With The Merge coming subsequent week and Cardano’s Vasil exhausting fork commencing quickly after, the market capitalization of the highest sensible contract tokens by valuation elevated 1.19% throughout the previous 24 hours to $316 billion on September 11, 2022. Furthermore, the market capitalization of the highest sensible contract crypto property in the present day has elevated 44.35% towards the U.S. greenback for the reason that finish of June.

Prime Sensible Contracts Tokens by Market Capitalization Acquire Extra Than 44% in 80 Days

The highest sensible contract tokens by market capitalization have elevated an awesome deal over the last two months forward of Ethereum’s extremely anticipated Merge. When The Merge takes place, the second largest crypto asset by market capitalization, and the most important sensible contract token by valuation, Ethereum (ETH), will transition from proof-of-work (PoW) to proof-of-stake (PoS).

Ethereum has gained an honest quantity of worth main as much as The Merge which is scheduled to occur in simply over two days or round September 14, 2022. Along with The Merge, the Cardano blockchain community is predicted to improve on September 22. On the time of writing on September 11, 2022, the combination USD worth of the highest sensible contract tokens by valuation is up 1.19% in the present day.

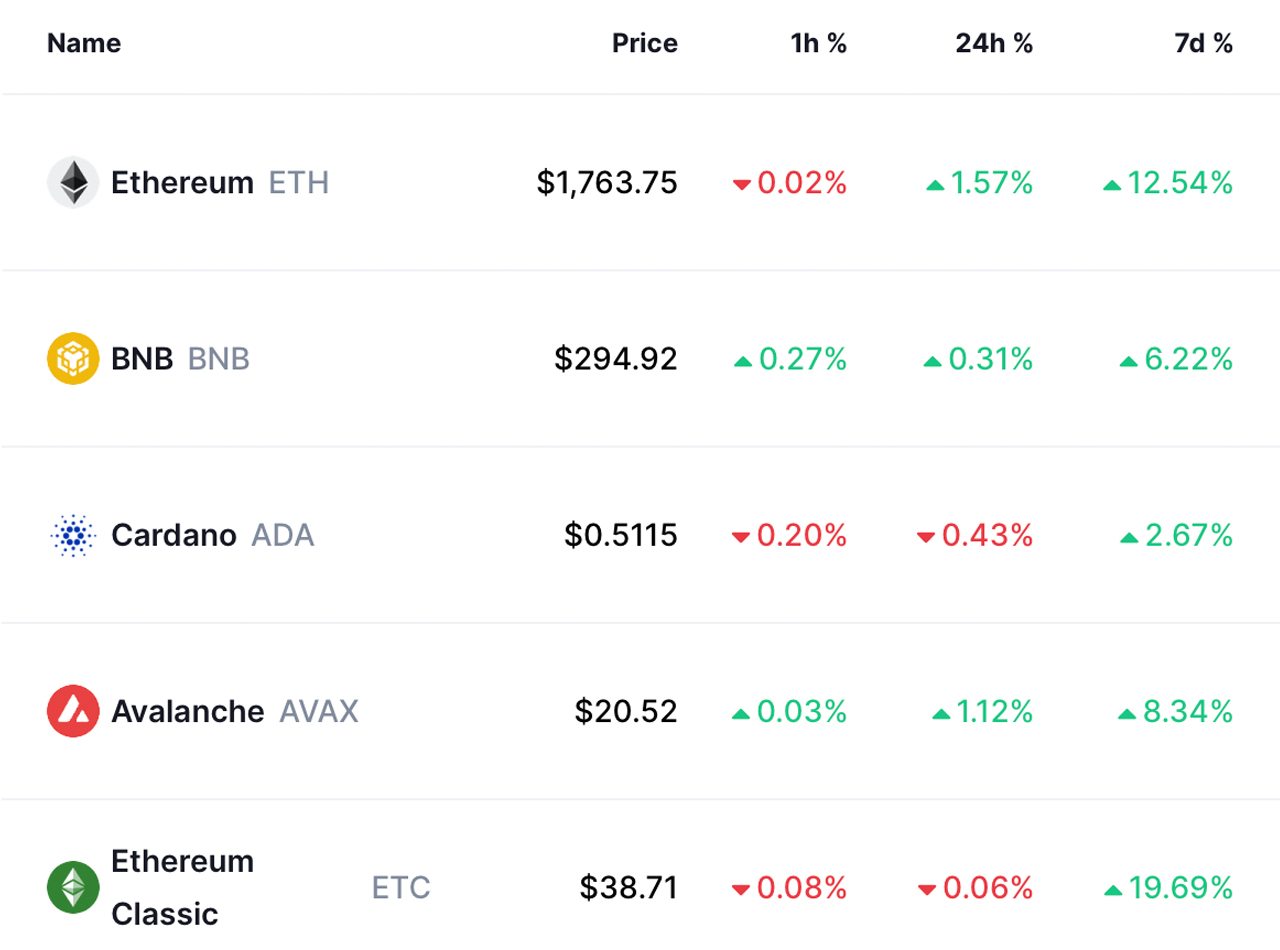

There’s $316 billion in collective worth among the many high sensible contract crypto property in accordance with coinmarketcap.com information. The highest 5 sensible contract tokens when it comes to valuation embody ethereum (ETH), bnb (BNB), cardano (ADA), avalanche (AVAX), and ethereum traditional (ETC) respectively.

