration addressed the topic. The White Home additionally claimed that the information is already outdated and the CPI report doesn’t mirror “the complete affect of almost 30 days of decreases in fuel costs.” In reality, the White Home says that “core inflation” has dropped for the third month in a row.

“Importantly, right now’s report exhibits that what economists name annual ‘core inflation’ got here down for the third month in a row, and is the primary month since final yr the place the annual ‘core’ inflation price is beneath six p.c,” Biden’s assertion detailed on Wednesday.

Based on Bloomberg, the information publication surveyed a variety of economists and so they anticipated the CPI knowledge for June to return in at 8.8%. With an enormous inflation print, it’s now assumed that the U.S. Federal Reserve should be “much more aggressive.” Along with the CPI numbers that got here in on Wednesday morning, the day earlier than, the Bureau of Labor Statistics reported on a picture that had proven “pretend” CPI knowledge. The pretend CPI quantity that was seen on social media said the CPI knowledge would are available at 10.2%.

Shares, Gold, and Crypto Markets Shudder After US Inflation Report Printed

After the actual report was launched, the inventory market noticed vital losses because the Dow Jones Industrial Common shed 400 factors. Each main inventory index is down and the worth of bitcoin (BTC) slipped from the $19,900 area to a July 13 low of $18,906 per unit. Valuable metals additionally dropped in worth as silver dipped by 0.58%, and gold slid by 0.41% on Wednesday.

Inflation adjusted earnings have been destructive throughout 88% of Biden’s presidency.

Subsequent month, actual earnings can be down for a sixteenth consecutive month: the longest stretch on document pic.twitter.com/JO0v7ju04S

— zerohedge (@zerohedge) July 13, 2022

Whereas the actual CPI numbers had been mentioned on Wednesday morning, many individuals tried to assimilate what the numbers can be with out meals and gasoline added to the equation. Nonetheless, critics of those sorts of statements defined how they had been silly.

“Anybody saying ‘In the event you take away meals and gasoline from the CPI, inflation actually isn’t that unhealthy,’ attempt to reside with out meals and fuel for a month and let me understand how that goes,” Washington Instances columnist Tim Younger wrote on Twitter.

Tags on this story

What do you consider the record-setting CPI knowledge that was printed on Wednesday? Tell us your ideas about this topic within the feedback part beneath.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency group since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 5,700 articles for Bitcoin.com Information concerning the disruptive protocols rising right now.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.