That is an opinion editorial by Michael Markle, a member of the San Juan BitDevs meetup.

Puerto Rico has seen all of it, from foreign money devaluations, confiscation of wealth, pure disasters, colonizers and fights for independence, all in lower than 100 years. Earlier than that, Pedro Albizu Campos fought for Puerto Rico to have its personal identification, its personal independence and its personal sovereignty.

However now the world has a decentralized cash that may present Puerto Rico with the independence and identification that it has been starved for and deserves.

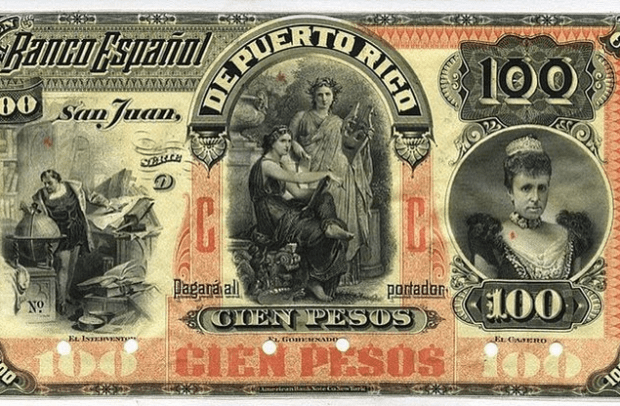

The Historical past Of Foreign money In Puerto Rico

In 1889, Puerto Rico suffered a 40% foreign money devaluation, crippling the Puerto Rican financial system. This was attributable to the USA establishing the American Colonial Financial institution and declaring the U.S. greenback as authorized tender (the official cash) of Puerto Rico, altering it from the peso.

Nevertheless, in 1899, one peso was solely value 60 cents, that means the native companies of Puerto Rico and its residents misplaced 40% of their internet worths in a single day from causes completely outdoors of their management. This resulted in Puerto Ricans, trying to save lots of their internet worths, borrowing cash from the American Colonial Financial institution. Nevertheless, excessive rates of interest made it most unlikely that locals have been going to have the ability to pay again their loans, inflicting many Puerto Ricans to default on their debt. The outcome was that the financial institution seized their property (in nowadays, usually their land).

The Response From America Central Financial institution In 2020

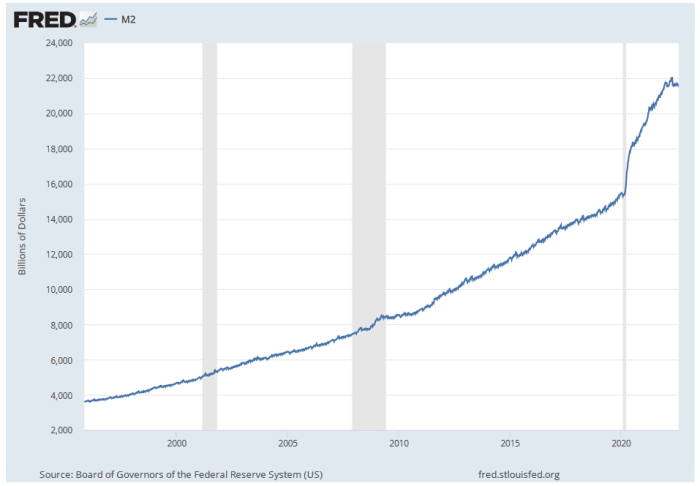

This chart represents the entire {dollars} within the U.S. and Puerto Rican financial system. Supply: M2 (M2SL), FRED, St. Louis Fed (stlouisfed.org).

Puerto Rico makes use of the U.S. greenback as its authorized tender and is weak to the implications of reckless financial coverage, together with the growth of this cash provide (inflation), and has already skilled main foreign money devaluation (as famous above). Wanting on the 2020 part of the chart above, through the COVID-19 pandemic, the USA central financial institution printed about 20% of the entire {dollars} circulating within the financial system, flooding the market with {dollars}. Cash printing has devastating penalties on native economies, particularly for lower- and middle-income households. Cash printing ends in a wider wealth hole with items and providers turning into costlier. Residence costs and meals costs in Puerto Rico are quickly growing.

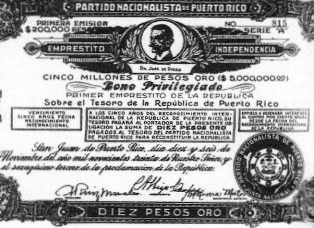

The Legacy Of Pedro Albizu Campos

Who was Pedro Albizu Campos? A person who valued human freedoms, the precise to privateness, self sovereignty, independence and prosperity.

He grew up within the Machuelo Abajo part of Ponce, Puerto Rico. Extremely properly educated, Campos graduated from a top-tier faculty in the USA and will converse six languages. He was that man, he led by instance, confirmed up on daily basis to guide, instilled values, dreamed large and supplied inclusiveness no matter class or standing. He was a real man of the individuals, who understood the ability inside others, recognizing that they don’t must be depending on anybody else.

