Whereas the crypto business is in a protracted bear market, the entire crypto market is price considerably greater than behemoths, reminiscent of Amazon.

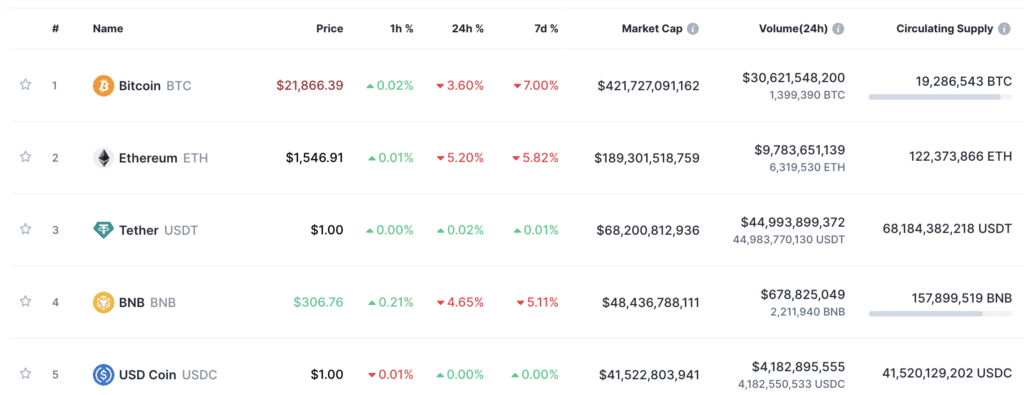

Cryptocurrency market knowledge reveals that each one the digital cash and tokens collectively have seen their market cap fall from $1.015 trillion all the way down to $1,023 trillion — a 4.8% fall in underneath 24 hours. Regardless of this, the crypto business continues to be price considerably greater than website hosting and on-line procuring large Amazon at its present market cap of $1.012 trillion.

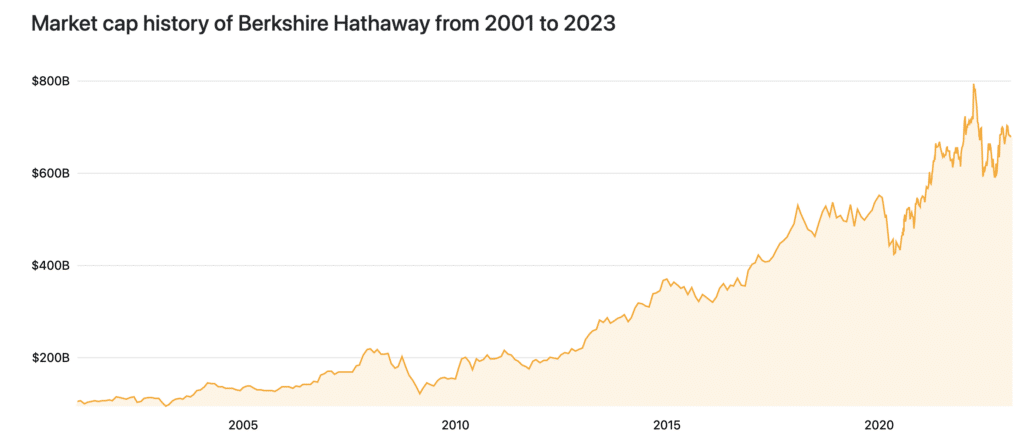

Moreover, cryptocurrencies are price greater than the world’s most outstanding funding agency Berkshire Hathaway — the one based by Warren Buffett, a well-known investor who described bitcoin (BTC) as “rat poison squared.” The wildly profitable multinational conglomerate holding firm based in 1839 and at the moment using 327,000 individuals is at the moment price solely $677.81 billion.

Additionally price lower than the cryptocurrency market are electrical automobile producer Tesla ($649,63 billion), graphic processing and AI acceleration items producer NVIDIA ($549,49), and TSMC ($501.43 billion). The latter most absolutely produced the silicon powering the system you’re studying this on. Moreover, it surpasses Fb at $461.28 billion and Visa at $472.05.

Bitcoin’s present market cap is $421 billion, which is considerably greater than the world’s largest financial institution JPMorgan Chase’s cap of $411,88 billion. The overall worth of the entire cryptocurrency market can be amusingly not far-off from the worth of web behemoth and Google dad or mum firm Alphabet, with its valuation of $1.22 trillion and the market cap of shiny metallic silver at the moment estimated to be $1.237 trillion.

Whereas as we speak the crypto market costs have reported a noticeable downturn, on-chain analytics showcase the continuation of some comparatively constructive tendencies. Specifically, Glassnode knowledge reveals that the quantity of bitcoin’s provide final energetic no less than ten years in the past reached an all-time excessive of two,633,468 BTC.

One other chart reveals that bitcoin’s quantity of provide final energetic 5 to seven years in the past additionally reached a five-year excessive of 1,598,078 BTC. On the similar time, the proportion of bitcoin’s provide that has not been moved for no less than 5 years reached an all-time excessive of 28.057%. The share of provide final energetic two or extra years in the past reached a brand new all-time excessive of 49.338%.

These important knowledge factors counsel that long-term buyers maintain a big quantity of bitcoin. They’re likelier to maintain it by way of the bear market and never trigger important promoting stress. One other Glassnode chart reveals that the bitcoin steadiness on exchanges simply reached a four-year low of two,246,301. The much less bitcoin is held on exchanges, the much less bitcoin is offered to promote at any second.

Observe Us on Google Information