A model of this text was initially printed right here.

In any new and creating area, there’s certain to be a variety of noise. New options each compete for a brand new market towards present monopolies — which presently personal the market, and towards different applied sciences attempting to displace them.

Exhausting To Perceive

That is very true in these breakthrough improvements/discoveries that change our world and power us to make use of a brand new lens to grasp it. Prior biases make us much less prone to examine the brand new improvements on a primary rules foundation. Knowledge is a legacy of our present fashions — not these new ones. New ones must be intuited to foretell what is going to occur as an alternative of forecasted utilizing historic knowledge. We simplify the fashions in our brains to save lots of time and in consequence, most individuals fall into the lure of predicting their future conduct by trying again at their previous.

It’s the similar motive that when utilizing a Blackberry cellphone when the iPhone was launched, we couldn’t predict how our minds would change — and our minds altering due to new worth created, would change an trade. We transfer immediately when given one thing of larger worth, and it’s inconceivable to foretell that transfer earlier than we’ve “seen” it.

It’s the similar motive why Kodak was destroyed by the very digital digital camera that Kodak created, and Blockbuster did not see the specter of Netflix till it was too late.

And it’s the similar motive why all monopolies fail when misunderstanding the worth creation delivered to society by a brand new know-how. Expertise adoption is most frequently backside up versus prime down. Why? Just because the individuals furthest away from monopoly energy have probably the most to achieve, and the individuals closest to the monopoly have probably the most to lose.

Add to this that there are at all times far bigger numbers of individuals farther away from the monopoly than near it, and it turns into straightforward to see how briskly one thing that creates extra worth for these individuals can take maintain and get stronger — rendering a monopoly impotent in preventing it.

Notice: This framework is essential to contemplate no matter whether or not the monopoly is inside an trade, or whether or not it applies to cash itself.

More durable To Perceive

It’s even more durable to grasp basic objective applied sciences like synthetic intelligence that have an effect on all industries or predict their fee of progress. As a result of these basic objective applied sciences apply to most worth creation over time, we will simply underestimate the corresponding influence on each enterprise and, in flip, our lives. For instance, pretending {that a} slender or basic synthetic intelligence gained’t negatively influence our job in the future is one thing we need to consider, which ensures narratives that help that line of considering are standard — even when unfaithful.

Hardest To Perceive

However the improvements which are hardest of all to grasp are open, decentralized, protocol-level applied sciences. These protocols create worth within the type of a brand new basis that emerges slowly and methodically. Protocols are inbuilt layers, which implies we will’t usually see what is feasible on the following layer till it’s already constructed. The bottom layer know-how protocol (Layer 1) that allowed computer systems to be networked collectively is named the transmission management protocol, and the web protocol (TCP-IP) and was developed by the Protection Superior Analysis Initiatives Company (DARPA) within the late Nineteen Sixties. It wasn’t till 1989 that Tim Berners-Lee invented the hypertext switch protocol (HTTP) on Layer 4, which might hyperlink these computer systems and webpages and would kind the world broad internet.

Which is why when you tried to clarify the TCP-IP open protocol layer that allowed beforehand remoted computer systems to speak to one another and even HTTP to somebody within the early Nineteen Nineties, or tried to inform them that in the future that very same know-how (largely unchanged) would give rise to the iPhone, Google, Zoom, Amazon, and every thing else we take as a right in the present day, their eyes would roll over in disbelief.

We expertise worth via services and products that give us worth as an alternative of attempting to grasp the intricate particulars of the plumbing that provides rise to these services and products.

I’m going to try to make use of a framework for contemplating how this is applicable to Bitcoin, and the predictable rise of altcoins, decentralized finance (DeFi) Web3, Metaverse and all the blockchain area.

However earlier than we go there, we should begin at a better stage as a result of the higher-level abstraction results and amplifies every thing else.

We should begin at cash. We should begin there for a similar motive said above.

Specifically:

- We expertise worth via services and products that give us worth, as an alternative of attempting to grasp the intricate particulars of the plumbing that provides rise to these services and products, and

- Cash is the inspiration layer that provides rise to every thing else.

Subsequently, when cash breaks down, standing your floor when the bottom offers method will present little in the best way of security.

Cash Is Simply Data

This could be onerous to see as a result of it will be significant data, however we don’t want extra items of paper (or the digital models it represents). We want the sensation we get from having these items of paper and what it could possibly purchase us. No matter whether or not that “purchase” is a sense of security, a legacy within the type of giving to your youngsters, a trip, standing, a house or freedom. Cash is simply the data (a ledger) that enables us to measure what we’ve got, and what it should take (in our personal minds) to realize our desired end result. Worry, greed and the human want to need extra comes on prime of that ledger and comparability to different individuals.

