The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Binance: FUD Or Reliable Questions?

By far, one of many greatest winners within the aftermath of the FTX collapse has appeared — on the floor — to be Binance. After solely having 7.82% market share of the bitcoin provide on exchanges in 2018, their share is now 27.50% regardless of a wider pattern of bitcoin provide leaving exchanges. The bitcoin stability on Binance now totals 595,864 BTC, which is 3.1% of excellent provide, price $10.58 billion. This bitcoin belongs to their clients and displays a rising pattern in market share over the previous few years that has made Binance the biggest bitcoin and cryptocurrency alternate on the planet.

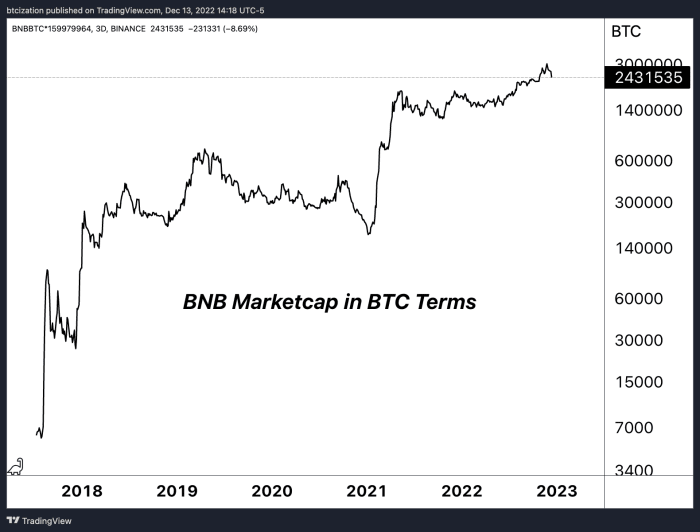

Binance now controls roughly 60% of the spot and derivatives quantity in the complete market. It’s arduous to see how any alternate within the area is usually a “winner” within the present market situations, however one may make the case for Binance, with the alternate’s rising power in a decimated trade. On high of that, Binance’s BNB token, the native foreign money of Binance’s personal Ethereum-competing Layer 1 blockchain, remains to be one of many higher performing tokens when valued in bitcoin phrases this 12 months.

But, is that this latest “power” all the things that it appears or is it a facade? We’ve discovered over the past month that no firm is protected on this trade proper now (particularly exchanges) and questions are rising round Binance’s practices, solvency, BNB token worth and the general state of their enterprise over the previous few weeks. Is it FUD or legit? Let’s attempt to break a few of it down, addressing the issues by means of an goal and skeptical lens.