Throughout his time, his focus particularly was Puerto Rico’s freedom and independence. Understanding the in-depth historical past of Puerto Rico is essential to understanding why he selected this focus. If Alibuzu Campos was alive right now, he can be a Bitcoiner. I encourage everybody to learn the “Conflict In opposition to All Puerto Ricans” by Nelson A. Denis for the complete story.

“Albizu additionally used his authorized abilities to create a sequence of bonds that have been registered on Wall Avenue. These bonds have been an funding within the Republic of Puerto Rico, redeemable from the island’s treasury on the day it turned unbiased. The primary bond providing was for $200,000 in increments of $10, $50 and $100 bonds.”

Banking The Unbanked

Puerto Rico has about 3.2 million residents and lots of are estimated to have 36% of its inhabitants unbanked.

When people don’t have entry to correct banking or monetary providers, the implications are devastating. Bitcoin not solely permits anybody to open a checking account, it permits anybody to develop into their very own banker.

Why Bitcoin?

Bitcoin is:

- Decentralized: Bitcoin is the primary type of cash within the historical past of human existence that’s not managed by any particular person, company or authorities.

- Open: Bitcoin permits anybody to take part within the community. It doesn’t acknowledge race, borders, religions or any cultural identities. On a deeper stage, it doesn’t even acknowledge people or age.

- Permissionless: Bitcoin doesn’t require permission from a authorities or third celebration to save lots of or transact worth, that means that the one members in a monetary transaction are the senders and receivers. No banks, PayPals, Venmos, ATH Móvil, and so forth. are concerned. You don’t want permission to open a financial savings account.

- Unconfiscatable: With Bitcoin, your wealth is protected for generations to come back. That is made attainable by encrypted keys (passwords) that solely you could know. It can’t be frozen, seized or stolen from you. When you die with no contingency plan, your bitcoin will die with you and might’t ever be spent.

- Clear: Bitcoin’s transaction ledger is accessible to anybody at any time. Issuance of the foreign money is thought and can’t be modified. Bitcoin’s community audits the ledger each 10 minutes to make sure all members are working throughout the guidelines of the community.

- Absolute Shortage: Bitcoin has absolute shortage. Solely 21 million bitcoin will ever exist. Bitcoin can’t be replicated, duplicated, counterfeited or double spent. Bitcoin is the right unit of account.

- Progress In The Future: Bitcoin permits Puerto Ricans to develop into individually sovereign. Bitcoin separates cash from the ability of the State, simply as critically because the separation of the church from the federal government was within the 18th century, which led to the good enlightenment. We are able to’t depend on techniques of belief in people, establishments or governments to have management over our monetary future. Bitcoin is trustless — confirm all the pieces.

Love For Puerto Rico

My inspiration to write down this piece got here from not solely being a bitcoiner however from being a neighborhood of Puerto Rico. I like the individuals, the communities and the values which can be instilled on this island.

Puerto Rico provides an Act 60 decree for enterprise and people who can transfer kind the USA to the island and set up companies there, which permits them to not pay any capital beneficial properties taxes and solely a 4% earnings tax so long as they spend 51% of their time in Puerto Rico.

Now, to be clear, Act 60 offers large worth to Puerto Rico and needs to be embraced. Nevertheless, quite the opposite, Act 60 additionally offers an open invitation to dangerous actors and scammers who can stroll away from their scams within the type of failed tasks/companies with out tax implications. In the course of the 2021 crypto bull market, I noticed personally that Puerto Rico turned a cesspool of people who launched cryptocurrency tasks and marketed their questionable monetary improvements to on a regular basis buyers, solely to stroll away from the tasks with giant sums of buyers’ cash, burning those that invested with funds earned from working actual jobs that supplied actual advantages to the world. There are numerous examples of this, which give context and makes it comprehensible as to why many locals could have resentment towards cryptocurrency.

Bitcoin just isn’t crypto, Bitcoin just isn’t a Ponzi scheme, Bitcoin just isn’t a person nor firm, Bitcoin just isn’t an Act 60 beneficiary, Bitcoin just isn’t colonialism, Bitcoin just isn’t instilled by the federal government. Bitcoin is cash, Bitcoin is freedom, Bitcoin is independence, Bitcoin permits each Puerto Rican to have the person prosperity that many locals have defended and died for.

Bitcoin is Puerto Rico’s likelihood to have an unbiased identification whereas permitting its residents to be 100% self sovereign. Adapting a bitcoin normal would offer large profit for locations like Puerto Rico. Study what bitcoin is, educate others, develop into individually sovereign and begin constructing the Puerto Rico your ancestors envisioned.

This can be a visitor put up by Michael Markle. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.