Even with the latest rise within the bitcoin worth, public bitcoin mining shares begin the 12 months with extra spectacular features than the asset itself.

The beneath is an excerpt from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Public Mining Replace

Wanting on the high-level view of bitcoin holdings, we’ve seen a declining pattern in holdings throughout public miners all through 2022, from 46,930 BTC at peak in April 2022, to 31,892 in January 2023 — a 32% decline in 10 months. With Bitfarms, Core Scientific and Northern Knowledge shedding their bitcoin, holdings throughout public miners are actually largely concentrated in Marathon Digital, Hut 8 and Riot Platforms.

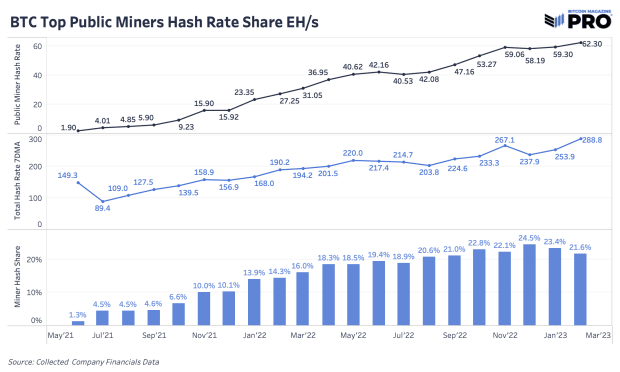

The pattern of hash fee enlargement is “up solely” with public miners rising their hash fee by 129% over the past 12 months. This progress has been a big driver of total hash fee enlargement with the community hash fee lately reaching 300 EH/s and public miners making up almost 25% of all hash fee on a given day. That share is simple as we’re not together with all public miners, like Cipher and Terawulf.

Mining Manufacturing Replace Notes

Marathon made an announcement about their option to promote some bitcoin that the corporate mined, “With bitcoin manufacturing rising and changing into extra constant, we made the strategic choice to promote a few of our bitcoin, as beforehand deliberate, to cowl a few of our working bills and for basic company functions. We intend to proceed to promote a portion of our bitcoin holdings in 2023 to fund month-to-month working prices.”

Of their announcement, they shared about locations for additional hash fee enlargement. “The corporate nonetheless expects to have roughly 23 EH/s of capability put in close to the center of 2023.”

Equally, HIVE’s manufacturing replace knowledgeable shareholders about bitcoin gross sales, “HIVE sells all the Bitcoin earned from our GPU mining hashrate, with a spotlight to HODL the inexperienced Bitcoin mined from ASICs.”

Riot Platforms introduced a delayed timeline for rising their hash fee, “Sadly, on account of this harm, our beforehand introduced goal of reaching 12.5 EH/s in complete hash fee capability in Q1 2023 is predicted to be delayed. We are going to present further updates as we receive better readability on the affect to our deliberate deployment schedule. Within the meantime, the remaining infrastructure build-out at our Rockdale Facility continues to progress, with Constructing E now at 50% completion and on observe to be totally accomplished this quarter, and we’re persevering with to execute on the enlargement at our Corsicana Facility.”

Iris Power elevated its mining capability from 2.0 to five.5 EH/s by utilizing prepayments to amass new miners.

In different public mining information, Hut 8 shared a couple of latest merger and their HODL technique:

“On February 7, 2023, Hut 8 introduced a merger of equals with U.S. Knowledge Mining Group, Inc. dba US Bitcoin Corp (‘USBTC’) which is predicted to determine the mixed firm as a big scale, publicly traded Bitcoin miner targeted on economical mining, extremely diversified income streams, and industry-leading greatest practices in ESG.

“We’ve been intentional and strategic in pursuing our HODL technique: by constructing a big, unencumbered stack, we have now afforded ourselves the optionality to strategically use a portion of it to cowl working bills quite than having to hunt different financing choices with much less enticing phrases,” mentioned Jaime Leverton, CEO. “I’m assured that promoting manufacturing whereas we deal with closing the merger with USBTC is the appropriate strategy, as we count on to create a robust self-mining, internet hosting, managed infrastructure operations, and HPC group in the long run.”

