The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin And The S&P 500

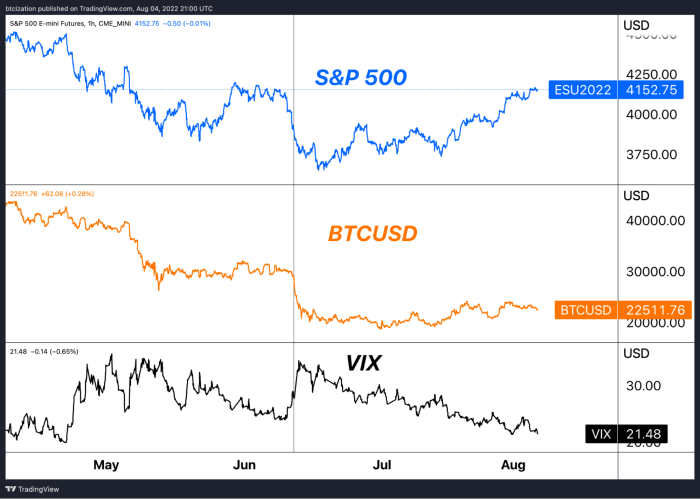

In our newest month-to-month report, which targeted extensively on the evolving macroeconomic atmosphere, we highlighted the robust correlation between bitcoin and equities over the course of 2020, whereas additionally referring to bitcoin as a quasi-24/7/365, inverse VIX (at the moment). Typically, because of this when equities are bidding, bitcoin has gotten a elevate as nicely; and when equities are promoting off (possible alongside an increase within the VIX), bitcoin would face draw back strain as nicely.

Market contributors ought to recall that following the implosion of LUNA/UST, bitcoin was consolidating across the $30,000 for practically a month earlier than fairness market volatility elevated as shares took a brand new leg decrease, which pulled bitcoin down with out key assist.

So what stands out within the present pattern? Effectively, each markets have exogenous variables that may have an effect on worth and historic realized correlations. As equities proceed to bid, on account of passive flows and a squeeze of late bearish positioning, bitcoin’s worth motion has began to meaningfully flip over, with its by-product market quick squeeze largely occurring already.

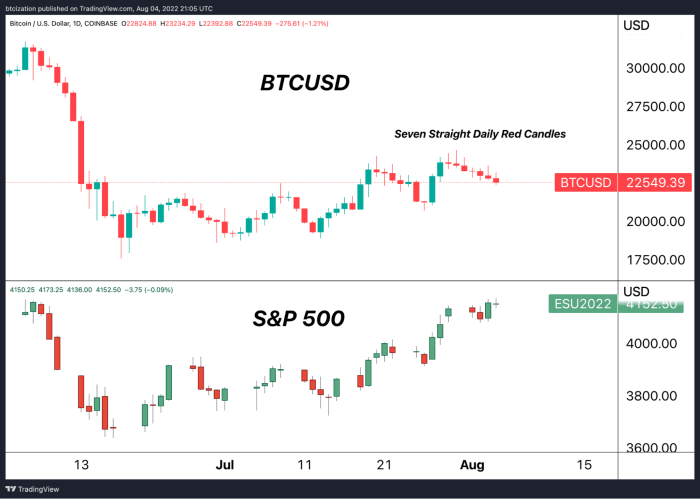

Bitcoin notably is within the midst of its seventh purple each day candle in a row (decrease closing worth than opening).

Provided that equities have been in a broader uptrend, the underperformance over the quick time period is regarding for bulls, as one ought to ask themselves the place bitcoin will commerce if/when fairness markets flip decrease and/or legacy market volatility considerably will increase.

Whereas this difficulty is concentrated much less on long-term fundamentals and extra on short-term worth motion, this aligns with our broader market thesis that danger belongings haven’t bottomed, as coated in our July Month-to-month Report. Macro guidelines all on the present second, and given bitcoin’s nonetheless nascent place as a mere pond amid a worldwide ocean of complete belongings, realized correlations and relative underperformance are anticipated and noteworthy, respectively.