Bitcoin (BTC) has handed Visa, a famend fee card firm, in market worth. Regardless of excessive volatility ranges within the crypto trade, bitcoin is steadily surpassing important gamers within the world market.

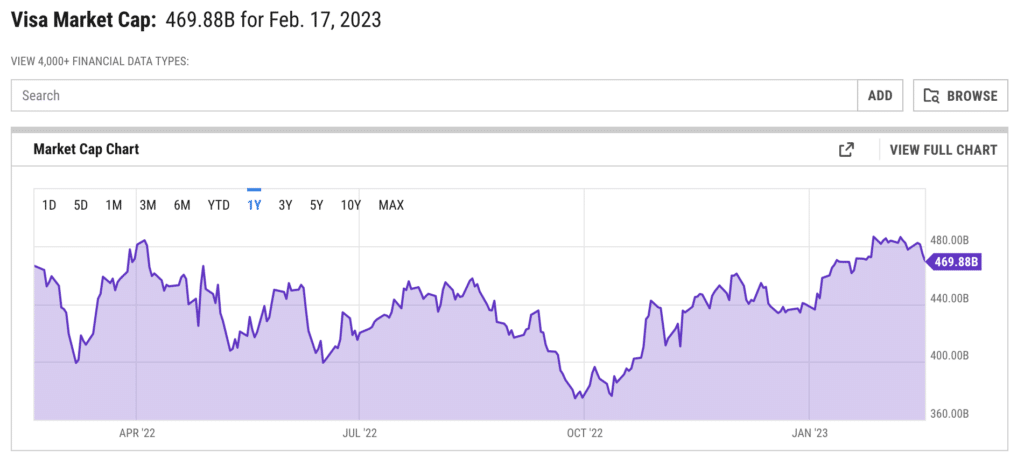

Information from CoinMarketCap exhibits bitcoin has hit greater than $472 billion in market capitalization in the previous few days rating 18th, whereas tradingeconomics.com reveals Visa’s market capitalization at about $460 billion.

The entry of bitcoin into the monetary world has modified a number of dimensions whereas attracting debate amongst economists, traders, and the state. Regardless of a myriad of skepticism and unpredictability, bitcoin’s market capitalization has quickly risen since its inception in 2009.

One of many prestigious firms providing worldwide monetary providers, Visa is now trailing behind bitcoin in market capitalization. The $460 billion market cap Visa originates from its publicly traded shares that measure the corporate’s value within the monetary markets. It’s momentous for bitcoin to outdo such a terrific firm in occasions of crypto winter.

Though there’s a slight lower in market cap by Visa, the corporate continues to take care of its grip on the highest firms on the planet. Properly, its announcement to embrace cryptocurrencies would open new avenues for its progress sooner or later.

Why is bitcoin outperforming flagship firms?

Bitcoin operates by a decentralized mode whereby transactions should not underneath the management of monetary establishments or authorities entities however rely on peer-to-peer processing by the blockchain.

To not point out, bitcoin’s restricted provide additionally performs an important position in driving its progress available in the market. In distinction to fiat currencies just like the US greenback, underneath the mercy of the central banks that authorize printing, bitcoin has a restricted provide of 21 million cash. Due to this fact, its shortage makes it a extra engaging funding than devaluing fiat currencies and huge inventory market shares.

As an illustration, on the finish of January, bitcoin surpassed Johnson and Johnson, one of many world’s largest healthcare firms. NVIDIA Company, Berkshire Hathaway Inc, Fb’s Meta Platforms, Inc, Berkshire Hathaway Inc and Tesla are only a handful of firms on bitcoin’s web site.

It’s only a matter of time till the flagship crypto hits the rails and achieves new heights. Extra or so, there was a excessive adoption fee of cryptocurrencies during the last ten years.

Comply with Us on Google Information