PlanB — the pseudonymous analyst behind the well-known Bitcoin (BTC) stock-to-flow (S2F) mannequin — anticipates that Bitcoin might quickly see a 5,800% rally.

Throughout a latest interview, PlanB advised that Bitcoin might be headed considerably greater and that his stock-to-flow mannequin has not but been invalidated. He mentioned:

“If we assume that the outdated mannequin, the unique 2019 mannequin is right, the $55,000 mannequin, then the following halving might result in costs someplace — and I’m making a really wide selection, some individuals don’t prefer it — however someplace between $100,000 and a $1 million.”

PlanB, crypto analyst

PlanB has gone so far as to say that he’s assured that the forecast will maintain until his mannequin is totally invalidated or “Bitcoin dies.” He highlighted:

“I’ve little doubt in any way that we go to that $100,000—$1 million vary, and regardless of the way you have a look at it, the present value is a steal if that’s what you consider. So yeah, I’m very optimistic.”

PlanB, crypto analyst

Speaking in regards to the close to time period, PlanB advised that Bitcoin would probably hit the underside of the continuing bear market over the following few months.

The stock-to-flow mannequin is a sort of financial quantitative mannequin that costs commodities primarily based on the entire current provide (inventory) and the brand new provide created in a given time (movement.) Within the case of Bitcoin, the present provide is the inventory, and the newly-mined Bitcoin is the movement.

Bitcoin halvings are pre-scheduled occasions that lower the speed at which new Bitcoin is mined in half by decreasing the BTC mining rewards for every new block by 50%. Halvings have an excellent affect on this mannequin’s value prediction. Trying on the 463-day model of the mannequin, which “smooths out” the value will increase following halvings by averaging out, we are able to see that the mannequin has predicted Bitcoin’s efficiency to a formidable diploma.

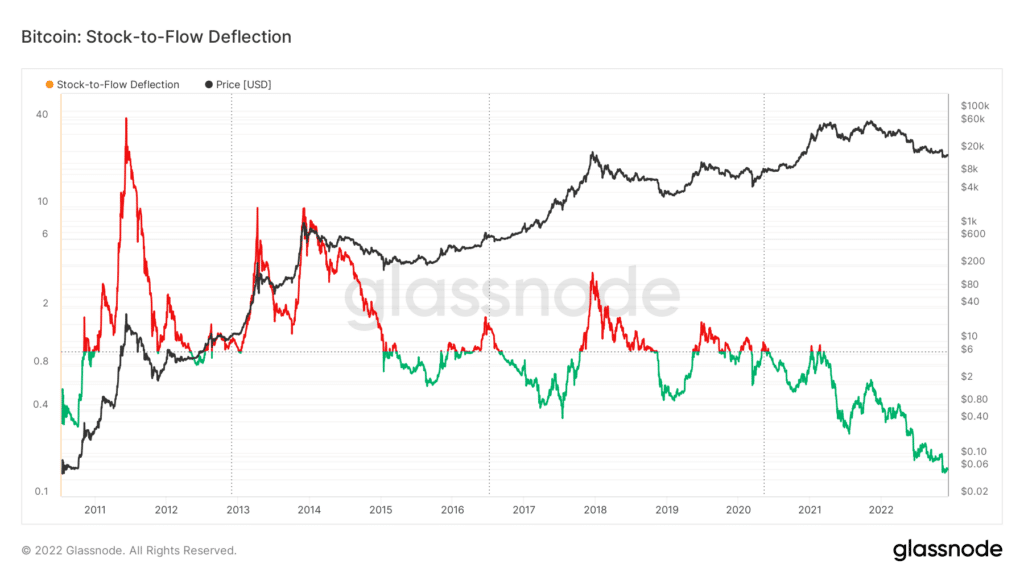

Many have claimed that the most recent bear market invalidated the Bitcoin stock-to-flow. Others reported that the coin’s value had ventured additional away from the mannequin’s prediction than anytime earlier than. Nonetheless, wanting on the stock-to-flow deflection chart accessible on the blockchain information service Glassnode we are able to observe that the latter assertion is just not true.

The chart clearly exhibits that Bitcoin is presently price below 15,3% of what the stock-to-flow suggests it ought to be. Nonetheless, throughout 2011’s bull market, the value was price virtually 40 instances greater than the mannequin estimated its worth to be. The worth ventured a lot farther from the S2F estimates earlier than than it’s now, simply by no means within the unfavourable.

Comply with Us on Google Information