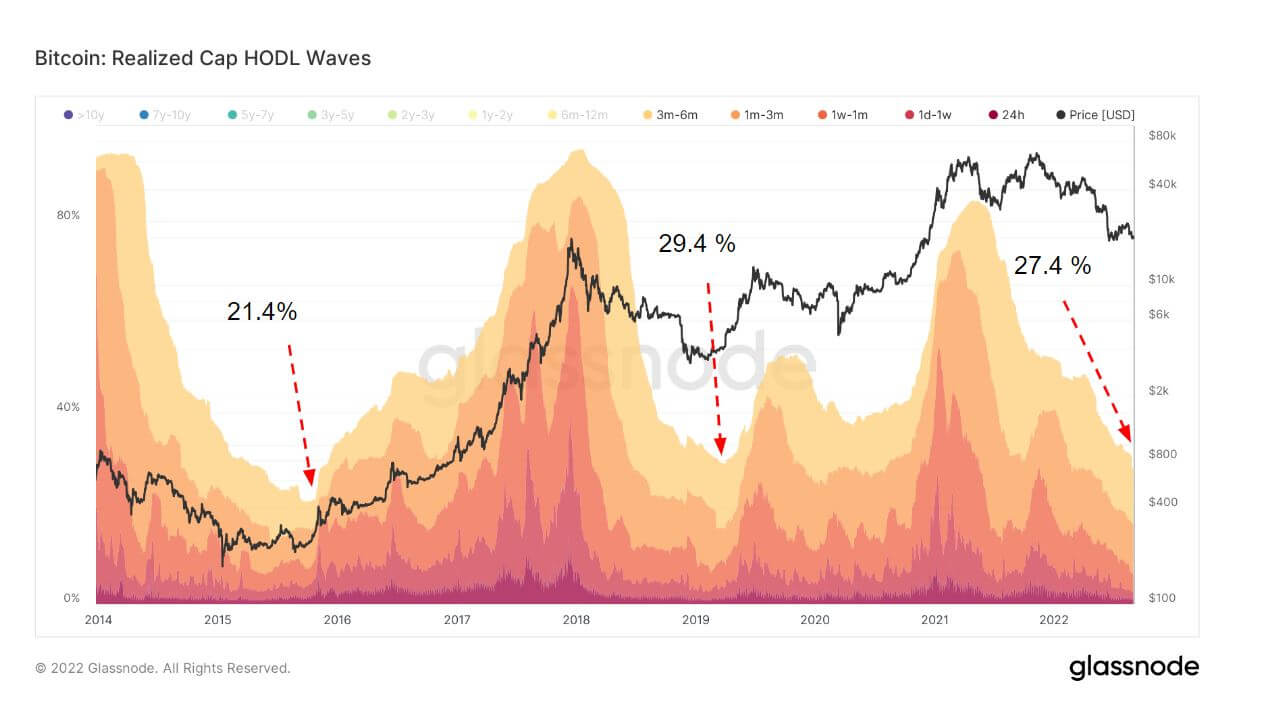

HODL Waves are an indicator that bundles all lively provide addresses by age bands. Every coloured band exhibits the proportion of Bitcoin in existence that was final moved throughout the time interval denoted within the legend.

A evaluation of the present state of the HODL Waves chart by CryptoSlate signifies that short-term holders are at a decrease stage than the underside of the 2016 – 2020 halving cycle.

Brief-term holders are outlined as a cohort holding bitcoin for lower than 155 days. Brief-term holders sometimes purchase in energy throughout bull runs and distribute when costs begin to drop attributable to elevated worth sensitivity.

The realized cap HODL Waves chart above showcases that short-term holders maintain a major quantity of cash and traditionally contribute to the ground of bear markets. In 2015 short-term holders made up 21.4% and in 2019, it was over 29%. Presently, it’s 27.4% marking a historically necessary second throughout the halving cycle.

