BNB at present ranks 4th available in the market capitalization of $46 billion, with 80% of BNB tokens entered into the circulation provide. Being the primary token community to use the deflationary scheme of burning tokens at repeated intervals.

By December 2022, Binance has already burnt shut to twenty% of its circulating provide of 100 million tokens showcasing it as a powerful measure to manage the inflation of cryptocurrencies and keep uptrending within the coming disruptive time. With the token values going through resistance close to the $300 – $350 mark, we anticipate a significant decline to consolidate across the $300 mark.

Binance Coin (BNB) Value Evaluation

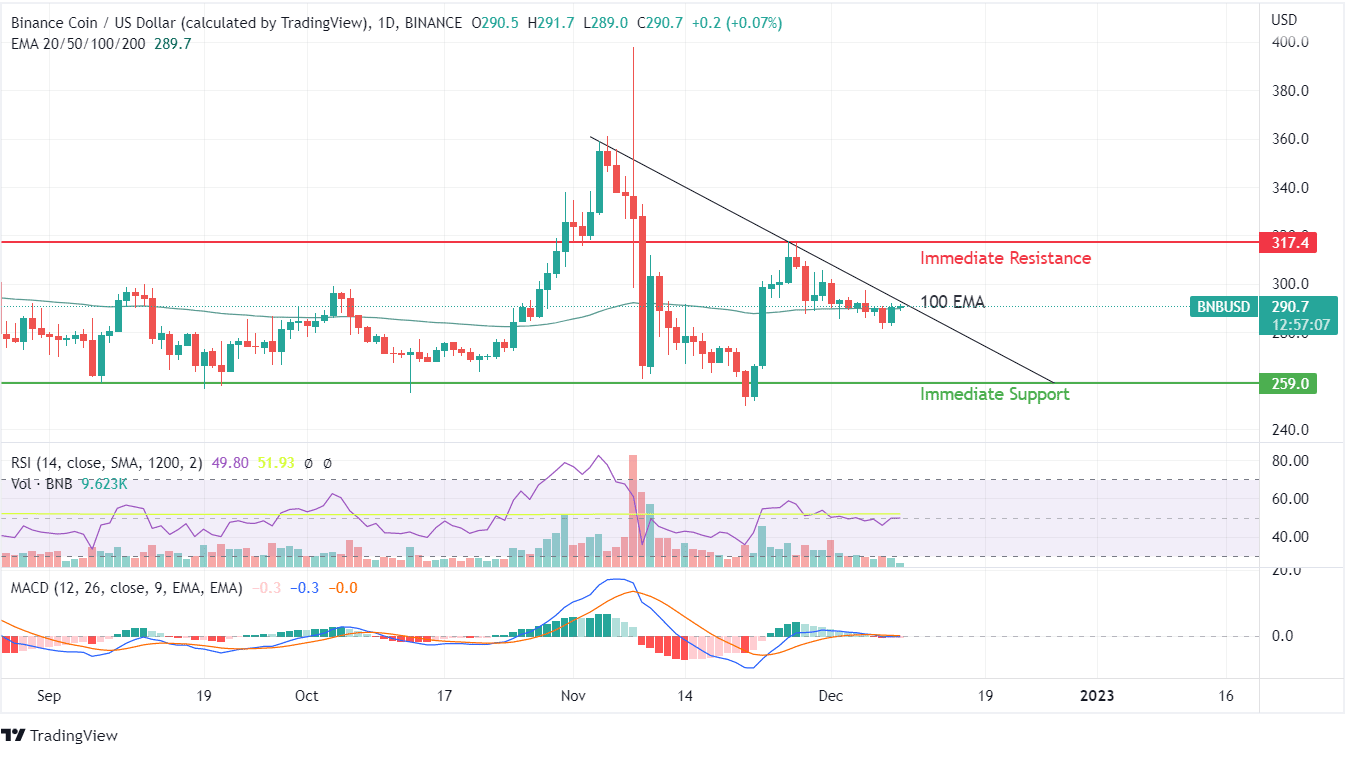

Binance Coin confronted its first resistance at $340, adopted by $317, establishing a detrimental trendline during the last month. The uptrend has been restrained by the 100 EMA curve, with costs stumbling close to the $300 mark. Technicals showcase a declining curiosity within the token.

Analyzing the worth motion of BNB, we will tackle the rising discomfort of this cryptocurrency with the brand new fiasco within the markets the place reputed tokens are shedding their footing. The BNB coin predictions showcase a breakout potential at a present worth of $290.

With the token values hitting contemporary lows after August 2022, the outlook of BNB is going through hassle from each technical indicators and shifting averages. MACD is buying and selling on the precipice of constructive ranges, carrying a powerful likelihood to say no. Help might be witnessed on the $260 mark, however the resistance of the trendline mixed with 100 EMA rejections is creating the best state of affairs for constructive motion.

The RSI indicator is trending on the 50 mark carrying a extremely impartial zone on the intraday candlestick sample. The weekly value motion showcases a rising consolidation between $260 and $320 worth. Regardless of the rejections at peak values, BNB is getting sturdy assist from the $260 degree.