The heated argument on which gold and bitcoin is the higher funding has been happening for some time. Since bitcoin has misplaced practically 64% of its worth in 2022, some traders might need misplaced assist for cryptocurrencies.

Many bitcoin (BTC) skeptics say there’s an excessive amount of uncertainty and volatility surrounding the foremost cryptocurrency. Moreover, bitcoin must catch as much as quite a lot of the numerous commitments meant to assist its worth proposition. As an example, the declare that it will shield towards inflation or extremely unstable markets.

Even when a few of bitcoin’s flaws have undoubtedly been revealed this yr, the next question continues to be pertinent: does gold symbolize a superior long-term funding to bitcoin?

Why spend money on gold

Bitcoin is buying and selling basically just like the shares of a high-risk, high-growth IT enterprise. Primarily based on the market-beating income that companies might present, they’ll make glorious investments throughout bull markets.

Traders, nevertheless, usually go for much less dangerous belongings throughout unhealthy calls, resembling blue-chip shares and gold. Primarily based on this argument, gold is a safer funding choice so long as issues about inflation and the potential of a recession proceed to hold over the economic system.

As well as, some might say that there are simply no “non-speculative use circumstances” for bitcoin. In distinction, gold has legitimate functions that constantly enhance demand for steel.

Why spend money on bitcoin

The first justification for bitcoin is that, traditionally, it has supplied yearly returns a lot larger than every other asset. With annualized beneficial properties of 230.6% over the ten years from 2011 to 2021, bitcoin was the world’s best-performing asset. This was ten occasions higher than the outcomes of even the very best high-growth tech shares. And over its existence, bitcoin has given traders a return of greater than 17,000%.

In distinction, historically, gold has produced meager annualized returns over extra prolonged intervals. The annualized return on gold from 2011 by 2021 was barely 1.5%.

Traders believed they had been getting the very best of each worlds with bitcoin till 2022 as a result of it supplied a safe place to maintain belongings and the potential of unbelievable yearly returns. Nevertheless, bitcoin didn’t present both final yr. Then again, gold fulfilled its promise. In distinction to bitcoin’s fall in 2022, gold is basically flat for the yr (down roughly 1%).

Though bitcoin had by no means developed into the funds community that many anticipated when it first appeared in 2009, there are indications that it’s more and more a viable alternative for on-line transactions, particularly now that the asset is recovering from the earlier bear market turbulence. That is partly due to artistic work so as to add speedier fee layers (just like the Lightning Community) on prime of its blockchain’s basis layer. The current slight comeback appears to be excellent news for varied bitcoin fans.

Cryptocurrencies like bitcoin will turn out to be extra essential because the digital economic system expands as a method of constructing funds. In line with this viewpoint, bodily gold may lose significance within the digital age.

Nevertheless, each belongings had a tricky yr primarily based on totally different facets. Beneath is how they carried out in 2022.

Gold value evaluation

In 2022, because the yellow steel confronted challenges from a robust US foreign money and the US Federal Reserve’s struggle on inflation, assist got here from its position as a haven and an inflation hedge.

Gold, which had declined by nearly 1.6% by December 2022, couldn’t maintain onto beneficial properties gained within the first quarter when a value surge in response to Russia’s invasion of Ukraine introduced the dear steel to a 19-month excessive of US$2,053 an oz.. The value soar in March represented a 13% enhance from the start worth in January, however it was short-lived as gold fell again to the US$1,939 stage after Q1.

Gold fell to US$1,811 through the yr’s second quarter, and market volatility prompted the Dow Jones Industrial Common and the very tech-heavy NASDAQ Composite to enter the bear market territory.

Seasonal weak point and a rising US greenback in Q3 drove gold to a 30-month low of US$1,691 per ounce. Early in 2022, when economies worldwide had been nonetheless recovering from the epidemic, Russia’s struggle on Ukraine sparked uncertainty, which helped gold all through the primary quarter of the yr.

Struggle in Ukraine considerably affected gold costs

There have been two main causes for the efficiency of gold in 2022. In fact, the primary one is the struggle, throughout which a number of valuable metals skilled substantial value will increase — flight to protected havens, which predominated the whole lot earlier than dissipating.

After the preliminary shock, the gold value steadied, and long-term influences began to indicate. The macro background and diving down extra profound, the actions and expectations of the Fed could possibly be what got here to the fore and are nonetheless essentially the most essential.

Opposite to common perception, the struggle had a extra important affect on output than on the worth of gold. Russia’s invasion of Ukraine and the following sanctions have made it tough for miners working in Russia to safe funding and tools from western sources.

As gold fell under $1,800 within the yr’s second half, US inflation hit a four-decade excessive of 9.1% in June. Some market gamers questioned the efficacy of gold as a hedge on account of its weak point within the face of inflation. Nevertheless, some specialists say the yellow steel is performing its job.

Whereas rising alternative prices affect gold, its worth has been considerably maintained regardless of widespread inflation. The year-to-date peak in output coincided with a greater than two-year low in gold’s value in Q3, a phenomenon Webb related to seasonality.

Mine output elevated to about 950 metric tons for the three months, up 2% from the earlier yr. Regardless that miners have profited from these favorable circumstances, inflation’s repercussions have been unavoidable.

