The surge of inscriptions raises outdated debates about Bitcoin’s “true” goal and its capability to change into the cash of the web.

That is an opinion editorial by Stephan Livera, host of the “Stephan Livera Podcast” and managing director of Swan Bitcoin Worldwide.

So, we’ve just lately seen a Bitcoin transaction take up practically a complete block and default mempools (300 MB) get filled up. What’s occurring with all this Ordinals and inscriptions insanity?

The Fast Explainer

Ordinals are a made up manner of monitoring sats (a fraction of a bitcoin) throughout transactions. Now, I stress it’s a made up manner of monitoring sats, because it doesn’t meaningfully influence bitcoin’s fungibility. As defined by creator Casey Rodarmor on my podcast, it’s a conference of numbering sats within the order they’re mined into existence, and monitoring them throughout transactions in a primary in, first out (FIFO) technique. So, as Bitcoin transactions are made up of inputs and outputs, the primary satoshi within the first enter is taken into account to be transferred to the primary output of a transaction. There are conventions round which Ordinals are unusual, uncommon, epic, and so forth.

What’s An Inscription?

An inscription is one other made-up conference the place sats may be inscribed with arbitrary content material, a form of Bitcoin-native digital artifact or NFT. Utilizing the conference, they are often despatched round and saved in a Bitcoin unspent transaction output (UTXO). Now, as a result of they’re coded in such a manner that they’re written into transaction witnesses, they by no means enter the UTXO set. The UTXO set is seen as having heightened consideration for the community as a result of each node (even pruned nodes) should preserve this UTXO set. So, I assume it may have been worse…

What’s The Bull Case For Ordinals And Inscriptions?

To metal man the case just a little: The professional Ordinals and inscriptions case may broadly be understood as: “Come for the enjoyable, wealthy artwork, keep for the decentralized digital cash.”

You would additionally agree with a number of the critiques of shitcoin NFTs, and see this as a manner of arguing that “Bitcoin does it higher” e.g., Bitcoin inscriptions are immutable, all the time on chain, easier and safer than shitcoin NFTs.

Considerations Raised With Inscriptions

The principle considerations listed here are:

- Diminished accessibility to transact on Bitcoin due to inscription/NFT degens making a transaction backlog and paying a decrease price per actual byte due to the witness low cost

- Diminished capability for customers to run a full Bitcoin node due to the elevated storage and bandwidth necessities

- The opportunity of unlawful materials being recorded into Bitcoin’s blockchain which may discourage some customers from operating a Bitcoin node

After all, there are counter arguments additionally:

- Bitcoin was ultimately going to develop a price/blockspace market anyway and this will likely assist with long-term viability of the community. Inscriptions may type a “low worth backlog” of transactions.

- Bandwidth and storage prices have come down through the years since 2017. Although, arguably, bandwidth over Tor should be problematic for these syncing a full node in a extra personal vogue. It may be argued that it’s all nonetheless inside conservative design limits that the community successfully accepted in 2017.

- Unlawful materials on chain was all the time attainable as a result of you possibly can’t absolutely cease steganography on bitcoin. Steganography is if you characterize info inside one other message, in such a way that the presence of the data just isn’t evident to regular human inspection.

Revisiting Outdated Debates In Bitcoin: Goal, Scaling And Extra

Some are arguing that, “We shouldn’t have raised the block dimension with SegWit and the witness low cost in 2017” and, to some extent, this newest Ordinals and inscriptions pattern is elevating related questions as these within the OP_RETURN wars of 2014.

What’s Bitcoin for? And may arbitrary knowledge that doesn’t relate to monetary transactions be inspired or discouraged on Bitcoin’s blockchain?

Taproot Is Not To Blame

Some commenters have been initially blaming the Taproot gentle fork for inscriptions. However Taproot appears to solely save about 4% on the price of inscriptions.

It’s additionally worthwhile to notice that this type of factor was attainable with SegWit, and beforehand with OP_RETURN and even earlier than that, with faux signatures, as defined by Adam Again right here:

Cultural Points

Some ETH huffers and cRyPtO persons are having fun with this second as a result of, of their eyes, they will “stick it to the maxis” and people of a extra “Bitcoin fundamentalist” persuasion, i.e., the individuals who imagine bitcoin needs to be a cash.