It makes logical sense then, that one, if cash is simply data and two, cash is being manipulated by central banks at an unprecedented fee to keep away from a credit score collapse of the system, then misinformation should be rising all through the system. (A second order spinoff of that misinformation is that belief should be declining all through the system.)

However that’s the unlucky system we reside in, and it has vastly unfavorable penalties. As a result of we measure a system from throughout the system, for a lot of the inhabitants, it could make the reality just about inconceivable to see. Equally, each firm, group and political celebration are made up of comparable individuals measuring the system from the system, whereas each member of our society writ massive every believes that they’ll see via this misinformation higher than others.

(Caveat emptor: Though I do my private greatest to go deeper on points to grasp either side and the place I could be incorrect, this consists of me, and the phrases on this web page.)

By consequence, it’s fully logical to see conspiracy theories, confusion, polarization, in-group, out-group bias and social chaos reign.

That misinformation within the type of cash wouldn’t simply create polarization. As a result of cash connects worth between individuals and nations, it could drive an amazing misallocation of capital and assets as particular person actors within the system all made the system worse with their actions to make sufficient cash to flee the system. Chasing ever larger returns, it wouldn’t solely be most of the people. Even pension plans, which want sure development returns to remain solvent to pay liabilities within the type of retirement advantages would seek for larger “actual” returns — all of them, and us too, trying to find methods to resolve a development drawback to flee the very system creating the issue.

In a world that appeared like this, it could be straightforward to fall right into a lure of pyramid and get-rich-quick schemes to flee. In reality, the very construction of manipulating cash (data) and corresponding incentive construction would guarantee a market grew to abuse it — each in crypto and the general market. Everybody measuring and attempting to create worth from this method would unknowingly contribute to larger insecurity. Nobody could be exempt. All, trying to find a better return to flee the prevailing debasement of currencies, crowded into markets that in flip, damage others.

With this one, misinformation as a backdrop, and two, a brand new protocol layer know-how rising, (do not forget that open protocols present probably the most worth to society and are the toughest to grasp) it could be terribly troublesome to see why Bitcoin alone stands out as a breakthrough know-how and the place it’s heading. By extension, it could be comparatively straightforward on this surroundings for ill-informed or unhealthy actors to conflate Bitcoin with crypto, Web3, DeFi, blockchains, Metaverse and different naming conventions to achieve a bonus for his or her providing. A public market that one, believed these have been related and watching a meteoritic rise in Bitcoin over the past 13 years (whereas they have been concurrently dropping buying energy in their very own currencies) and two, lacked the time to do deep analysis, could be straightforward targets for copycats, fraudsters and even well-intentioned actors who could be misinformed, selling the following large factor.

This might act to amplify the cycles of highs and lows in Bitcoin and obfuscate its true nature. Firstly, by bringing extra leverage, hypothecation and rehypothecation into the general area by leveraging bitcoin (which has no counterparty threat) as a pristine bearer asset and amplifying the value of bitcoin on the best way up. And secondly, as every of the altcoins and DeFii schemes tied to them, then fell on account of that very same leverage, creating “financial institution runs” that may amplify bitcoin’s fall in value (in USD phrases) because the pristine bearer asset (BTC) was bought right into a failing market to cowl losses.

Because the vastly greater market of cash broke down, (the world stability sheet is roughly 4 orders of magnitude bigger than bitcoin market cap in the present day) and the Federal Reserve and different central banks eased or tightened in fiat phrases, it could solely amplify all the course of described right here and create extra confusion.

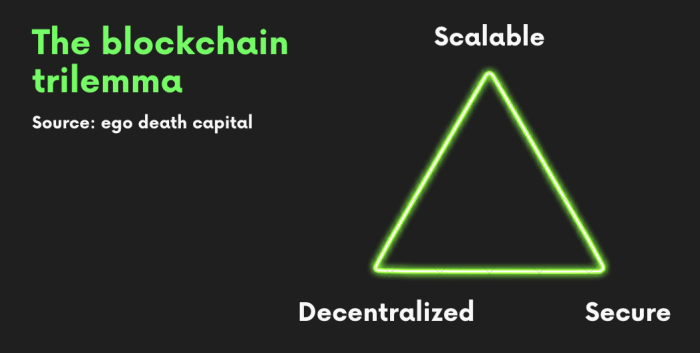

With that as a backdrop, I’ll present a easy framework to clarify why Bitcoin is the ultimate in its design so others can use that framework to resolve for themselves. My hope is that by understanding the required commerce offs required within the design of any blockchain, a basic public, and/or coverage makers can extra precisely perceive the commerce offs and see the sign via the noise. In doing so, I’ll additionally present why the rise of competing blockchains and altcoins are predictable, the benefits and drawbacks of them and why, in my view, every will fail in the long run.

