The well-known writer of the best-selling ebook Wealthy Dad Poor Dad, Robert Kiyosaki, has warned that every one markets are crashing, particularly naming actual property, shares, gold, silver, and bitcoin. Referencing his earlier prediction of a much bigger crash than throughout the 2008 monetary disaster, Kiyosaki mentioned: “That crash is right here. Thousands and thousands shall be worn out.”

Robert Kiyosaki Predicts Market Crashes

The writer of Wealthy Dad Poor Dad, Robert Kiyosaki, is again with dire warnings about market crashes. Wealthy Dad Poor Dad is a 1997 ebook co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Instances Greatest Vendor Listing for over six years. Greater than 32 million copies of the ebook have been offered in over 51 languages throughout greater than 109 international locations.

Kiyosaki described in a tweet Friday that each market is crashing and the center class shall be worn out by “greater oil inflation.” He wrote:

All markets crashing: actual property, shares, gold, silver, bitcoin. Center class worn out by greater oil inflation.

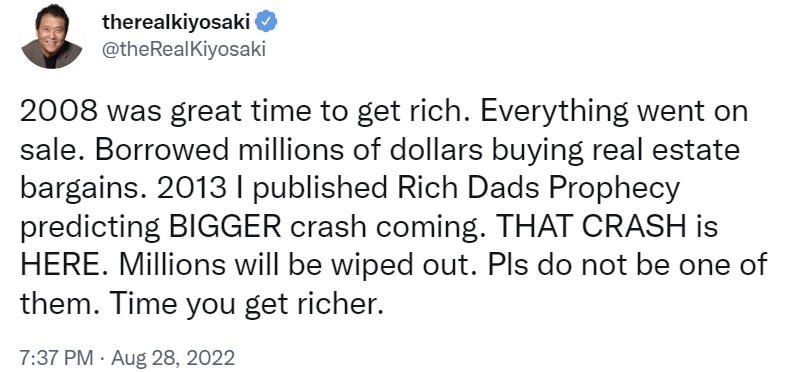

On Sunday, he adopted up with a tweet referencing a ebook he revealed in October 2013 titled “Wealthy Dad’s Prophecy: Why the Greatest Inventory Market Crash in Historical past Is Nonetheless Coming … And How You Can Put together Your self and Revenue From It!”

He detailed that 2008 was a good time to get wealthy since every part “went on sale.” Noting his prediction of a much bigger crash outlined in his ebook, the famend writer wrote: “That crash is right here. Thousands and thousands shall be worn out.”

Kiyosaki urged his 2 million Twitter followers to not be amongst those that get worn out, including that it’s time for them to “get richer.” Final week, he defined that “It’s not what’s in your pockets … It’s what’s in your head,” emphasizing: “Change what’s in your head first… then get richer.”

The famed writer has warned about market crashes on a number of events. He just lately predicted the largest bond crash since 1788, stating that shares and bonds are crashing. Asserting {that a} despair and civil unrest are coming, he additional cautioned that inflation might result in the Better Melancholy.

Final week, he revealed that he modified his thoughts about treasury bonds after listening to economist Harry Dent. The Wealthy Dad Poor Dad writer has been recommending buyers purchase gold, silver, and bitcoin for fairly a while, stressing that the U.S. greenback is dying. In July, he mentioned silver was the most effective funding worth at this time.

Kiyosaki has additionally been ready to purchase bitcoin at a cheaper price. In June, he mentioned he was ready for the cryptocurrency to check $1,100 earlier than shopping for. In July, he famous that he was in money place ready to purchase BTC. This week, BTC dipped under $20K. On the time of writing, bitcoin is buying and selling at $19,629, down over 9% within the final seven days. The general cryptocurrency market stands at about $944 billion, based mostly on Coinmarketcap’s information.

Tags on this story

What do you consider the warnings by Wealthy Dad Poor Dad writer Robert Kiyosaki? Tell us within the feedback part under.

Kevin Helms

A pupil of Austrian Economics, Kevin discovered Bitcoin in 2011 and has been an evangelist ever since. His pursuits lie in Bitcoin safety, open-source programs, community results and the intersection between economics and cryptography.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, lev radin

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.