Bitcoin miners seem to have paused their liquidations, in response to CryptoQuant information on Feb. 5.

Per streams, bitcoin miners’ reserve pattern has been flat at round 1.837m BTC from Jan. 19. This marked the day when bitcoin miners held off from promoting their cash.

The shift within the pattern of BTC reserve coincided with the revival of Bitcoin costs from mid-January 2022.

From Jan. 19, BTC costs have rallied from $21,081 to $23,063 on Jan. 25. Reserves remained flat at round 1.837m.

Merchants observe the variety of cash held by bitcoin miners. The bitcoin miner reserve information follows the variety of cash in addresses affiliated with miners. Nonetheless, the tracker doesn’t present the variety of cash held by particular person mining swimming pools or farms.

Miners are tasked with confirming transaction blocks and securing the community. They need to put money into fashionable gear and cater to operation prices, together with paying electrical energy payments and salaries. Presently, the Bitcoin community rewards 6.25 BTC to each profitable miner.

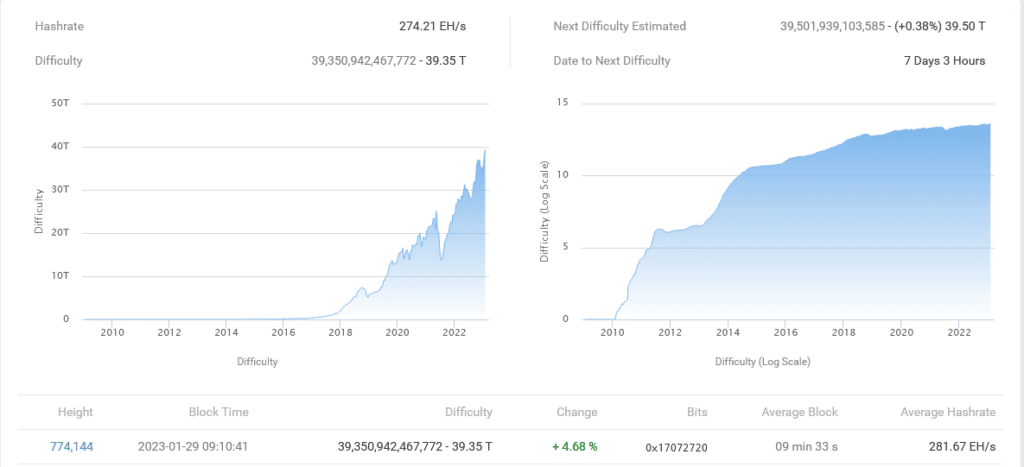

Cash are distributed each 10 minutes, whatever the general issue. Issue ranges have elevated in current weeks, rising by 4.68% within the final adjustment in response to rising BTC costs.

Usually, miners’ reserves enhance once they pause the promoting of cash in centralized exchanges corresponding to Coinbase or Binance, or on over-the-counter (OTC) desks. This growth of their reserves might point out confidence within the markets and their expectations of extra worth good points within the months forward. Conversely, when reserves are fast-falling, they might concern the markets might publish extra losses in coming classes.

Since BTC reserves are rising, transferring in sync with spot costs, there might be extra upsides going ahead. In January, costs bottomed up after dropping to as little as $15,300 in This autumn 2022.

The chapter of FTX, a cryptocurrency trade, and a number of other CeFi platforms, principally lending platforms submitting for chapter, accelerated the sell-off. Bitcoin costs fell from $20,000 to register 200 lows.

Trackers present that BTC is buying and selling at $23,135, up 37% within the final month.

Comply with Us on Google Information