Decentralization, Safety, Scalability

Bitcoin (on Layer 1) solved decentralization and safety. By no means in historical past has society had decentralization and safety collectively. 13 years after its discovery/invention by the pseudonymous Satoshi Nakamoto and irrespective of the quantity of nation state, financial problem, or worry, uncertainty and doubt (FUD) thrown at it, it stays decentralized and fully safe. This can be a greater deal than it appears at first look. As a result of society all through time may by no means depend on decentralization and safety collectively, it wanted to depend on belief in establishments and the rule of regulation (to maintain these establishments in test) for cover, the Magna Carta, Declaration Of Independence and lots of different such frameworks over time enshrining rights to residents from unchecked energy over them by their rulers. The issue is that over an extended time horizon, cash surpasses legal guidelines, so legal guidelines alone can’t clear up belief. Legal guidelines change over time making certain these with entry to cash both re-write the legal guidelines or prevail in court docket. A mirrored image of the world we reside in reveals this unlucky fact, i.e., the place cash is most damaged, rule of regulation breaks down!

The rule of regulation does not defend residents from the manipulation of cash. It protects these closest to the manipulation.

Bitcoin stays decentralized and safe due to its design. Two important design components led to this consequence: One, a restricted block dimension and two, utilizing vitality to safe the community via proof of labor. (Extra components of design linked to those two design components stay important to the safety and decentralization of the community. For the reader who needs to go deeper, these shall be explored later on this submit with hyperlinks to some nice thought leaders and content material.) It is very important keep in mind, Bitcoin is open supply which implies it’s open to everybody (to audit or use freely), managed by nobody and freely out there for anybody to vary via a fork to attempt to design another way that creates extra worth for customers.

By designing in such a method, Bitcoin over the past 13 years grew to become a wonderful retailer of worth, but in addition remained largely unviable for use as a foreign money or broader know-how stack on account of its lack of transaction pace at 5 to seven transactions per second (on the primary layer). The transaction pace wasn’t the one limitation. By protecting block dimension small to make sure continued decentralization, Bitcoin left a gap for competing blockchains/altcoins to do extra on Layer 1. Enterprise capital, entrepreneurs and builders raced into this ecosystem as a result of one, inventing a brand new coin that might compete with bitcoin would obtain large short-term earnings for its founders and enterprise capital backers, and two, with a bigger block dimension and extra permissive blockchain, extra could possibly be performed. These competing blockchains would give rise to sensible contracts, non-fungible tokens (NFTs) and “decentralized” finance.

It might be straightforward to point out Bitcoin as previous know-how, as an alternative of a protocol layer to an viewers searching for scalability and different use instances. That very same alternative although, both transaction pace or offering extra functionality via sensible contracts on Layer 1, required these blockchains to sacrifice both decentralization or safety, to realize their targets.

You will notice from an extended historical past of competing blockchains that they all both change into centralized (via a council or small variety of individuals/nodes who make choices for everybody) or change into weak to hacks/outages as they scale.

Bitcoin stands alone in decentralization and safety.

Why? As a result of there’s merely no method across the two-of-three alternative for a blockchain on Layer 1.

The logical conclusion although, is that if one sacrifices safety for scalability, the blockchain fails as a result of it’s insecure, or If one sacrifices decentralization for scalability, a blockchain should finally change into ineffective for financial causes. And whilst you might argue that perspective from an ecosystem that appears to offer worth for a window of time, the financial commerce offs of working a blockchain that’s centralized guarantee it could possibly’t work in the long run. Acknowledged merely, if centralization is a requirement of the design, a database is a a lot less expensive resolution — when it comes to economics and vitality utilization. That financial motive alone negates any long-term profit (aside from preliminary holders of tokens) of a centralized blockchain for the individuals of the system as a result of somebody must pay for it.

Which ensures that every one initiatives constructed on prime of those different blockchains (Web3, Metaverse, NFTs, and many others.) whatever the intent of the founders of those initiatives, should undergo the identical destiny because the underlying blockchain.

Constructing on prime of quicksand is just not a great long-term technique.