I’m nearer to the “fundamentalist” camp myself, seeing my mission as being about advancing bitcoin as cash. And absolutely, in any case the trouble of Bitcoin builders to optimize and use blockspace extra effectively, the inscriptions on chain appear wasteful and unnecessarily lowering Bitcoin’s accessibility to be used in monetary transactions.

Some argue that taking actions in opposition to Bitcoin inscriptions is “censorship” and that it’s unsuitable to view these transactions as “spam,” provided that they pay a bitcoin transaction price. However in the long run, it involves the aim of the venture. Whereas sure, it’s true that Bitcoin is designed to be censorship resistant and that NFTs arguably “began on Bitcoin” in years passed by, Bitcoin is arguably meant to be extra about decentralized and peer-to-peer digital money.

Can This Pattern Realistically Be Stopped?

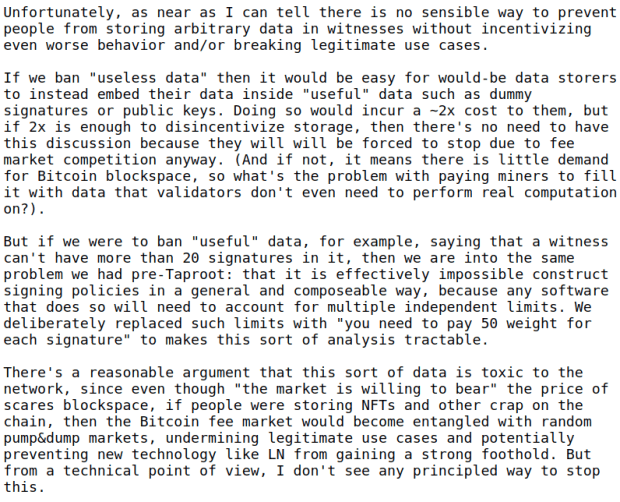

In need of drastic motion, in all probability not. Not less than, that’s what Andrew Poelstra spelled out in a current put up on the bitcoin-dev mailing checklist:

It’s additionally the unsuitable play to be too reactive about inscriptions and to attempt to take some drastic motion to gentle fork or make inscriptions unviable at a technical stage. There are arguably greater fish to fry, like serving to enhance Bitcoin adoption as cash and serving to encourage additional decentralization within the custody of bitcoin, the mining of bitcoin, the scalability and verifiability of Bitcoin, and so forth.

Ossification? Not But

Some even go as far as to argue that, “Oh, it is a mistake and we should ossify the Bitcoin protocol now to cease any additional errors.” I believe this may even be an error. There are numerous gentle fork concepts which can be decide in, don’t hurt non customers and will assist scale bitcoin self custody. For instance, ANYPREVOUT or OP_VAULT.

ANYPREVOUT particularly is attention-grabbing to me as a result of sometime, with international adoption, we could have roughly 80,000 occasions the transactional demand that we have now now. In that world, ANYPREVOUT allows an improve to “Eltoo” Lightning, giving us a method to share the price of on-chain transactions in a self-custodial manner. If we would like Bitcoin for use in a manner that’s extra self sovereign, we ideally need folks to have the ability to afford to take self custody on chain. With out this, they might be confined into custodial platforms as a result of the price of self custody is simply too prohibitive. Eltoo additionally has numerous advantages for Lightning, reminiscent of making backups simpler.

Sure, we needs to be conservative, however we also needs to contemplate applied sciences that assist bitcoin be the very best that it may be at being digital onerous cash.

Backside Line

Whereas I’m “in opposition to” inscriptions in a way and would slightly they be socially discouraged, I additionally don’t assume it’s value getting too nervous about them for now. For all we all know, they might be a short-lived fad.

However even when they aren’t a short-lived fad, what’s the more than likely end result right here? Low-value inscriptions will probably be priced out by monetary transactions over time as Bitcoin will get adopted by extra folks. It’s simply that adoption occurs in a “lumpy” manner and it’s concentrated into durations of excessive use (as seen in 2013, 2017 and 2021), after which durations of relative doldrums as transaction quantity subsides, and new know-how and scaling methods are utilized.

Or as eloquently memed right here:

Over the medium to lengthy phrases, monetary transactions will come to dominate in Bitcoin. Different makes use of of Bitcoin can be subordinate to its use as decentralized cash for the web.

It is a visitor put up by Stephan Livera. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.