Main crypto property are persevering with to reliably transfer off of centralized cryptocurrency exchanges regardless of the service suppliers’ greatest efforts to regain person belief after the autumn of FTX.

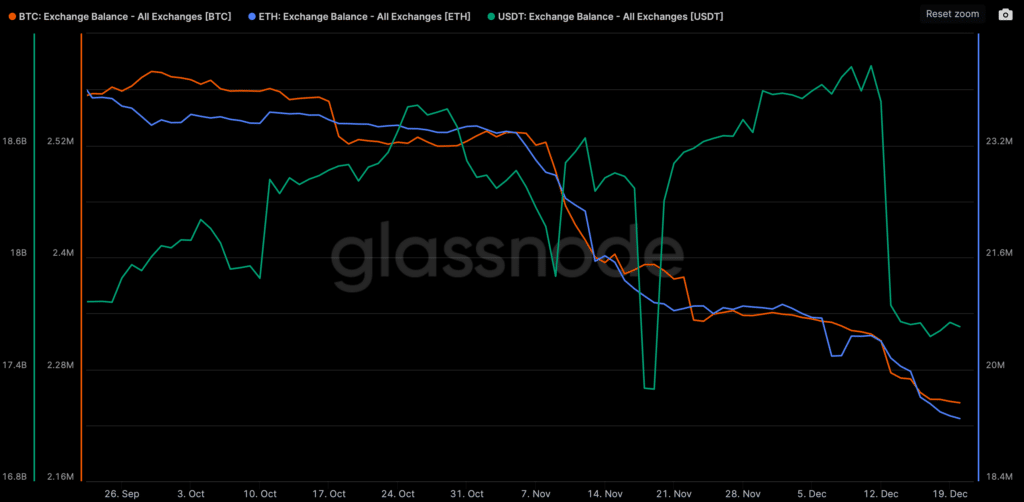

Cryptocurrency exchanges are nonetheless bleeding deposits out of their wallets at an astonishing fee ever since main crypto trade FTX went bankrupt and decimated public belief in centralized crypto custodians. Knowledge offered by blockchain analytics service Glassnode reveals that over the 24 hours to press time $24.6 million of Bitcoin (BTC), $46.8 million of Ethereum (ETH) and $23.1 million of Tether (USDT) left cryptocurrency exchanges.

A large amount of Bitcoin and Ethereum has left cryptocurrency exchanges ever for the reason that fall of FTX, with knowledge displaying that trade reserves in each the cash are falling in unison. Tether’s USDT alternatively has lately spiked, probably resulting from lack of belief in centralized stablecoins motivating customers to maneuver it onto exchanges to promote it for decentralized property to withdraw these as a substitute.

Self-custody — the follow of holding one’s personal cryptocurrency property reasonably than counting on a 3rd get together — is a good focus within the cryptocurrency house. It permits people and organizations to have full management over their property and ensures that their property are safe from third-party hacks or fraud.

Moreover, self-custody grants people and organizations full possession and management over their property, which might be important to guard these funds from authoritarian authorities overreach. Nonetheless, not everybody within the cryptocurrency house believes that self-custody is the way in which most customers ought to deal with their property.

Changpeng Zhao — the CEO of world’s high crypto trade Binance — lately claimed that extra cryptocurrency is misplaced to self-custody than centralized service suppliers and suggesting that self-custody shouldn’t be proper for 99% of the customers.

Comply with Us on Google Information