Some fast inquiries to carry readability:

- How may decentralized finance happen on a centrally-controlled blockchain?

- How would Web3’s promise be any completely different than in the present day’s monopoly energy in know-how if it was constructed on a base layer that was extra expensive, and managed by only a few?

- What’s the long-term worth of a digital copy (NFT) of one thing linked to a blockchain that fails?

- If a decrease value (via Layers 2 and three) and decentralized different existed that enabled gaming and digital actuality firms to manage their very own future quite than threat their future on a centrally-controlled blockchain, what would these entrepreneurs select? Wouldn’t or not it’s extra seemingly that this new protocol, as an alternative of a centrally-controlled one, kinds the inspiration of the “metaverse”?

All of the whereas, entrepreneurs constructing to these blockchains, most of the people and regulators

could also be unaware of the long-term nature of the vulnerability. Worse nonetheless, capital, and enormous holders of the varied altcoins schemes may change into keen or unwilling individuals in a perverse incentive scheme the place they get wealthy or get out simply in time, on the unknowing public’s expense. Charlie Munger’s well-known quote “present me an incentive and I’ll present you the result” applies properly right here. If invested capital (by enterprise capitalists) and time (by an entrepreneur or staff) has gone into designing certainly one of these blockchains or constructing an organization on prime of 1, human nature tells us that it’s a lot simpler to obfuscate the reality to promote to a better bidder earlier than it collapses than to confess a incorrect technique.

As at all times, comply with the cash.

The road turns into notably skewed by exchanges who supply these cash to an unknowing public. By providing a mess of securities (altcoins, 20,000 and counting) that every one finally undergo the same destiny, they create huge wealth at society’s expense, making transaction charges on the best way out and in, each time somebody trades any certainly one of these 20,000-plus cash. It’s a really low-risk enterprise enabled by a extremely prone public. That very same wealth is then used to advocate/foyer governments for favorable insurance policies to permit them to function. Seeing alternatives for funding and jobs from the most important exchanges, whereas believing that bitcoin and altcoins are related in nature, ensures coverage makers are simply swayed. A lot of this provides to the general public and media being fully misinformed about Bitcoin and proof of labor.

Why? As a result of conflating Bitcoin, blockchains and altcoins is essential to working earnings.

A Deeper Dive On The Three Sides Of The Pyramid

1. Safety

By proof of labor, Bitcoin gives miners a technique to compete to resolve cryptographic hash puzzles to confirm new transactions on the blockchain. Miners buy the most recent {hardware}, to compete for Bitcoin within the type of block rewards. The reward follows a halving schedule the place the reward for fixing the hash puzzle is programmatically decreased each 210,000 blocks. Beginning in 2009 at 50 bitcoin per verified new transaction on the blockchain (roughly as soon as each 10 minutes) to 25 bitcoin in 2013, to 12.5 in 2016, to six.25 BTC in the present day, and to be decreased by half each 210,000 blocks till the 12 months 2140. Within the pure competitors that arises within the free market with different financial actors attempting to “win” bitcoin, an incentive is created the place miners win bitcoin by securing the community. As a result of the first prices of mining are one, the {hardware} (required to resolve the cryptographic hash puzzles) and two, the intensive vitality prices to run the {hardware}, miners are incentivized via competitors to achieve benefit over different miners which provides hash fee to the community (hash fee is the full computational energy securing the community).

Nakamoto developed a novel technique to defend the community and reap the benefits of recreation concept because the community ebbed and flowed with the most recent {hardware} enhancements permitting quicker computing, and new nodes being added or faraway from the community. Known as the problem adjustment, the community robotically adjusts the problem each 2,016 blocks, based mostly on the time it took to mine the final 2,016 blocks, to maintain the common time for locating the following block at 10 minutes. This takes benefit of greed and worry in a free market of financial actors working in their very own greatest pursuits for acquire, to continuously stability and defend the community. As extra compute energy is added to the community, the problem adjustment robotically makes it more durable to search out the following 2,016 blocks and conversely, as compute energy is eliminated, the problem robotically adjusts to make it simpler to search out the following 2,016 blocks. This course of creates extra and fewer worthwhile mining operations which reap the benefits of the free market. For instance, when China instituted a ban on all bitcoin mining in Might 2021, Bitcoin hash fee fell over a two-month interval from roughly 185 million terahashes per second to 58 million terahashes per second. Each two weeks, the problem adjusted downwards to maintain the typical block time at 10 minutes. With fewer miners competing for rewards, and a glut of newly-available mining tools hitting the market, creating downwards pricing strain on the tools, mining grew to become far more worthwhile. In flip, many U.S. firms rushed in to fill the void (and the financial alternative) that China created. A “gold rush” for mining ensued. As extra financial actors rushed in to reap the benefits of straightforward earnings, and the problem adjustment clocked larger, earnings rationalized as soon as once more.

