The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Shiller P/E Ratio

A lot of our commentary for the reason that begin of Bitcoin Journal Professional has been regarding the relationship between bitcoin and equities, and their reflection of the worldwide “liquidity tide.” As we’ve got beforehand mentioned, on condition that the dimensions of the bitcoin market relative to that of U.S. equities is minuscule (the present market capitalization of U.S. equities is roughly $41.5 trillion, in comparison with $452 billion for bitcoin). Given the trending market correlation between the 2, it is helpful to ask simply how over/undervalued equities are relative to historic values.

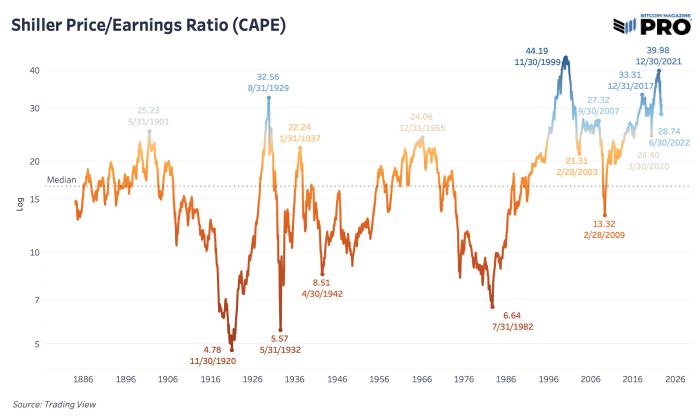

Among the best methods to investigate when the broader equities market is overvalued is the Shiller price-per-earnings (PE) ratio. Often known as cyclically-adjusted PE ratio (CAPE), the metric relies on inflation-adjusted earnings from the final 10 years. By means of a long time of histories and cycles, it’s been key at exhibiting when costs available in the market are far overvalued or undervalued relative to historical past. The median worth of 16.60 over the past 140-plus years reveals that costs relative to earnings all the time discover a strategy to revert again. For fairness investing, the place return on funding is essentially depending on future earnings, the worth you pay for stated earnings is of utmost significance.

We discover ourselves in one of many distinctive factors in historical past the place valuations have soared simply shy of their 1999 highs and the “every thing bubble” has began to point out indicators of bursting. But, by all comparisons to earlier bubbles bursting, we’re solely eight months down this path. Regardless of the rally we’ve seen over the previous few months and the explosive inflation shock upside transfer that got here right now, this can be a sign of the broader market image that’s arduous to disregard.

Though the discharge of Shopper Worth Index information got here in at a shocking 0.0% studying month over month, year-over-year inflation is at an unpalatable 8.7% in the USA. Even when inflation have been to fully abate for the remainder of the 12 months, 2022 would nonetheless have skilled over 6% inflation through the course of the 12 months. The important thing right here being that the price of capital (Treasury yields) are within the means of adjusting to this new world, with inflation being the very best felt over the past 40 years, yields have risen in document trend and have pulled down the multiples in equities consequently.

If we consider the potential paths going ahead, with inflation being fought by the Federal Reserve with tighter coverage, there’s the potential for stagflation when it comes to unfavorable actual progress, whereas the labor market turns over.

Wanting on the relative valuation ranges of U.S. equities throughout earlier durations of excessive inflation and/or sustained monetary repression, it’s clear that equities are nonetheless close to priced to perfection in actual phrases (inflation-adjusted 10-year earnings). As we consider that sustained monetary repression is an absolute necessity so long as debt stays above productiveness ranges (U.S. public debt-to-GDP > 100%), equities nonetheless look fairly costly in actual phrases.

Both U.S. fairness valuations are not tied to actuality (unlikely), or:

- U.S. fairness markets crash in nominal phrases to decrease multiples relative to the historic imply/median

- U.S. equities soften up in nominal phrases because of a sustained excessive inflation, but fall in actual phrases, thus bleeding investor buying energy

The conclusion is that international buyers will possible more and more seek for an asset to park their buying energy that may escape each the unfavorable actual yields current within the mounted revenue market and the excessive earnings multiples (and subsequently low or unfavorable actual fairness yields).

In a world the place each bond and fairness yields are decrease than the annual price inflation, the place do buyers park their wealth, and what do they use to conduct financial calculation?

Our reply over the long run is straightforward, simply test the title of our publication.