Hash Fee All-Time Highs

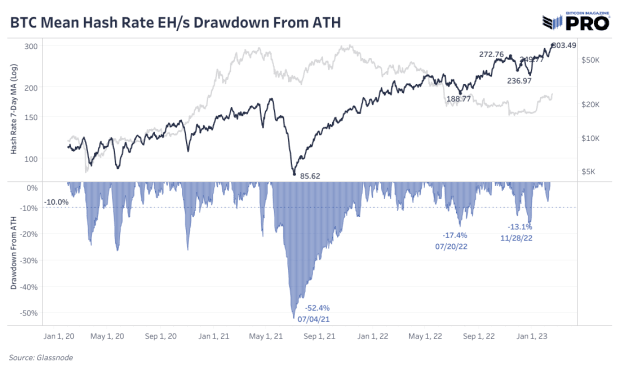

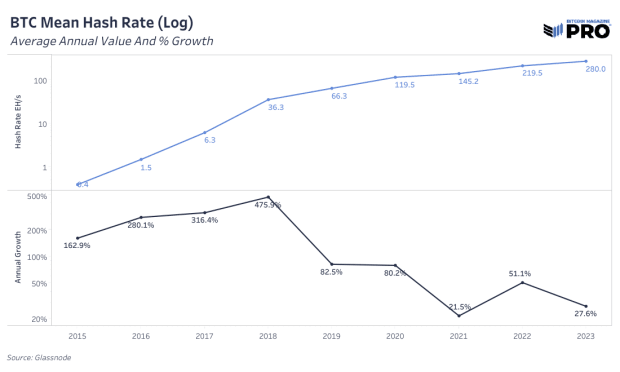

With some assist from cost-sensitive miners turning rigs again on, Bitcoin’s imply 7-day hash fee has as soon as once more damaged to new all-time highs, with a weekly common of 303 EH/s.

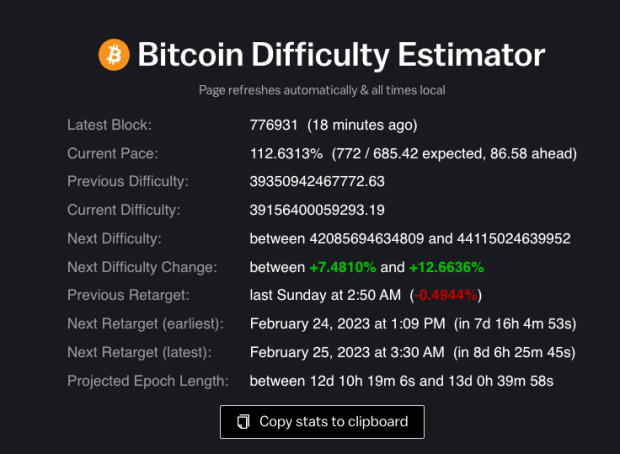

With community hash fee pushing to new highs, the subsequent problem adjustment is projected to be +12.0%, doubtless occurring on February 25.

The anticipated ratchet upward in mining problem will take away among the reduction that operations have been feeling in latest weeks, as a result of improve in USD-denominated income. Miner income denominated in bitcoin phrases will as soon as once more head to new lows.

As hash fee, and subsequently mining problem, proceed to stretch towards highs, older era machines and inefficient operations will proceed to get squeezed on the expense of extra environment friendly companies with newer era mining machines.