And so, no matter a nation state assault, or a increase bust cycle pushed by greed and worry, the

community, globally, is at all times protected via the problem adjustment in making a pure incentive to win a bigger share of an financial prize. As extra market entrances race in to reap the benefits of the upper revenue alternative created by a neater problem fee, they add extra safety to the community — in flip taking the problem fee larger and their earnings decrease. (Bitcoin hash fee is presently 212 million terahashes)

Moreover, the method of paying for extra tools which is then obsoleted over time as new tools turns into superior, is expensive. This has the impact of supporting new entrants/concepts out there. In different phrases, its very nature reduces the monopolistic tendencies of a market to consolidate round just a few massive miners and value others out.

The increase and bust cycles of bitcoin mining must be checked out because the free market competitors for a bonus in a superbly clear market with every rational actor, in their very own minds looking for a bonus (which results in vitality innovation, see under). All of the whereas, securing the community as a byproduct of this pure competitors.

Power (As A Half Of Safety)

Whereas many individuals falsely consider that Bitcoin and the best way it makes use of proof of labor to validate blocks is unhealthy for the planet due to the vitality used to safe the community, the reality is that Bitcoin is the solely factor that I’ve discovered that may enable a transition to a system of planetary alignment and abundance. As I’ve typically said: Abundance in cash creates shortage in every single place else, and shortage in cash creates abundance.

On the highest stage, it is because our present financial system for the planet is incongruent with the place know-how is taking us and life on a finite planet.

As defined in “The Worth Of Tomorrow: Why Deflation Is Key To An Considerable Future” and in “The Best Recreation.”

A battle must be resolved at a system stage:

- Exponentially growing effectivity pushed by technological progress requires a foreign money that enables for deflation (bitcoin). We get extra for much less work.

- The present fiat financial system requires inflation and consequently, it wants manipulation to stay viable. We get much less for extra work.

As a result of the prevailing system is credit score based mostly, it can’t enable ongoing deflation with out full collapse (as a result of the credit score could be worn out and the credit score is the system). Society would by no means vote to have its total way of life collapse. Which implies a paradox exists the place society will at all times finally insist on manipulated “development” for worry of the results of collapse, and that manipulated development is the first supply of the issues that society is coping with — together with environmental injury.

In the end, it is because as an alternative of permitting costs to fall (and society to achieve time and freedom) with growing productiveness, it presupposes that we will “develop” ceaselessly. And the expansion itself presupposes that cash might be created out of skinny air to realize it. This “development” for extra jobs to have the ability to pay the payments, to pay for larger costs, that are manipulated larger within the first place retains society on a hamster wheel unable to see that it’s the system itself with its embedded development obligation to service unpayable debt that’s accountable for all of the ache. It will get worse — from the prevailing system each innovation decreasing value or saving time sooner or later should be offset with extra manipulation of foreign money to maintain the prevailing financial scheme going. Power itself gives a great instance. It isn’t like there hasn’t been an abundance of know-how deployed into the exploration, manufacturing, transportation and growth of recent vitality sources. If you understand that the first motive (growing demand is essential, too) vitality costs have risen towards new vitality coming on-line and effectivity good points of present vitality sources, is that they need to rise to help the prevailing credit score system, you additionally understand there isn’t any method out from the system.

Past the environmental drawback being unsolvable from the prevailing system, Bitcoin gives a path to a Kardashev kind 1 planet the place we harness all of the vitality that may attain earth from the solar.

It does so as a result of it gives a constructive financial incentive in a transition to plentiful vitality. From the attitude of provide and demand, Bitcoin’s excessive vitality value to safe the community is a function as a result of an financial incentive is created that’s each pure and constructive to construct out vitality abundance. Power is the primary driver of profitability in Bitcoin mining, which means that low-cost vitality is required for earnings. A bitcoin miner can’t stay worthwhile by paying for vitality at charges {that a} retail buyer will, so it doesn’t compete with that vitality.

