That is an opinion editorial by Mike Ermolaev, head of public relations on the ChangeNOW trade.

As a retail dealer or somebody who simply obtained began with bitcoin not way back, it’s possible you’ll be looking for clues about what to anticipate subsequent with its value. A second opinion can also be necessary for seasoned bitcoin traders to check their very own views.

Analyzing Open Curiosity Of Bitcoin Futures

Bitcoin open curiosity supplies perception into how a lot cash is flowing into and out of the bitcoin derivatives market. Derivatives like bitcoin futures and perpetual swaps are utilized by merchants to take a position on whether or not bitcoin’s value will rise or fall with out having to personal the digital asset. The next bitcoin open curiosity means extra merchants have opened positions, whereas a decrease one means extra merchants have closed them.

As of writing, bitcoin-denominated open curiosity had elevated to 592,000 BTC from 350,000 BTC initially of April 2022. A have a look at the bitcoin denomination may help isolate intervals of elevated leverage from value fluctuations.

In USD phrases, present open curiosity is $13.67 billion, which is comparatively low, corresponding to early bull market ranges in January 2021 and June 2021 sell-off lows.

At any time when there’s a giant improve in open curiosity on a BTC foundation, however not on a USD foundation, that indicators markets are taking up extra BTC publicity, however nonetheless do not anticipate it to maneuver a lot.

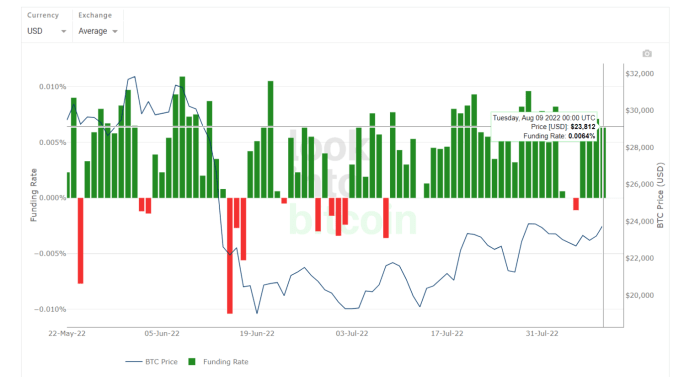

Funding Charges Rise For Perpetual Swaps

So as to perceive how most merchants are positioned available in the market, we will have a look at funding charges used on perpetual swap contracts: by-product monetary contracts distinctive to bitcoin and cryptocurrency that haven’t any expiration date or settlement. They permit merchants to make use of leverage — as much as 100x — when betting on the worth of bitcoin. A funding price is a periodic cost made to or by a dealer who’s lengthy or quick based mostly on the distinction between the perpetual contract value and the spot value.

Typically, we will say that optimistic funding charges point out merchants are taking lengthy positions and are usually bullish in regards to the value shifting upward, whereas damaging funding charges point out merchants are normally taking quick positions and are usually bearish, believing the worth will transfer downward. Funding charges breaking above 0.005% sign elevated speculative premium, a development that’s at present occurring.

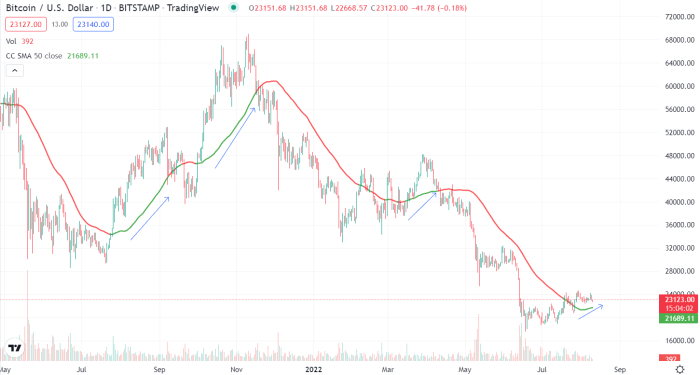

The Bitcoin Worth Is Above Its 50-Day Easy Transferring Common

Analysts like myself who use technical evaluation charts and patterns to make funding selections, be aware that bitcoin is at present buying and selling above its 50-day easy shifting common (SMA) — an efficient development indicator — for the primary time since mid-July. This confirms that underlying momentum could also be constructing.

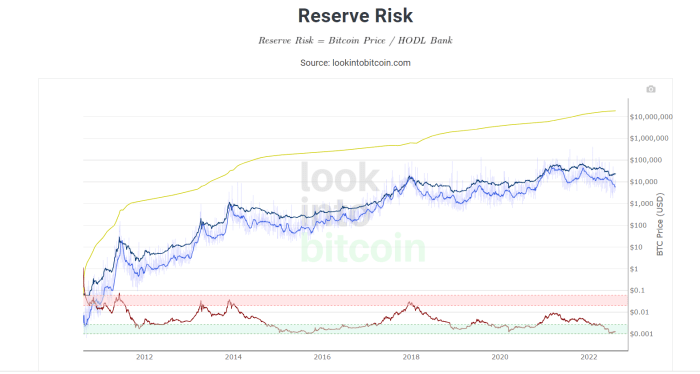

Lengthy-Time period Holders See Bitcoin As An Interesting Danger/Reward Funding

Under is one other chart that visualizes how long-term BTC holders really feel about bitcoin relative to its value. Bitcoin’s long-term holders are usually higher at figuring out the perfect time to purchase and promote bitcoin. This isn’t shocking, since they’ve extra expertise within the area than newcomers who’re simply getting began. You will need to acknowledge when they’re assured that the primary cryptocurrency will rise in value sooner or later.

The reserve threat chart is at present within the inexperienced zone, which means a excessive stage of confidence mixed with a low value, making bitcoin a beautiful threat/reward funding. Traders who make investments throughout inexperienced reserve threat have traditionally loved excessive returns over time.

Conclusion

Market perceptions of varied savvy market members, who’ve historically been good in making their funding selections, present that they’re more and more assured about the way forward for bitcoin value and are keen to tackle extra value threat. There’s a cautious upward bias in bitcoin derivatives markets and long-term traders seem like pretty assured. The bitcoin value can also be exhibiting indicators of enchancment based mostly on technical indicators.

Disclaimer: This isn’t monetary recommendation. All opinions, statements, estimates, and projections expressed on this article are solely these of Mike Ermolaev, PR Head at ChangeNOW.

This can be a visitor submit by Mike Ermolaev. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.