Bitcoin price markets are displaying small indicators of life regardless of bitcoin’s worth dropping roughly 70% since its newest all-time highs and hash worth — a measure of the worth for hash price — falling by roughly the identical quantity.

Charges and the long-term prospects of price income for miners is a hotly-debated matter, particularly throughout bearish market traits. Bear markets are prime time for arguing about charges not solely as a result of market contributors are bored and antsy, but additionally as a result of this income dwindles significantly throughout these durations.

Regardless of the on-going bear market — which simply completed its eighth consecutive month — the bitcoin price market remains to be displaying indicators of life. This text gives an summary of some bits of peculiar bear market price knowledge, and it discusses in context of those numbers the chance of deciding whether or not or not Bitcoin’s future is doomed or comparatively constructive, regardless of what a rising variety of loud critics proceed to say.

Bitcoin Bear Market Price Knowledge

Beginning with absolute price income, the pattern in dollar-denominated price progress remains to be barely downward. A lot of the drop occurred by way of the ultimate months of 2021, nonetheless, and year-to-date charges have been principally flat. The chart beneath exhibits whole weekly price income from the market’s peak in November 2021 to this point with a logarithmic pattern line to spotlight the general price progress trajectory.

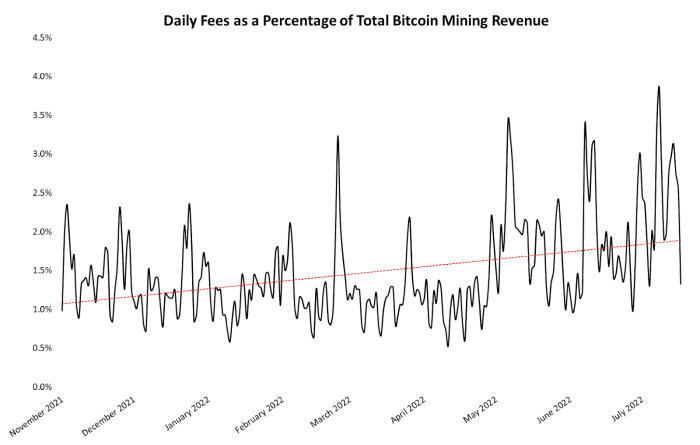

However weekly charges aren’t probably the most fascinating knowledge. As an alternative, taking a look at what share of mining income comes from charges is likely one of the strongest indicators of the trade’s well being. A mandatory situation for Bitcoin to have a wholesome, long-term outlook is for price income to ultimately supplant a good portion of the present subsidy income, such that miners stay incentivized to contribute power to securing the community regardless of the eventual disappearance of subsidies, in order that hash price doesn’t drop to dangerously low ranges.

Considerably surprisingly, though the bitcoin market has continued dropping for months, the proportion of day by day mining income coming from charges has slowly trended upward since after the beginning of the market’s worth collapse in November 2021.

After all, charges within the 1% to three% vary are an extremely massive discount from the ten% to twenty% vary that miners loved through the warmth of the earlier bull market. The highway to full price income restoration will seemingly be lengthy, and it’ll seemingly depend upon the resurgence of bullish worth motion.

Bitcoin Price Market Criticisms

Single-digit share price revenues are positive to bear the brunt of criticisms about Bitcoin for so long as the present bear market persists. Journalists are reporting and opining on perceived bitcoin price market weaknesses. Some traders and researchers are seemingly satisfied that low charges spell dying for Bitcoin. And a few outstanding builders are advocating for altering Bitcoin to incorporate a tail emission as an answer for the less-than-robust price market.

Even after the market pattern shifts, a few of the critics will proceed hammering their talking points as different blockchains see elevated use of varied purposes not (but?) constructed on Bitcoin. And a few Bitcoin-adjacent builders are optimistic {that a} extra strong price market will come as extra purposes are constructed on Bitcoin.

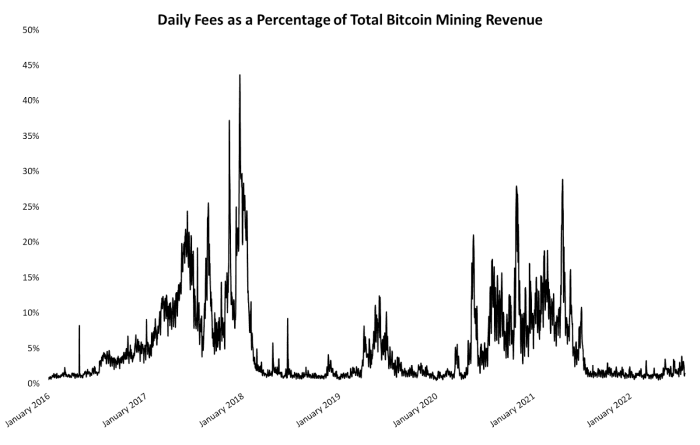

However setting apart all of this conjecture, criticism and (in some instances) normal craziness, it’s essential to do not forget that price knowledge exhibits that — if nothing else — price income is cyclical, similar to worth traits. And talked about beforehand, bear markets (when price income is low) are prime alternatives on this cycle to spotlight perceived basic weaknesses in community charges.

The road chart beneath exhibits day by day charges as a % of whole mining income since early 2016. From even a cursory look on the visualization, it’s simple to note how the 2 main spikes in price income coincide immediately with the newest two bitcoin bull market durations. Additionally, the quasi-bullish market interval throughout 2019 and a concurrent spike in price income is clear.

There aren’t any indications that this cyclical price sample will break from bitcoin’s cyclical worth motion. The most certainly short-term end result is a continued battering of price knowledge by critics for so long as the bearish pattern lasts.

However most builders and buyers within the Bitcoin financial system notice that present price knowledge is one thing that must be monitored however not panicked over. And cyclically-volatile price income through the early years of Bitcoin’s second decade isn’t a catastrophic drawback.

The Future Of Bitcoin Charges

Bitcoin’s price market and “safety price range” (the sum of price income and block subsidies) will at all times be meticulously-analyzed and hotly-debated matters. These conversations will seemingly grow to be much more contentious as different blockchain protocols garner important price income — at occasions much more so than Bitcoin’s numbers — from varied purposes constructed for various use instances within the broader cryptocurrency trade.

However the Bitcoin financial system continues to go sturdy, and regardless of what the loudest critics say, the present knowledge provides no purpose for long-term concern. Use of Bitcoin scaling protocols (e.g., the Lightning Community) continues rising, the mining sector continues constructing and increasing regardless of the bear market, and normal use and consciousness of Bitcoin remains to be sturdy, contemplating market situations.

This can be a visitor put up by Zack Voell. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.