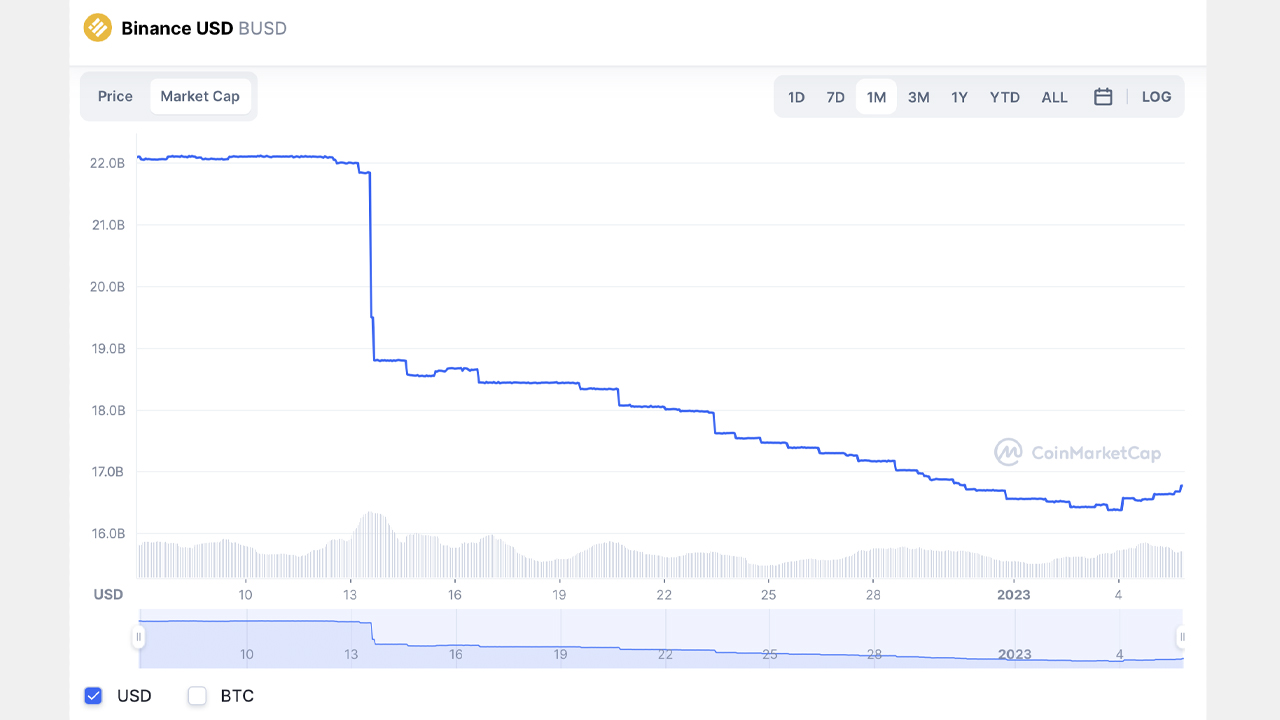

In line with statistics, the stablecoin BUSD noticed a major drop in its provide over the previous 30 days, shedding roughly 23.8% from Dec. 5, 2022, to Jan. 6, 2023. Since Dec. 13, 2022, BUSD’s provide has been lowered by greater than $5 billion, going from $21.84 billion to its present degree of $16.77 billion.

Stablecoin Market Sees Fluctuations With BUSD Shedding Vital Provide, Ties to Turkish Lira

BUSD, the stablecoin based by Paxos and Binance, has skilled a major discount in its circulating provide. Knowledge reveals that among the many prime ten stablecoins by market capitalization, BUSD has misplaced probably the most between Dec. 5, 2022, and Jan. 6, 2023. Tether managed to extend by 1.1% over the previous month, and USDC jumped by 1.8% within the final 30 days. Nonetheless, BUSD shed 23.8% over the last month and now has a market cap of round $16.77 billion. Since Dec. 13, 2022, BUSD has seen roughly 5,066,884,674 internet redemptions.

The discount in stablecoin provide coincides with a time of serious hypothesis surrounding the world’s largest cryptocurrency change, Binance. Final month, Binance introduced that Binance US would try to accumulate Voyager Digital’s property, however the U.S. Securities and Alternate Fee (SEC) intervened within the buy. The SEC acknowledged that it was “formally investigating” the debtors within the matter. Along with the SEC, Alameda Analysis, a defunct buying and selling unit of FTX, has additionally objected to Binance US’ buy of Voyager’s property.

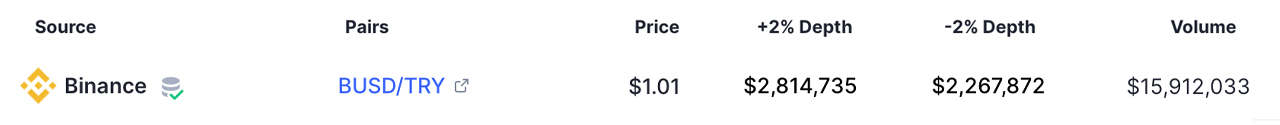

Of the greater than $5 billion in BUSD redemptions, BUSD’s provide shrank by 3.24 billion in three days from Dec. 13 to Dec. 16, 2022. World commerce quantity was considerably larger at the moment, as Dec. 13 statistics present that BUSD had round $9.38 billion in 24-hour quantity in comparison with at the moment’s $4.41 billion. BUSD’s prime buying and selling pair is tether (USDT), however statistics from cryptocompare.com point out that BUSD has a powerful relationship with the Turkish lira. As of Jan. 6, 2023, metrics present that the lira represents 2.45% of all BUSD trades.

Turkey has been experiencing a sovereign debt and foreign money disaster since 2018. In early 2022, Bitcoin.com reported on the rising recognition of stablecoins in Turkey, when the lira represented 7.20% of the $3.51 billion in 24-hour BUSD trades on Jan. 3. On Jan. 5, 2023, the Turkish lira accounted for $15,912,033 of Binance’s 24-hour trades. Along with the lira, different prime BUSD buying and selling pairs on Binance embody BTC, ETH, and BNB. Along with BUSD, the stablecoin DAI issued by Makerdao shed 2.9% final month, and GUSD, issued by Gemini, dropped by 3.8%.

Tags on this story

What do you concentrate on BUSD’s $5 billion in internet redemptions since Dec. 13, 2022? Tell us what you concentrate on this topic within the feedback part beneath.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an energetic member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising at the moment.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.