As an alternative, it unleashes the identical free market conduct in vitality manufacturing and utilization. Specifically trying to find decrease value or stranded vitality. By doing so, it gives a ground value for vitality and a technique to allocate capital to investments that may in any other case not be made. These new vitality investments, together with renewables, enable areas that have been as soon as lower off from the world on account of an absence of dependable vitality to construct wealth and vitality independence. The fixed competitors to search out decrease prices in vitality and/or to make use of the warmth offered from Bitcoin mining for different industrial makes use of reminiscent of heating greenhouses or industrial buildings unleashes a wave of entrepreneurial expertise onto the problem of vitality utilization. All by the use of free market competitors to make sure a dependable abundance of vitality and utilization.

It must be apparent to most observers by now that vitality is extra essential in our lives than the quantity of printed paper notes or digital representations of these notes. Printing extra paper or digital models solely creates extra vitality shortage. Power supersedes {dollars} as a result of with out vitality, there isn’t any economic system.

Bitcoin’s tie to vitality for safety and its corresponding constructive impact on actual development and vitality abundance is then maybe its most under-appreciated function (and one which the mainstream press has fully backwards).

This excerpt from Gigi (@dergigi) gives a novel method of understanding how vitality protects the community:

“Something that does not have any actual value—value that’s instantly apparent and might be verified by anybody at a look—might be trivially solid or just made up. Within the phrases of Hugo Nguyen: ‘By attaching vitality to a block, we give it ‘kind’, permitting it to have actual weight & penalties within the bodily world.’

“If we take away this vitality, for instance by shifting from miners to signers, we reintroduce trusted third events into the equation, which removes the tie to bodily actuality that makes the previous self-evident.

“It’s this vitality, this weight, that protects the general public ledger. By bringing this unlikely data into existence, miners create a clear force-field round previous transactions, securing everybody’s worth within the course of—together with their very own—with none use of personal data.

“It’s this vitality, this weight, that protects the general public ledger. By bringing this unlikely data into existence, miners create a clear force-field round previous transactions, securing everybody’s worth within the course of—together with their very own—with none use of personal data.

“Right here comes the half that’s tough to grasp: the worth that’s protected is just not solely worth within the financial sense, however the very ethical worth of the integrity of the system. By extending the sincere chain with probably the most work, miners select to behave truthfully, defending the very guidelines that everybody agrees to. In flip, they’re rewarded monetarily by the collective that’s the community.”

2. Decentralization

There are two main design selections that result in the continuing decentralization of Bitcoin:

1. First is the character of proof of labor in fixing the Byzantine generals drawback. Importantly, it’s a discovery that can’t be solved once more. It may be copied which units up its personal challenges, or it may be modified to attempt to clear up it in a unique method. However, due to basic relativity, altering it can’t clear up the issue with out introducing an oracle and centralization. Let’s dive into every of those:

a. A duplicate by necessity isn’t the longest chain as a result of it should begin later than Bitcoin which has probably the most proof of labor defending its historical past. The longest blockchain, by definition, is the one with probably the most belief. Subsequently, a replica can’t have the identical safety or belief. Which begs the query, what utility would the brand new copy of Bitcoin present that wouldn’t be higher achieved via using probably the most trusted and safe chain? Or how would a brand new chain with out utility acquire sufficient traction to compete with Bitcoin, whereas on the similar time Bitcoin was exponentially growing its safety and hash fee due to its belief?

b. There is no such thing as a such factor as common time. Einstein’s concept of basic relativity says the best way we expertise time is from our perspective. Time is relative to us — the place we’re. Relying on orbits, this “time” distinction from our perspective on earth to Mars is between 4 minutes and 24 minutes. This similar time distinction happens on earth as properly however in such small intervals that we don’t discover it in our day by day lives. The truth that we don’t discover them, doesn’t change the truth that these small time variations exist. When pc techniques are trying to find cryptographic keys to show they discovered the following block and gained the prize, these small variations in time between completely different areas change into critically essential. Two Bitcoin miners on completely different sides of the world may clear up the cryptography at precisely the identical “time” due to these small variations and each be appropriate. It isn’t simply theoretical, it has occurred quite a few occasions on the Bitcoin protocol and the best way it’s solved is, once more, the longest chain, or most belief wins. For a interval of 10 minutes then, or till the following block is mined, these two chains can each be legitimate till the following block is mined and the nodes affirm the longest chain. Miners select which block they consider is legitimate and as 51% of them select the legitimate block, the opposite miners transfer to the longest chain. It’s a waste of vitality and assets to mine on prime of an orphaned block. Once more, the longest chain is the one with probably the most belief.

Due to this discovery that ties vitality and proof of labor collectively, there exists just one different technique to clear up the time drawback. This includes introducing a “trusted” agent or oracle that defines the “guidelines” after which chooses which transactions are legitimate (what transaction got here first). However as soon as an oracle is launched to resolve the issue, belief is positioned within the oracle, the principles can change and decentralization is misplaced.