Binance Flows

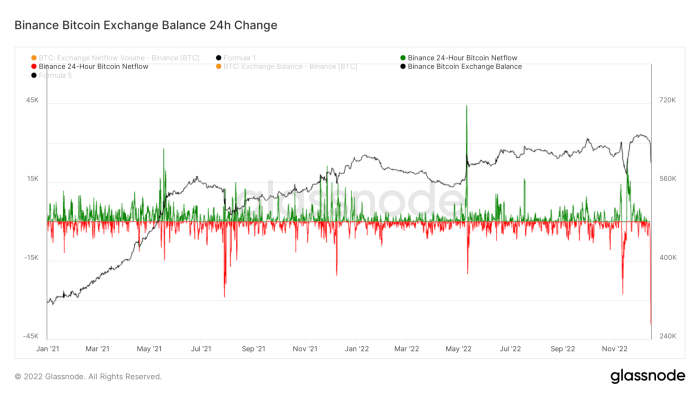

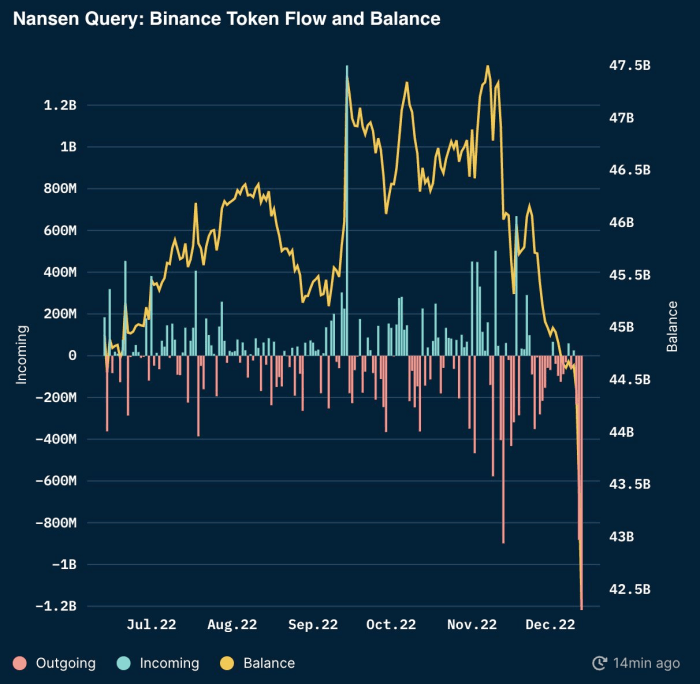

We’ve seen vital outflows from Binance throughout totally different numerous tokens and bitcoin when each Nansen and Glassnode monitoring. Throughout ETH and ERC20 tokens, Binance noticed $3 billion leaving the alternate in its largest single-day outflow since June. Throughout Nansen whole pockets monitoring, all Binance balances are estimated at $62.5 billion with round 50% of these balances in stablecoins throughout BUSD and USDT.

Supply: Nansen

In line with Glassnode, the entire bitcoin alternate stability on Binance is down round 6-7% over the past day, after reaching a peak on December 1. Though balances stay above 500,000 bitcoin and Binance has proven a rising pattern of bitcoin balances on the platform this 12 months, it is a vital transfer for outflows in simply 24 hours. As a basic comparability, the pattern of bitcoin alternate balances was a a lot totally different story for FTX, whose stability had been falling closely since June. Binance outflows over the past couple days are a bit alarming and lift questions: Is that this a one-off occasion and simply enterprise as typical or is that this the beginning of one thing extra?

Readers can observe the on-chain addresses supplied by Binance without cost right here.

The principle trigger for concern is just not whether or not Binance has any bitcoin/crypto or not. We will transparently see that the agency controls tens of billions price of crypto belongings. What isn’t precisely clear, just like FTX, is whether or not the agency has commingled customers funds or whether or not the agency has any excellent liabilities in opposition to consumer belongings.

Binance CEO Changpeng Zhao (CZ) has mentioned that the agency has no liabilities with every other companies, however as latest months have proven, phrases don’t imply all that a lot. Whereas we aren’t claiming that CZ is mendacity to the general public concerning the state of Binance funds, we now have no method to show in any other case.

CZ’s response as as to whether the corporate was going to audit liabilities in opposition to consumer belongings was, “Sure, however liabilities are more durable. We do not owe any loans to anybody. You’ll be able to ask round.”

Sadly, “ask round” isn’t a passable sufficient reply for an ecosystem supposedly constructed across the ethos of “don’t belief, confirm.”

Whereas there isn’t any doubt that Binance is an trade big within the crypto derivatives trade, how do we all know the agency isn’t doing related issues as previous actors with reference to buying and selling in opposition to purchasers utilizing consumer funds and/or proprietary knowledge. Issues like the previous Chief Authorized Officer of Coinbase departing Binance U.S. final summer time after simply three months because the CEO leaves one with many questions.

So as to add to our skepticism, the worth of the Binance alternate token BNB is close to all-time highs in bitcoin phrases, appreciating an astounding 828% in opposition to bitcoin within the final 785 calendar days.

The approaching weeks shall be stuffed with headlines across the state of worldwide crypto regulation in a post-FTX world. In a 48-hour interval, Reuters revealed information stating that the U.S. Justice Dept is break up over charging Binance, Binance withdrawals for bitcoin and mixture stablecoin pairs have hit all-time highs and the BNB alternate token has fallen 10% relative to bitcoin.

Out of an abundance of warning, we are going to proceed to induce readers working on any centralized alternate — of which Binance is most positively included — to look into self custody options. There have been far too many situations of incompetence and/or misconduct from exchanges.

It’s not that we don’t belief CZ or Binance, it is the truth that we don’t belief anybody.

The entire level of bitcoin is we now have an asset that’s actually the legal responsibility of nobody. Confirm the possession of an open distributed community with cryptography; don’t belief permissioned IOUs. With the combination of regulatory issues concerning the world crypto derivatives trade, a questionable alternate token with unbelievable relative efficiency over the past two years and a shaky proof-of-reserves attestation — that was incorrectly claimed to be an audit and had trade CEOs elevating eyebrows — we discover the necessity to urge our readers to judge their counterparty threat.