Whereas the stablecoin market has seen vital redemptions previously three months, the provision of tether, the most important stablecoin by market capitalization, has elevated by 2.46 billion since mid-November 2022. Tether is the one one of many high 5 stablecoins by market valuation that has seen a provide enhance previously three months.

Tether Provide Rises Whereas Competitor Stablecoins See Declines

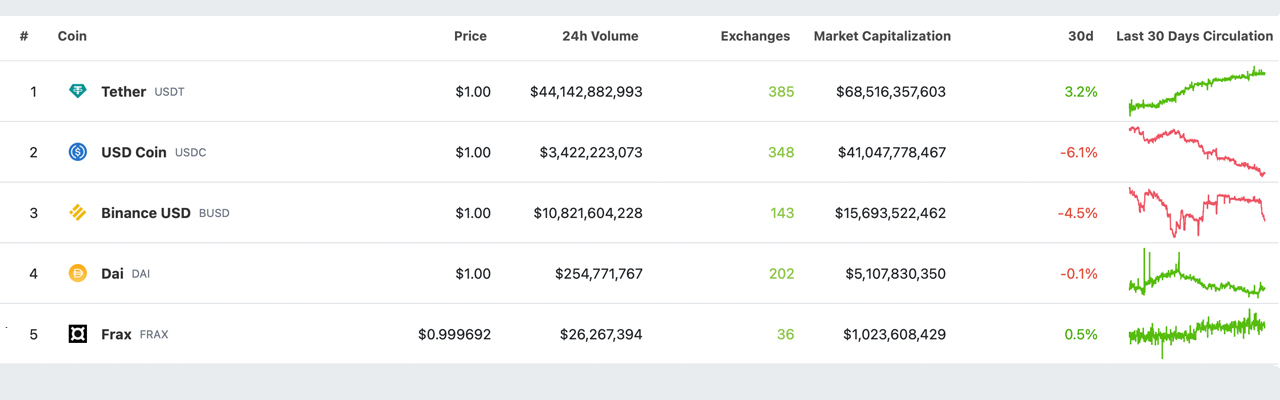

A lot has modified previously three months following the collapse of FTX and its aftermath. The stablecoin financial system has skilled vital redemptions, and 30-day statistics from February 14, 2023, present that three of the highest 5 stablecoins have seen a decline of their market capitalizations. The affected stablecoins are usd coin (USDC), binance usd (BUSD), and DAI. Whereas BUSD skilled vital redemptions after the announcement that Paxos would now not mint the stablecoin, USDC noticed the most important decline, dropping 6.2% within the final month. BUSD decreased by 4.5% within the final 30 days, and DAI had a slight lower of 0.1%.

Tether (USDT), however, has seen a 3.2% enhance in provide during the last 30 days. In actual fact, over the previous three months, USDT’s provide has grown by 3.74%. Collectively, the highest 5 stablecoins make up the vast majority of the stablecoin financial system and the considerably massive commerce quantity of dollar-pegged tokens. On November 17, 2022, USDT’s circulating provide was round 65.94 billion, and after a 3.74% enhance, it has risen to 68.41 billion as we speak. Whereas USDT’s provide has grown over the previous three months, the underside 4 stablecoins haven’t seen any progress and, the truth is, have all skilled declines.

For instance, usd coin’s circulating provide on November 17, 2022, was round 44.40 billion, nevertheless it has since dropped to the present 40.98 billion. BUSD had a circulating provide of 23.03 billion on November 17, 2022, and it’s now roughly 15.69 billion, a lower of 31.87%. Makerdao’s DAI token has a circulating provide of 5.09 billion as we speak, in comparison with 5.44 billion three months in the past, a 6.43% lower. The fifth-largest stablecoin by market valuation, FRAX, had a circulating provide of 1.177 billion on November 17, 2022, and now has 1.024 billion as of February 14, 2023, a lower of 12.99%.

Over the previous 5 years, stablecoins have enormously expanded, with some dollar-linked tokens failing to endure. The soundness of the reserve and the issuer’s potential to uphold it are essential elements in a stablecoin’s success. The Terra UST collapse of 2022 underlined this significance, and the previous 12 months has demonstrated that the stablecoin financial system is enormously impacted by exterior elements like financial circumstances, market volatility, and regulatory developments.

Tags on this story

What are your ideas on Tether’s latest provide progress in comparison with the remainder of the stablecoin market? Share your ideas within the feedback part beneath.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist dwelling in Florida. Redman has been an lively member of the cryptocurrency group since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information concerning the disruptive protocols rising as we speak.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.