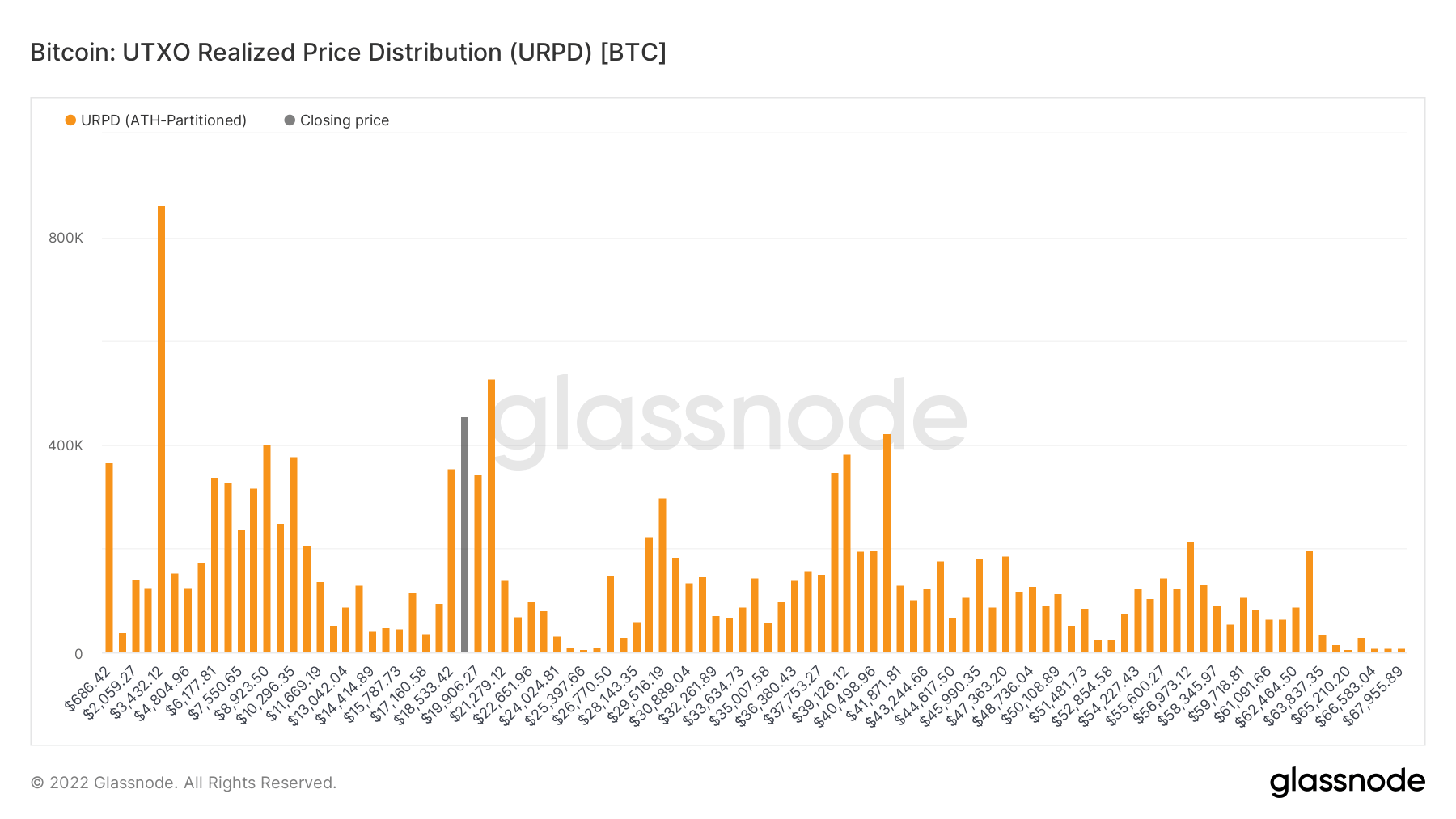

Brief-term holders purchased when BTC dropped under the psychological help at $20,000. The Unrealized Value Distribution (URPD) metric helps this thesis as a major quantity of concentrated cash have been purchased round $17.5k to $22k. The overwhelming majority of holders, nevertheless, are long-term holders which kind the bottom.

The necessary issue to recollect is that Bitcoin has by no means needed to navigate a world recession or Quantitative Tightening. Since 2009, Bitcoin has had the good thing about using a wave of rising asset costs throughout myriad markets. Whereas short-term holders drop to ranges typical of a market backside, on-chain metrics must take care of different macro elements amid hovering inflation and continued cash printing.

Nevertheless, one doubtlessly constructive indicator is the truth that the M1 cash provide within the US has lastly ticked down after reaching a excessive of $20.69 trillion. Up to date numbers for August will likely be launched later in September, but, the latest figures from July present the cash provide dropping to $20.51 trillion.

Robust on-chain knowledge may be seen as a sign of when Bitcoin is able to head again in direction of a bull run when the worldwide macro atmosphere permits for it.

Get an Edge on the Crypto Market 👇

Develop into a member of CryptoSlate Edge and entry our unique Discord group, extra unique content material and evaluation.

On-chain evaluation

Value snapshots

Extra context

Be a part of now for $19/month Discover all advantages