Bitcoin, via proof of labor, is the one technique to clear up the issue. As Neil Degrasse Tyson factors out, “After the legal guidelines of physics, every thing else is an opinion.”

2. The second design alternative that retains Bitcoin decentralized is the dimensions of the block. Sacrificing extra block dimension on Layer 1 of Bitcoin meant a decrease variety of transactions per 10 minute block and/or much less room for sensible contracts within the underlying code. By protecting the block dimension small, the tens of 1000’s of full node operators world wide are the true rule enforcers of the community. (Tomer Strolight offers an amazing firsthand account of this energy within the palms of the node operators right here.)

Subsequently, whereas miners compete as financial actors to safe the community, they’re held in test by nodes (open to anybody to simply arrange and run) who affirm the transactions. These full nodes every have a complete historical past of the blockchain and make sure every of its transactions. As a result of block dimension is stored small, it signifies that these nodes are very economical to run in {hardware} and vitality prices, which in flip results in extra nodes or individuals validating the system (decentralization).

By including extra data or area to the blockchain on Layer 1, the price in vitality and compute energy to safe the community explodes, and in flip results in solely probably the most highly effective or rich having sufficient cash to run nodes, which in flip controls the choices, i.e., centralization. The Blocksize Wars beginning in 2015 to 2019 have been fought over this key concern with most of the strongest Bitcoin proponents on the time favoring a rule change that may carry extra performance to Layer 1, however in flip would give them extra management within the type of centralization. Bitcoin onerous forked over this struggle with new code representing the brand new guidelines. In contrast to gentle forks that are agreed to by the miners and nodes and are backwards appropriate, onerous forks create a brand new chain. For instance, when you owned bitcoin previous to August 1, 2017, and a tough fork to Bitcoin Money occured, you’ll personal cash in each chains. You possibly can then elect to promote certainly one of them in favor of the opposite or preserve each. Under is a snapshot of what the market determines as worth in each cash:

Market capitalization of Bitcoin as of August 6, 2022: $443 billion

Market capitalization of Bitcoin Money as of August 6, 2022: $2.7 billion

The worth discrepancy of the fork demonstrates once more that whereas anybody can change the principles to supply a unique coin, the longest chain with probably the most proof of labor has probably the most belief, and is valued larger by market individuals in consequence. Decentralization is a giant a part of this belief.

3. Scalability

As strengthened all through this text, the design selections that led to decentralization and safety which itself wasn’t attainable earlier than Bitcoin, additionally led to design selections that lacked scalability. It’s right here that a lot of the battle and confusion in blockchains originate. From a human nature perspective, it’s straightforward to see that there could be conflicts, some customers that needed to construct extra when it comes to scaling or differentiation on prime of Bitcoin and felt blocked by its sluggish and methodical consensus of nodes defending the ecosystem. They then determined to create their very own blockchains with differentiation and tried to persuade others that the brand new blockchains have been higher in a roundabout way. Whereas many have been/are full fraudsters trying to make a fast buck on the again of ignorance, some might not have even been conscious of the long-term implications of their design choices in creating blockchains that should fail — both on account of one, centralization and lack of financial incentives, or two, safety vulnerabilities. And as soon as created, there was no method out however to confess failure, or to maintain altering whereas promising to resolve the paradox in some unspecified time in the future sooner or later.

A Totally different Means To Scale

Protocols scale in layers. Scaling Bitcoin in layers gives a technique to retain safety and decentralization of Layer 1, but in addition acquire scalability within the second or third layers as an alternative of sacrificing the primary, much like the layers that kind the constructing blocks of the web and finally the merchandise that you just use every single day. Every of the completely different protocols function solely at that layer. This abstraction ensures that every layer is self-contained, solely needing to know how one can interface with the layer above and under it, which simplifies design and adaptability with out sacrificing what one other layer gives. This quick YouTube video gives a great overview of the community protocol layers of the TCP-IP layered mannequin.

