That is an opinion editorial by Federico Rivi, an unbiased journalist and creator of the Bitcoin Practice e-newsletter.

We’re elevating rates of interest “as a result of we’re combating inflation. Inflation has come out of virtually nothing.” So stated European Central Financial institution President Christine Lagarde, host of the Irish discuss present Late Late Present on Friday, October 28, 2022. Phrases apparently contradicting a press release that got here shortly afterwards in the identical interview. Inflation, she said, is induced “by Russian President Vladimir Putin’s battle in Ukraine. […] This vitality disaster is inflicting huge inflation that now we have to defeat.”

The Charge Hike

The day earlier than the interview the European Central Financial institution had raised rates of interest by an extra 75 foundation factors, bringing the full progress utilized within the final three conferences to 2%: the very best stage since 2009. In all probability it is not going to finish there, because the Governing Council plans to “elevate charges additional to make sure a well timed return of inflation to its medium-term goal of two per cent.”

In line with the most recent knowledge, the rise in costs within the euro space has really reached ranges by no means seen within the final 20 years: +9.9% in September in comparison with the identical month final 12 months. International locations like Latvia, Lithuania and Estonia are seeing value will increase of twenty-two%, 22.5% and 24.1% respectively.

Within the widespread consensus on the which means of the time period inflation, nonetheless, there’s a main inconsistency. A distortion of the true idea that leads leaders, consultants – and consequently the media – to attribute completely different causes to the phrase, relying on the comfort of the second. When the trigger, in actuality, is at all times and just one.

Inflation And Worth Will increase Are Completely different

For a lot of, inflation is now synonymous with rising costs. This isn’t only a widespread perception however a which means that has additionally been adopted by economics textbooks and the official language. In line with Cambridge Dictionary inflation is “a basic, steady enhance in costs.”

However is that this actually the case? Bitcoin teaches one factor: Do not belief, confirm. And by verifying, an issue emerges: the reversal of trigger and impact.

Inflation is handled because the impact of a sure occasion: an vitality disaster, a chip scarcity, a drought can all result in larger costs for items and companies in sure sectors. However in actuality inflation, in its unique which means, doesn’t imply the rise in costs, it signifies its trigger.

The clue comes straight from etymology: inflation comes from the Latin phrase inflatio, itself a spinoff of inflare, i.e. to inflate. Take into consideration inflating a balloon: the act of inflare (inflating) is when air is blown from the mouth into the balloon: the trigger. The instant consequence is the enlargement of the quantity of the balloon that’s taking in air: the impact.

Pumping new air into the balloon is the motion that results in its enlargement. The identical reasoning applies to cash: the very act of printing cash is inflation and its consequence is a rise in costs. This reversal of trigger and impact was already referred to within the late Fifties as semantic confusion by one of the crucial distinguished economists of the Austrian college, Ludwig von Mises:

“There’s these days a really reprehensible, even harmful, semantic confusion that makes it extraordinarily troublesome for the non-expert to know the true state of affairs. Inflation, as this time period was at all times used in every single place and particularly on this nation, means rising the amount of cash and financial institution notes in circulation and the amount of financial institution deposits topic to test. However individuals as we speak use the time period “inflation” to discuss with the phenomenon that’s an inevitable consequence of inflation, that’s the tendency of all costs and wage charges to rise. The results of this deplorable confusion is that there is no such thing as a time period left to indicate the reason for this rise in costs and wages.”

If, due to this fact, there may be many causes of value will increase, there can’t be as many causes of inflation as a result of it’s itself an origin of value will increase. It might be rather more enough and intellectually trustworthy to say that the lower in buying energy may result from a number of elements together with inflation, i.e. the printing of cash.

Cash Flooding

So how has the European Central Financial institution behaved when it comes to financial issuance lately? The best determine to grasp that is the ECB steadiness sheet, which exhibits the countervalue of property held: these property for which the Eurotower doesn’t pay however acquires by creating new forex. As of October 2022, the ECB held nearly EUR 9 trillion. Earlier than the pandemic, firstly of 2019, it had round 4,75 trillion. Frankfurt has nearly doubled its cash provide in three and a half years.

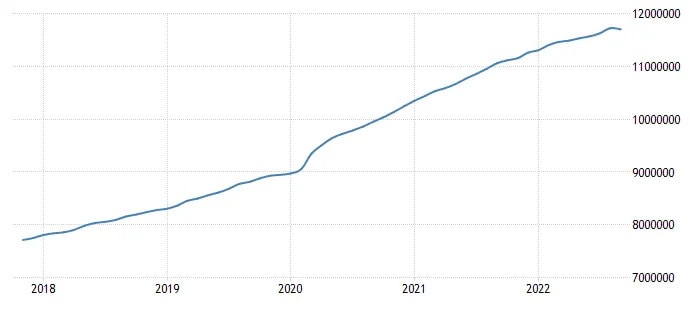

If we measure the quantity of euros circulating within the type of banknotes and deposits – the determine outlined as M1 – the quantity is barely extra reassuring, however not a lot: firstly of 2019 there have been nearly EUR 8.5 trillion in circulation, as we speak there are 11.7 trillion. A progress of 37.6%.

Are we actually certain, then, that this value progress – or as it’s wrongly known as by everybody, inflation – comes from nowhere? Or that it’s only a consequence of the battle in Ukraine? Given the sum of money provide injected into the market within the final three years, we must always rely ourselves fortunate that the common value progress of products and companies remains to be caught at 10%, because of the restrictions of the pandemic and the following financial disaster we’re getting into.

What does Bitcoin need to do with all this? Bitcoin has the whole lot to do with it as a result of it was born as an alternative choice to the financial catastrophes for which central banks proceed to make themselves accountable. A substitute for the bubbles of unsustainable progress alternating with ruinous crises attributable to the market manipulation of the interventionist utopia. Bitcoin can’t inform the world that “inflation got here from nowhere,” as a result of its code is public and everybody can test its financial coverage. A coverage that doesn’t change and can’t be manipulated. It’s fastened and can stay so. 2.1 quadrillion satoshis. Not yet one more.

It is a visitor publish by Federico Rivi. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.