Public Miner Efficiency

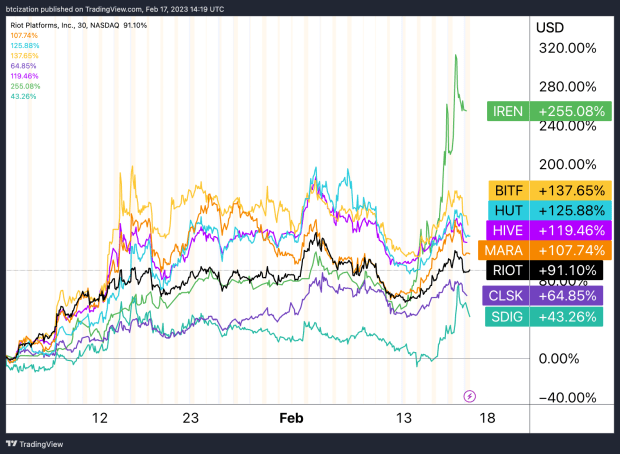

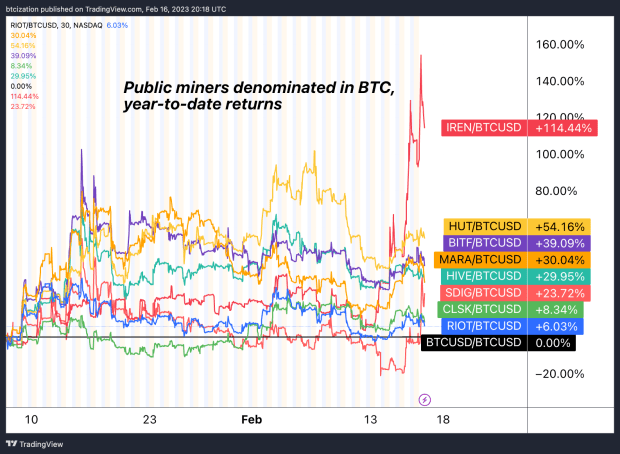

Public miners have been among the many greatest performers within the equities markets year-to-date, with shares of Iris Power main the best way at a powerful 255% acquire, and shares of Bitfarms, Hut 8 and HIVE Blockchain following.

These corporations’ efficiency towards bitcoin is equally as spectacular as a result of each main public miner in our intently adopted basket has outperformed their baseline (BTC) to begin 2023.

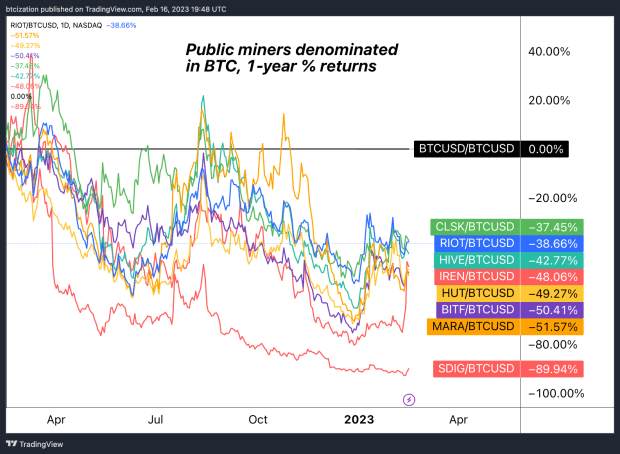

On longer time horizons, we discover bitcoin outperformance to be a really tall order, given the ruthless competitiveness of the worldwide mining {industry}, coupled with a programmatically reducing block subsidy that continues to happen each 210,000 bitcoin blocks — roughly as soon as each 4 years.

Whatever the subsequent path taken by bitcoin or fairness markets extra broadly, mining equities will proceed to supply buyers volatility galore, with the appropriate market circumstances presenting a lot of that volatility within the type of upside appreciation.

Ultimate Be aware

World buyers shall be hard-pressed to search out something on the planet that continues to flourish and develop at a comparable tempo to the bitcoin hash fee. The story right here that has been unfolding for greater than a decade’s time is the evolution of the strongest, decentralized computing power the world has ever seen, but most miss the forest for the timber.

Brief-term market correlations and exchange-rate efficiency apart, bitcoin stays the world’s singular greatest likelihood at attaining a globally impartial, financial protocol for remaining settlement.

Related Articles:

- State Of The Mining Trade: Survival Of The Fittest

- Time-Primarily based Capitulation: Bitcoin Volatility Hits Historic Lows Amid Market Apathy

- This Time Isn’t Completely different: Miners Are Largest Threat Going through Bitcoin Market In Repeat of 2018 Cycle

- Hash Fee Hits New All-Time Excessive: Implications For Mining Equities

- Bitcoin Hash Fee Plummets 17% From All-Time Excessive