Regardless of a pointy fall in funding demand, demand improved by 28% yr over yr within the September quarter. Even whereas purchases of bars and cash elevated by 36%, exchange-traded funds (ETFs) struggled with bigger withdrawals.

Bitcoin value evaluation

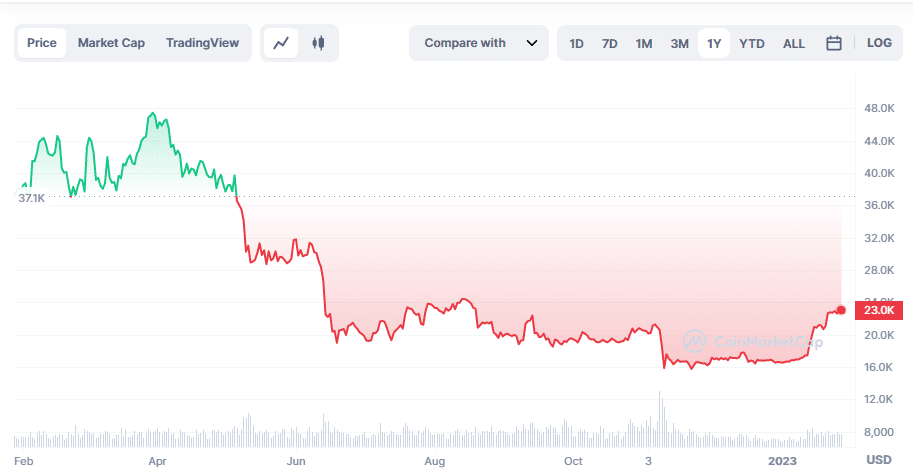

The second main crypto winter started in 2022, with high-profile companies crumbling in all places and the worth of cryptocurrencies lowering considerably. The yr’s occasions shocked many traders and made it tougher to forecast the worth of bitcoin.

The cryptocurrency market was flooded with analysts speculating fervently about the place bitcoin would possibly go subsequent. They had been incessantly optimistic, though a handful predicted that bitcoin would go under $20,000 per coin.

However many market observers had been shocked in what has been a turbulent yr for cryptocurrencies, with high-profile agency and mission failures sending shockwaves throughout the sector.

The crimson flag appeared again in Might with the collapse of terra, also referred to as UST, an algorithmic stablecoin meant to be tied 1:1 to the US greenback. Because of its downfall, companies uncovered to each cryptocurrencies had been harm, and luna, the sister coin of terraUSD.

Because of hyperlinks to terraUSD, Three Arrows Capital, a hedge agency with stable views on cryptocurrencies, entered liquidation and filed for chapter. Then, in November, one of many greatest cryptocurrency exchanges on this planet, FTX, which Sam Bankman-Fried, a outstanding businessman, headed, collapsed. The cryptocurrency sector continues to be feeling the results of FTX.

Bitcoin forecast for 2023

Within the early days of the upheaval after the failure of the alternate FTX, co-founder of Mobius Capital Companions Mark Mobius anticipates bitcoin will drop under $10,000 per coin. The truth that bitcoin is “extraordinarily hazardous” prevented him from investing any of his shoppers’ or his funds in it, he stated, though “crypto is right here to remain.”

Later, in an interview with CNBC, Mobius expanded on his prediction, attributing the expected losses to rising rates of interest and rising investor apprehensions concerning the cryptocurrency sector. He stated that whereas he anticipates bitcoin’s value to stay round $17,000, it could drop under $10,000 within the subsequent yr.

Matthew Sigel, the director of analysis for digital belongings on the brokerage VanEck, anticipates the same value goal. Within the first quarter of 2023, he believes that the worth of bitcoin will drop to between $10,000 and $12,000 per coin. Nevertheless, he thinks that by Q3 2023, BTC may attain $30,000.

Sigel attributes the autumn on struggling cryptocurrency miners, writing final month that bitcoin mining is mostly unprofitable given current rising energy payments and decrease bitcoin costs. He believes that many miners will reorganize or mix.

Over the subsequent yr, some specialists anticipate that the worth of bitcoin would possibly fall as little as $5,000, whereas others forecast an increase to $250,000. The specialists at Ark Funding Administration, led by famend entrepreneur and investor Cathie Wooden, stick by their forecast that the worth of 1 bitcoin would surpass $1 million by 2030.

Gold’s 2023 forecast

A number of components level to a possible decline within the value of gold in 2023, together with elevated rates of interest and geopolitical upheaval. That is the result of the Federal Reserve persevering with to lift rates of interest and low funding demand. The latest commodity value projection printed by the World Financial institution states that “since rate of interest rises are anticipated to proceed far into subsequent yr, gold costs are predicted to say no by 4% in 2023.”

Which is healthier, gold or bitcoin?

All depends upon your funding technique. The conservative traders would go for gold, usually thought-about as a protected haven. The share of dangerous belongings, resembling bitcoin, in conventional portfolios doesn’t surpass 10%. Nevertheless, in the event you’re buying and selling actively, BTC volatility would possibly look engaging.

What impacts bitcoin and gold value?

Each bitcoin and gold react to normal market and political situations, resembling US rates of interest, main fiat charges, native conflicts, pandemics, and so forth.

Comply with Us on Google Information