The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Worth-Based mostly Capitulation Versus Time-Based mostly Capitulation

A have a look at earlier bitcoin bear market cycles reveals two distinct phases of capitulation:

- The primary is a price-based capitulation, by way of a sequence of sharp selloffs and liquidations, because the asset attracts down anyplace from 70 to 90% beneath earlier all-time-high ranges.

- The second part, and the one that’s spoken of far much less typically, is the time-based capitulation, the place the market lastly begins to seek out an equilibrium of provide and demand in a deep trough.

Let’s cowl each of those phases with visuals and knowledge derived from the blockchain.

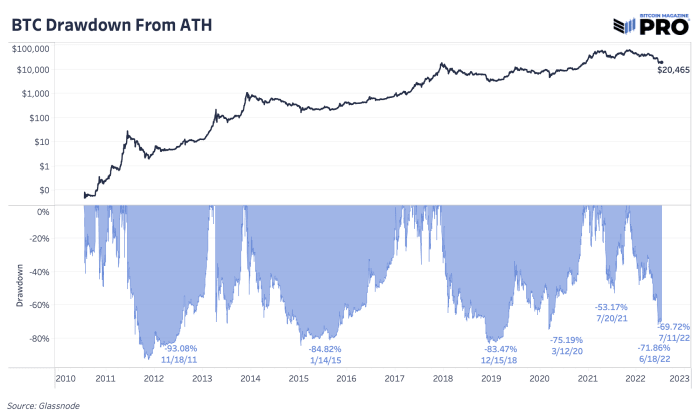

Bitcoin Drawdowns from All-Time Highs

Whereas a lot has been written concerning the macroeconomic backdrop concerning the bitcoin market (with our evaluation assuredly included), this bitcoin cycle mockingly doesn’t look all that completely different from the cycles of the previous.

On the time of writing, bitcoin is 69.72% beneath earlier all-time highs, with the height of the drawdown reaching 71.86% on Could 18. Bear markets of bitcoin’s previous noticed drawdowns of 93.08%, 84.82% and 83.47% respectively. With this in thoughts, regardless of absolutely the dimension of this cycle’s drawdown dwarfing earlier cycles, in relative phrases this was nothing out of the bizarre for bitcoin.

When the typical holder of bitcoin is underwater, regardless of the parabolic features seen throughout longer time frames, we view this as a traditional price-based capitulation occasion.

Time-Based mostly Capitulation

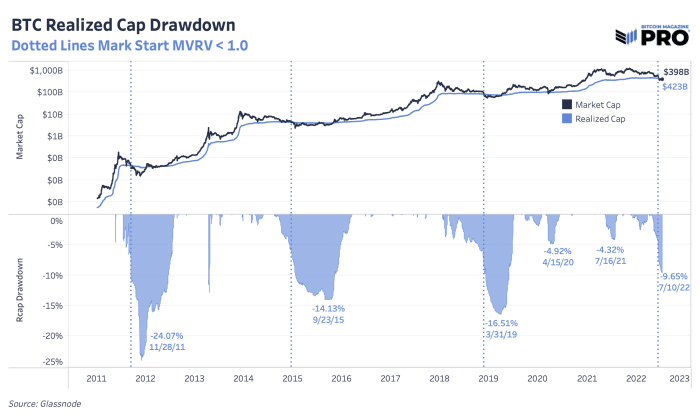

What follows the collapse of the market beneath the typical price foundation of the typical holder is what we contemplate the time-based capitulation occasion. As the typical holder is underwater, most marginal sellers have already bought their holdings, and whereas additional draw back is feasible, the “ache” market individuals really feel is within the type of a protracted time frame spent underwater moderately than quickly declining costs that characterised the beginning of the bear market.

It’s also value noting that as worth falls, and market individuals capitulate at a loss, the typical price foundation (realized worth) falls. To contextualize this decline in “truthful” worth of bitcoin, the historical past of realized worth drawdowns is proven beneath.

Bear market cycles take time to play out and range in size relying on the way you outline them.

In all chance, the brunt of the most important capitulation occasion within the historical past of bitcoin has simply occurred. Extra stability sheet contagion is definitely on the desk (moderately hiding beneath it), and the macroeconomic setting appears to be like more and more ugly. Holders ought to buckle in, not simply in case of extra extreme market downturns, however the arguably extra painful risk of prolonged sideways motion along with decrease costs and loads of sideways chop as cash are transferred from weak arms to sturdy arms, and from the impatient to the satisfied.

Bitcoin is right here to remain. Your job is just to outlive.