Over the past week ETH elevated by 12.52%, BNB jumped by 6.05%, ADA swelled by 2.67%, AVAX gained 8.15%, and ETC elevated by 19.34%. Sensible contract token costs are quite a bit larger than they had been 80 days in the past when the combination complete worth of all of them was $218.9 billion on June 23, 2022.

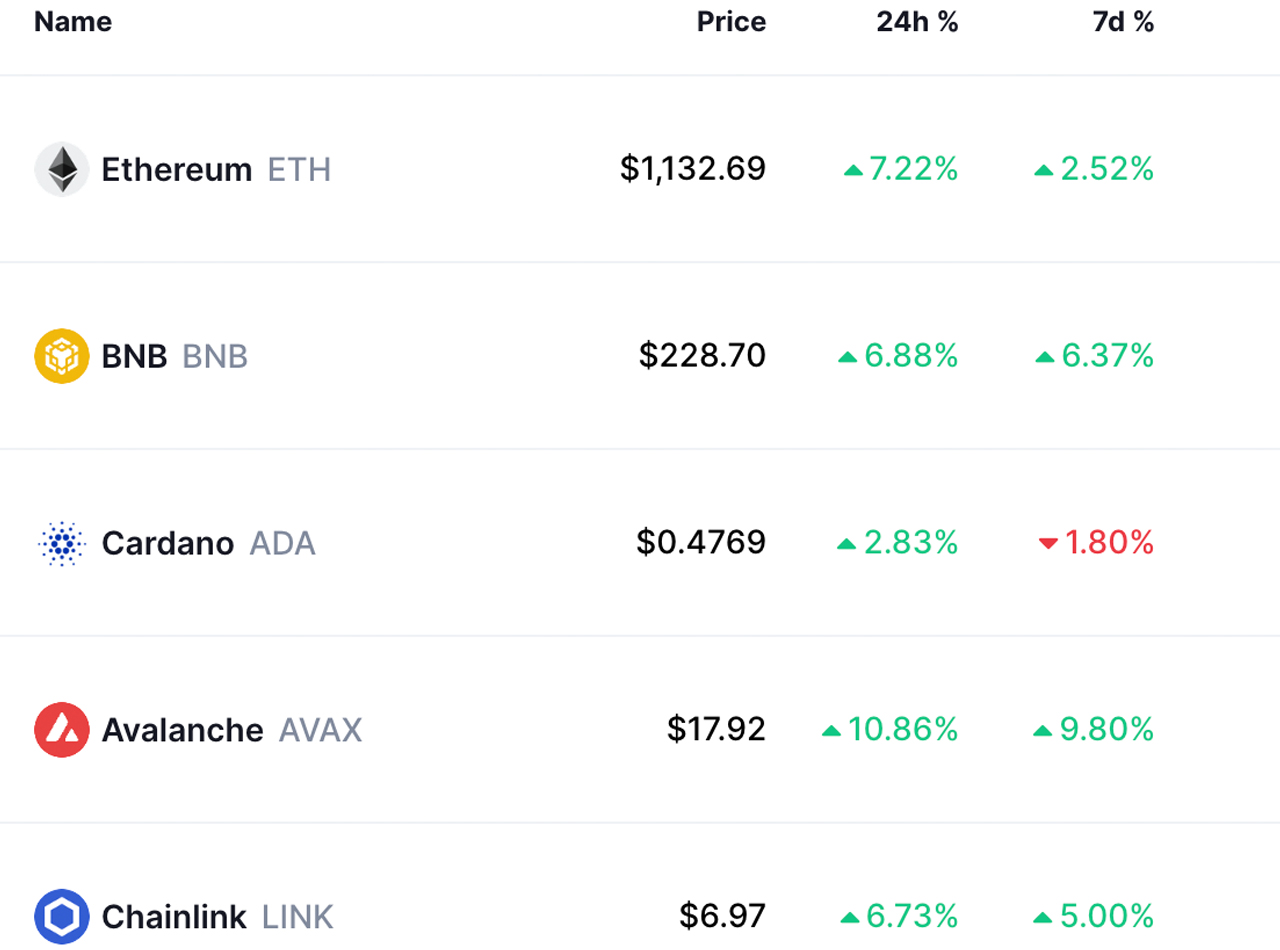

On that day, ETH was exchanging palms for $1,132 per unit after it tapped a low of 877 per ether on June 17. BNB was buying and selling for $228 on June 23 and ADA was $0.47 per unit. 80 days in the past, AVAX was buying and selling for $17.92 and chainlink (LINK) was $6.97. LINK was forward of ETC on that day however chainlink is now under ethereum traditional since ETC’s latest rise.

The entire worth locked in decentralized finance (defi) protocols jumped as nicely since June 23 because the TVL was round $55.29 billion. Immediately, defillama.com stats present the TVL is round $60.26 billion or a rise of round 8.98% since then.

The most important sensible contract token gainers this week embody liquidapps (DAPP), up 124.05%, aergo (AERGO), up 118.57%, and enecuum (ENQ), which gained 112.86%. The week’s greatest losers when it comes to sensible contract coin losses throughout the previous week embody salt (SALT), down 35.82%, edgeware (EDG), down 13.28%, and aurora (AOA), down 10% this week.

Tags on this story

What do you concentrate on the positive factors sensible contract tokens have seen main as much as The Merge and Cardano’s Vasil exhausting fork? Tell us what you concentrate on this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized purposes. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising in the present day.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.