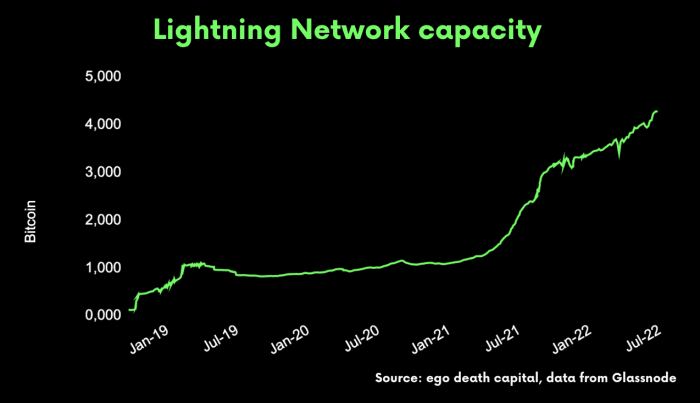

Due to the misunderstanding that protocols scale in layers, and the general noise out there, improvements like Lightning that enable Bitcoin to scale could be largely dismissed by an viewers that noticed Bitcoin as slow-moving, previous know-how, uncompromising in its safety and decentralization.

This would supply an uneven alternative for the nations, entrepreneurs, capital and public who took time to grasp what was taking place within the ecosystem versus those that dismissed it.

I consider that we’re at that inflection level the place applied sciences reminiscent of Lightning, Fedimint, Taro and others will usher in a wave of innovation within the area. I additionally consider though it’s nonetheless in its infancy, Bitcoin and the protocol are unstoppable.

Under is a chart of Lightning adoption since inception:

From Lyn Alden’s latest masterpiece on The Lightning Community:

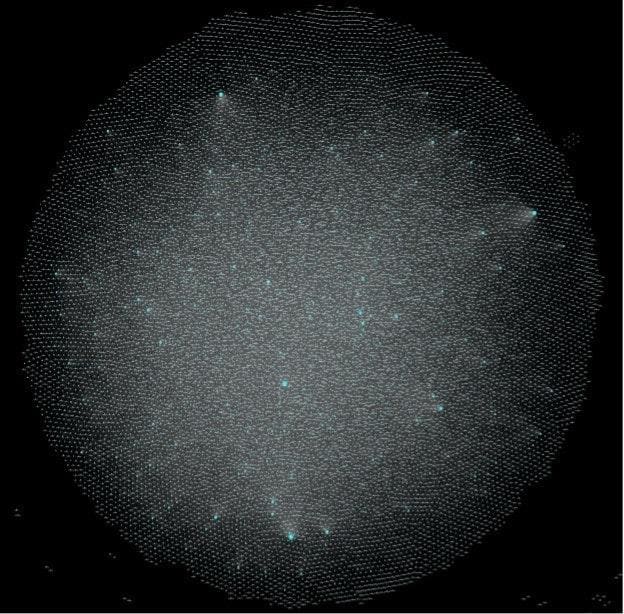

“Think about a worldwide system with an enormous variety of interconnected nodes. Anybody can enter the community with a brand new node and begin creating channels. Alternatively, many custodial providers additionally offers their account-holders entry to the community via their nodes and channels.

“Right here’s a visualization of the general public Lightning community in the meanwhile. It’s a rising community of interconnected nodes linked by cost channels, with these greater dots representing notably well-connected nodes:”

It’s early, and never every thing will work out as deliberate, however every success scaling in layers reinforces and brings extra expertise and capital to the ecosystem. A few of these items of the puzzle (like Lightning, Taro and Fedimint) will work collectively in methods not but fully understood — accelerating adoption, all of them will construct upon a Layer 1 basis that’s rock stable. In doing so, most of the long-term “use instances” of other cash will disappear and one after the other, they may fail.

The Bitcoin protocol, scaling in layers, will present a base layer that merges a brand new peer-to-peer web and cash natively inside it. This can kind a very safe, open to anybody, integral basis for know-how extra broadly. Just like the daybreak of the web, however this time decentralized and safe, making certain with its design a hopeful path for humanity the place the pure abundance gained via know-how is broadly distributed to society as an alternative of being consolidated within the palms of some. Regulators in sure nations may attempt to sluggish or cease it, however in doing so, they might be making a grave mistake, analogous to shutting down the web from their residents and blocking the innovation that got here with it. It wouldn’t cease the innovation however would as an alternative be sure that the innovation, and worth derived from that innovation moved to different nations. Over time, individuals will understand that as an alternative of pricing bitcoin “from the system” that they reside in in the present day, bitcoin will value every thing in that system.

There shall be unbelievable successes, failures, and learnings. Most significantly although, there shall be enduring worth to society that comes on prime of a stable basis that’s incorruptible by a small group of individuals — decentralized and safe by its design. That emergent system, launched to the world by Nakamoto in 2009, adjustments every thing.

Some main thinkers in area and their work:

Lyn Alden

Dergigi

Troy Cross and Kyn Urso

This can be a visitor submit by Jeff Sales space. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.