Based on an analyst on Dec. 29, 2022, the disgraced co-founder of FTX, Sam Bankman-Fried (SBF), could have cashed out $684,000 in crypto property whereas underneath home arrest. If the funds had been spent by SBF, it goes in opposition to the courtroom’s launch circumstances that notice the previous FTX government shouldn’t be allowed to spend greater than $1,000 with out permission from the courtroom.

Analyst Discovers Funds Tied to SBF’s and Alameda’s Wallets Moved Whereas the FTX Co-Founder Is on Home Arrest

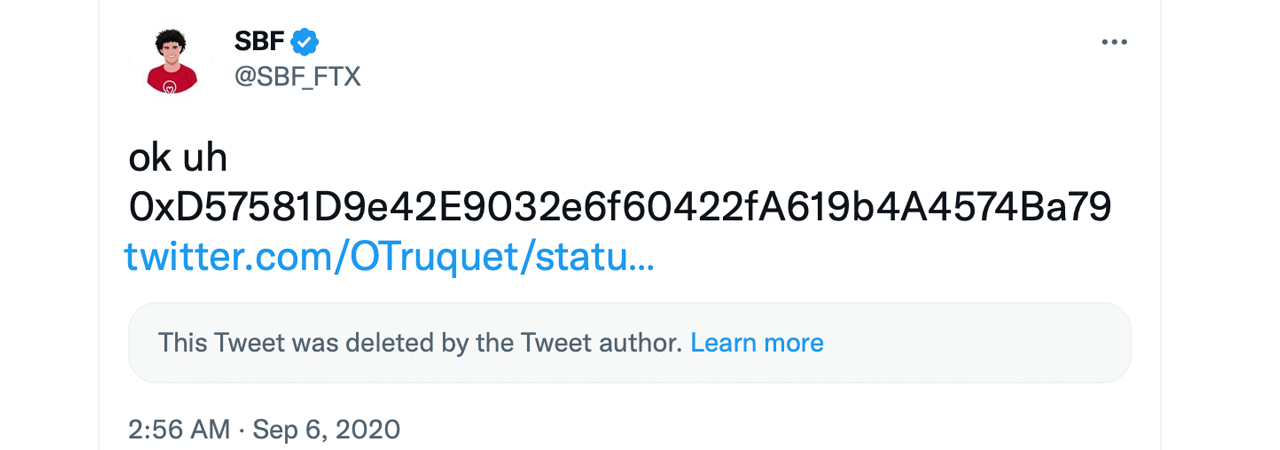

On Thursday, an analyst referred to as “Bowtiediguana” published a Twitter thread that reveals Sam Bankman-Fried could have spent $684K whereas he’s on home arrest. Based on Bowtiediguana, in August 2020, SBF agreed to briefly take over the decentralized change (dex) Sushiswap, after the nameless founder Chef Nomi determined to go away. When the deal was made, SBF shared a public Ethereum deal with and Chef Nomi transferred possession of Sushiswap to SBF’s deal with.

“After SBF was launched, his pockets despatched all its remaining crypto tokens to a brand new Ethereum deal with created an hour earlier,” Bowtiediguana tweeted. “In 3 hours, over 100 new deposits had been made to this pockets from varied addresses, most having hyperlinks to SBFs defunct hedge fund Alameda Analysis.” The analyst continued:

In lower than [four] hours, 570 [ethereum] price roughly $684,000 was transferred out of this new pockets, to varied locations. Funds had been despatched to a no-KYC change based mostly in Seychelles and to the Bitcoin community by way of the [Ren Protocol], a bridge funded by Alameda. Maybe the SEC attorneys would really like discover of this?

The deal with in query is that this ethereum deal with “which obtained an extra $1M from 11 wallets labeled as Alameda Analysis,” Bowtiediguana stated. “[Five] separate transactions of 51 ETH had been used to maneuver funds to newly created wallets [and] then onwards to a Seychelles-based change. [Three] tranches of 200K USDT had been additionally despatched from the SBF linked pockets to the Fixedfloat change,” the analyst added.

Bowtiediguana’s thread reveals that a person decided to email the knowledge to the U.S. Securities and Alternate Fee (SEC) concerning the newest onchain actions. Others tagged the U.S. regulator within the Twitter thread and said: “@secgov u gave [SBF] 2 lengthy of a leash sires. plz deal with this legal.” It’s unconfirmed for the time being as to who truly moved the funds, however many are speculating that it was SBF.

Since SBF’s arrest and his later launch, FTX and Alameda-related funds have been transferring, and transfers have been caught by onchain sleuths. Funds linked to Alameda had been transferred two days in the past and reportedly they had been despatched to Fixedfloat and Changenow and additional transformed into BTC. In one other occasion, an Alameda-labeled pockets despatched 11.37 wrapped bitcoin (WBTC) to a pockets after eradicating it from Aave on Dec. 29.

The identical day, one other Alameda-labeled pockets despatched 22,500 USDC on Dec. 29. Each of those transactions came about the day after a big swathe of ERC20 tokens linked to Alameda had been moved on Wednesday, Dec. 28.

Tags on this story

What do you concentrate on the onchain actions caught by the analyst Bowtiediguana? Tell us what you concentrate on this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency group since 2011. He has a ardour for Bitcoin, open-source code, and decentralized purposes. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising at present.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: Stephanie Keith / Getty Photos

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.