Advert

Because the crypto asset market has expanded dramatically in recent times, stablecoins have additionally skilled outstanding development.

In response to this, the Digital Euro Affiliation (DEA) issued a report analyzing the use instances of European-Union-denominated stablecoins, taking a look at tendencies like machine-to-machine (M2M) funds and different features of decentralized finance impacting the broader sector of the stablecoin market.

The report titled – “The way forward for machine cash – Alternatives for stablecoins in Europe” – means that Europe may leverage stablecoins to facilitate the event of the Web of Issues (IoT), supplied that laws are established.

Europe’s DEA believes that automated micropayments enabled by stablecoins might be a method for Europe to uphold its digital competitiveness.

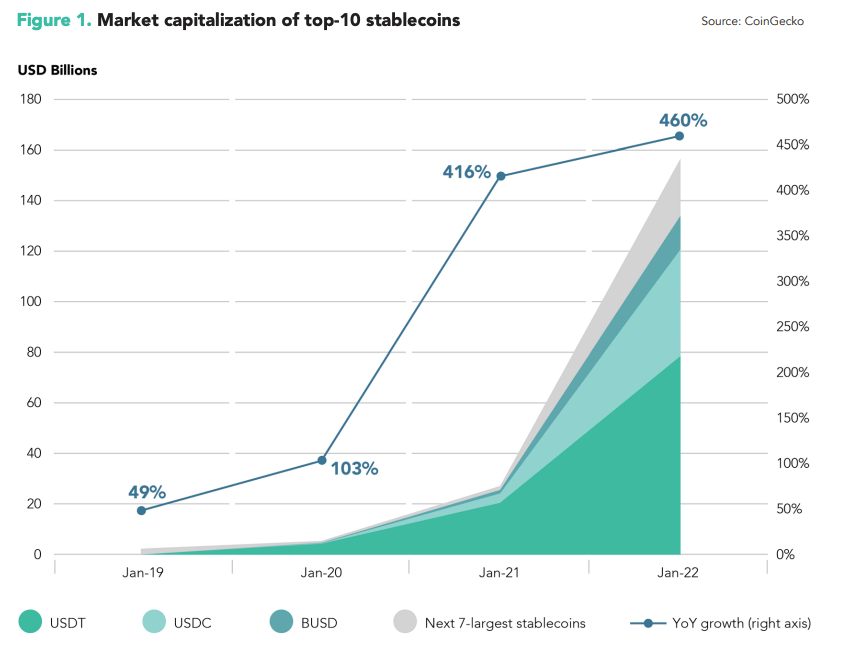

Market capitalization of top-10 stablecoins

As of March 2022, previous to the collapse of TerraUSD, the highest ten stablecoins had a mixed worth of roughly USD 164 billion, representing a 460% improve from the earlier 12 months.

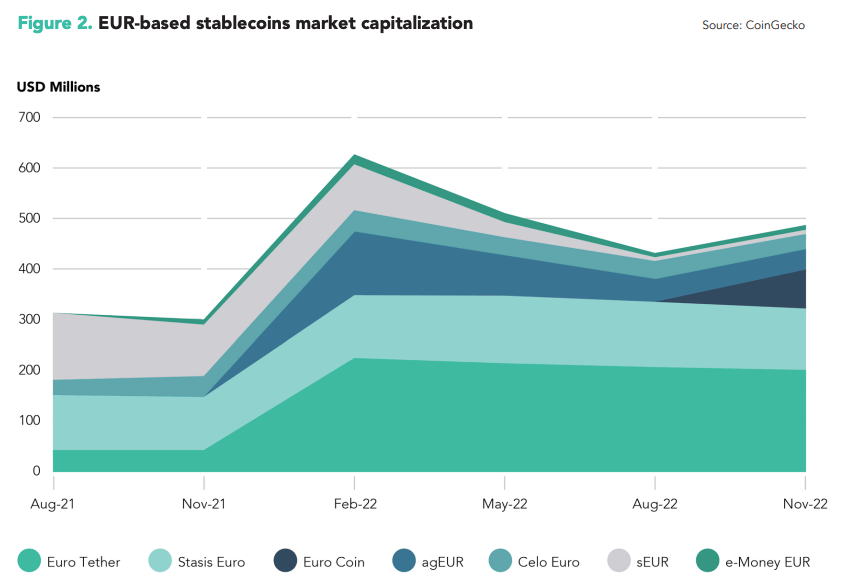

The 2 largest stablecoin issuers, Tether and Circle, have each launched stablecoins backed by the Euro. Tether’s Euro Tether (EURT) is valued at $220 million, with greater than 200 million tokens at present in circulation, whereas its USD-pegged stablecoin, USDT, has a market capitalization of $71 billion. Circle’s Euro Coin (EUROC) has a market capitalization of $33 million, whereas its USD-pegged stablecoin, USDC, has a market capitalization of $43 billion.

As of November 2022, EUR-based stablecoins accounted for lower than USD 500 million in market capitalization, equal to roughly 0.2 % of the full stablecoin market.

Europe’s potential stablecoin future

Aside from appearing as an entry level to crypto buying and selling, a protected haven from market volatility, and offering entry to decentralized finance (DeFi) markets, stablecoins have additionally been utilized to reinforce monetary inclusion and facilitate cross-border funds for underserved communities, the report argues.

Buying and selling, cross border remittances, inflation hedge, decentralized finance, and settlement of tokenized securities all function causes for stablecoin adoption.

Differentiation between internet-of-things (IoT) IoT and machine-to-machine (M2M) funds is beginning to emerge, nonetheless, led by greater than 11.3 billion operational IoT units worldwide in 2021, which consultants imagine will surge to 30 billion by 2030. This burgeoning pattern is ready to impression all sectors of the economic system and is predicted to unlock financial worth starting from USD 5.5 trillion to USD 12.6 trillion, an financial boon for world finance too.

Key findings

The report says that European policymakers and regulators ought to encourage the implementation of industry-wide or EU-level requirements that incorporate established finest practices and world requirements.

- “EUR-based stablecoins for M2M funds might be issued on various kinds of blockchains or distributed ledgers (e.g., permissionless, permissioned, hybrid and even consortiums).”

- “With a digital euro not prone to be issued till late 2026 on the earliest, another instrument is required for development within the M2M area to really develop. EUR-based stablecoins may play an vital function on this regard.”