The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

CPI Volatility Doesn’t Disappoint

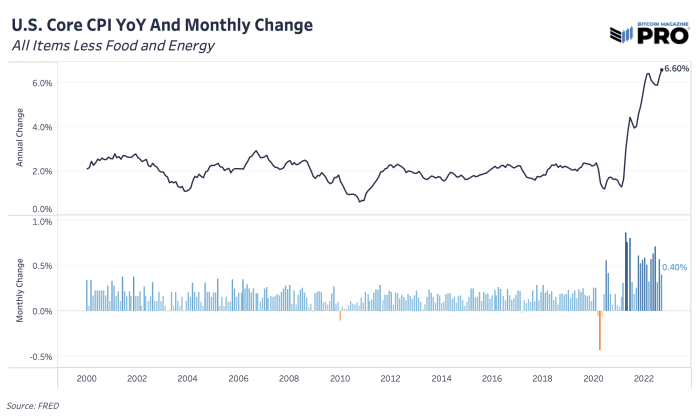

Within the final article, we highlighted a possible for CPI to shock to the upside and produce extra volatility — and that’s precisely what we bought and extra. We gained’t cowl the parts that drove the shock intimately since we already highlighted a lot of that, however the important thing takeaway is that Core CPI got here in hotter than anticipated at 6.6% year-over-year and 0.4% month-over-month with shelter (hire, housing parts, and so on) and medical companies as key drivers. That is the quickest price of change in annual headline Core CPI since 1982. To match the varied parts over the past three months, try this chart.

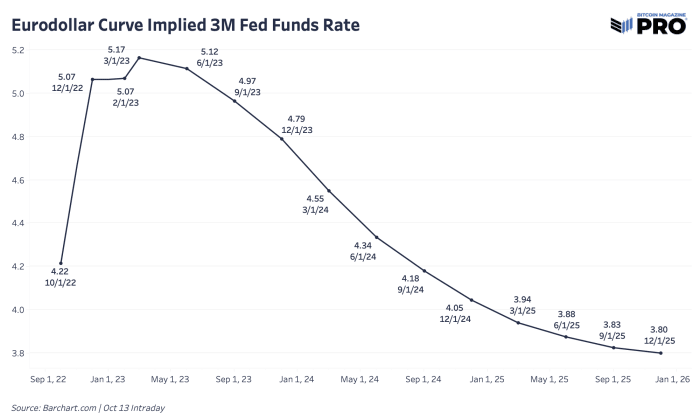

As for the charges, the most recent implied federal funds price from the eurodollar market reveals a peak simply above 5% in March 2023 earlier than any price cuts occur on the finish of the 12 months.

The place’s The Bitcoin Worth Low?

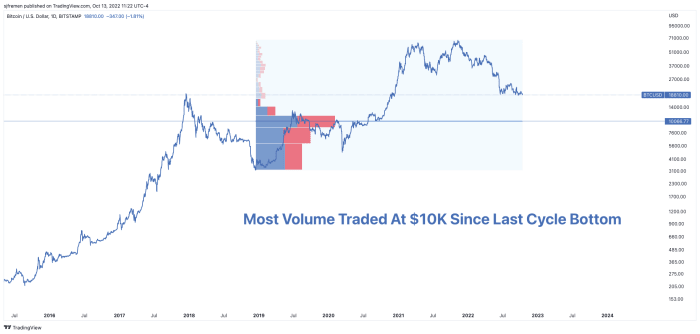

With a fall to $18,000 inching nearer and bitcoin going through dangers of latest year-to-date lows, it’s value looking at just a few key backside value ranges to gauge the place the worth might find yourself. First, let’s have a look at the mounted quantity vary profile of bitcoin because the December 2018 backside of final cycle. The overwhelming majority of traded quantity available in the market occurred proper round $10,000, additionally a key psychological degree. In a powerful downward transfer, $10,000 is a spot the place many available in the market have their spot price foundation and will begin feeling some actual drawdown ache or lack of conviction.

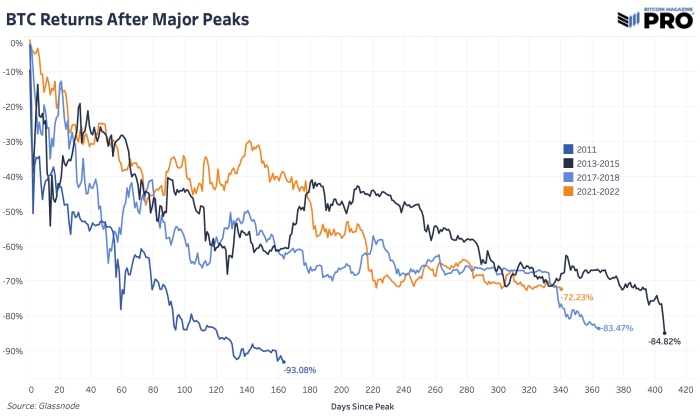

By way of bear market and cycle period, let’s revisit the cyclical drawdown chart for bitcoin in present and former cycles. Presently, we’re proper round a 72.23% drawdown from an all-time excessive closing value of $67,589. If we’re going to see a max cycle drawdown are available in lower than the final two cycles — let’s say round 80% — then we’re taking a look at a value round $13,500. If we assume that this cycle and popping of valuations can be a lot worse, let’s say round 85%, then we’re taking a look at a value round $10,100. The bull case is that we’ve discovered a sturdy backside at $18,000 and we gained’t see the max drawdown attain past 73%.

From an on-chain perspective, one of many extra attention-grabbing realized value areas is the realized value held by the cohort of addresses which have 10-100 BTC. Recall that realized value is an estimate of the typical price foundation based mostly on the worth when UTXOs final moved. This specific group accounts for round 22.6% of all circulating provide. This group will surely mirror an honest portion of long-term holders and there’s a case to be made that in a deep, extended bear market, long-term holders have but to really feel the ache or capitulation that we’ve seen up to now.

Related Previous Articles: