The Large Flip thesis has been gaining traction within the monetary world and describes the market’s misplaced perception within the path of inflation and coverage charges.

The article beneath is a free full piece from a latest version of Bitcoin Journal PRO, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

The Large Flip

On this article, we break down a macro thesis that has been gaining an rising quantity of traction within the monetary world. The “Large Flip” was first launched by pseudonymous macro dealer INArteCarloDoss, and is predicated in the marketplace’s obvious misplaced perception on the trail of inflation and subsequently the trail of coverage charges.

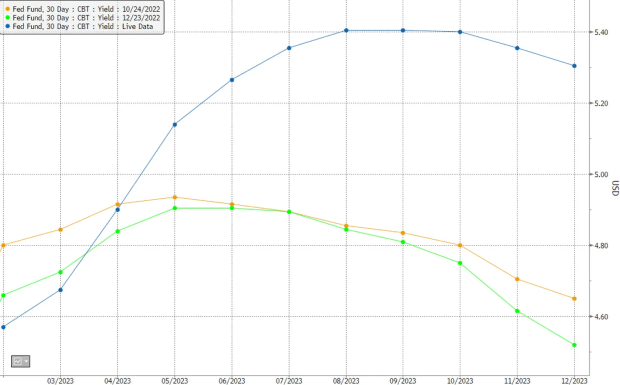

To simplify the thesis, the Large Flip was constructed upon the idea that an imminent recession in 2023 was flawed. Despite the fact that the charges market had totally priced within the perception that an impending recession was seemingly, the large flip and recession timeline could take longer to play out. Particularly, this alteration in market expectations could be seen by way of Fed fund futures and short-end charges in U.S. Treasuries.

Within the second half of 2022, because the market consensus flipped from anticipating entrenched inflation to disinflation and an eventual financial contraction in 2023, the charges market started to cost in a number of charge cuts by the Federal Reserve, which served as a tailwind for equites resulting from this expectation of a decrease low cost charge.

In “No Coverage Pivot In Sight: “Larger For Longer” Charges On The Horizon,” we wrote:

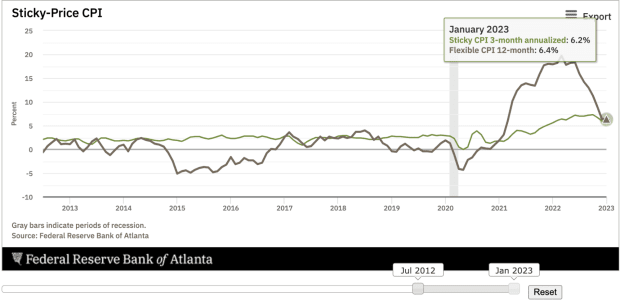

“In our view, till there may be significant deceleration within the 1-month and 3-month annualized readings for measures within the sticky bucket, Fed coverage will stay sufficiently restrictive — and will even tighten additional.”

“Whereas it’s seemingly not within the pursuits of most passive market members to dramatically alter the asset allocation of their portfolio based mostly on the tone or expression of the Fed Chairman, we do imagine that “greater for longer” is a tone that the Fed will proceed to speak with the market.

“In that regard, it’s seemingly that these trying to aggressively front-run the coverage pivot could as soon as once more get caught offside, not less than briefly.

“We imagine {that a} readjustment of charge expectations greater is feasible in 2023, as inflation stays persistent. This situation would result in a continued ratcheting of charges, sending threat asset costs decrease to mirror greater low cost charges.”

For the reason that launch of that article on January 31, the Fed funds futures for January 2024 have risen by 82 foundation factors (+0.82%), erasing over three full interest-rate cuts that the market initially anticipated to happen throughout 2023, with a slew of Fed audio system just lately reiterating this “greater for longer” stance.

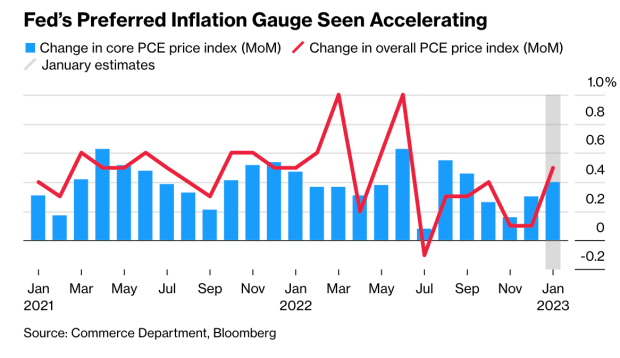

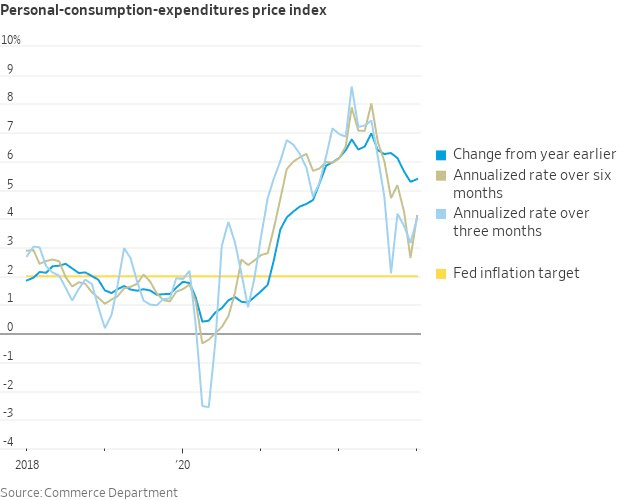

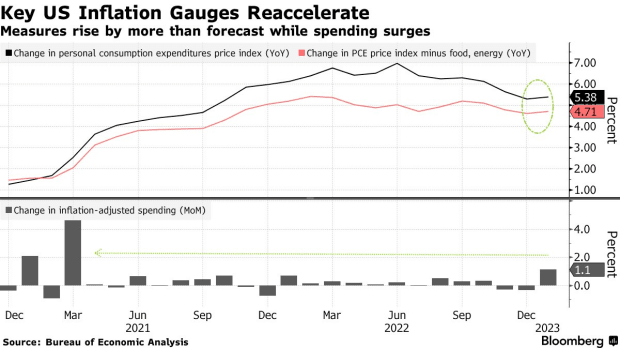

As we drafted this text, the Large Flip thesis continues to play out. On February 24, Core PCE worth index got here in greater than anticipated.

Proven beneath is the anticipated path for the Fed funds charge throughout October, December and within the current.

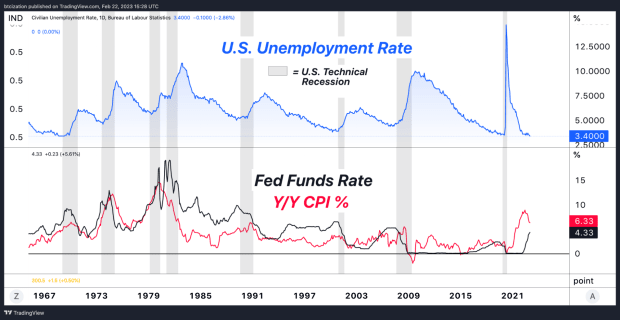

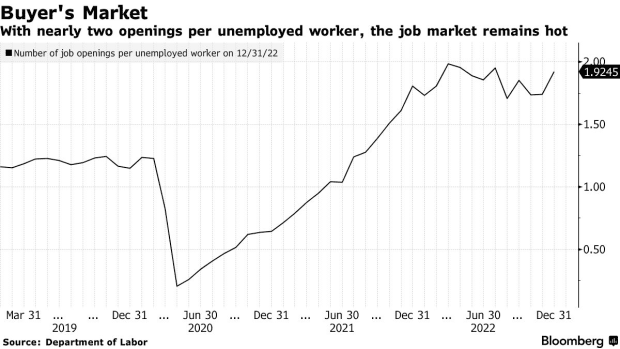

Regardless of the disinflation CPI readings on a year-over-year foundation throughout a lot of the second half of 2022, the character of this inflationary market regime is one thing that almost all market members have by no means skilled. This will result in the idea of “transitory” pressures, when in actuality, inflation seems to be to be entrenched resulting from a structural scarcity within the labor market, to not point out monetary circumstances which have vastly eased since October. The easing of monetary circumstances will increase the propensity for shoppers to proceed to spend, including to the inflationary strain the Fed is trying to squash.

With the official unemployment charge in the US at 53-year lows, structural inflation within the office will stay till there may be ample slack within the labor market, which would require the Fed to proceed to tighten the belt in an try and choke out the inflation that more and more seems to be to be entrenched.

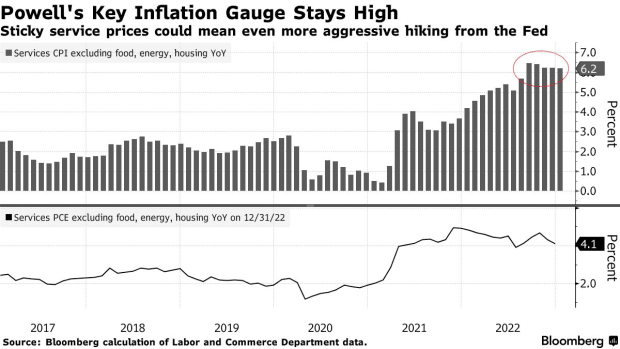

Whereas versatile parts of the patron worth index have fallen aggressively since their peak in 2022, the sticky parts of inflation — with a selected deal with wages within the service sector — proceed to stay stubbornly excessive, prompting the Fed to proceed their mission to suck the air out of the figurative room within the U.S. financial system.

Sticky CPI measures inflation in items and providers the place costs have a tendency to vary extra slowly. Which means as soon as a worth hike comes, it’s a lot much less more likely to abate and is much less delicate to pressures that come from the tighter financial coverage. With Sticky CPI nonetheless studying 6.2% on a three-month annualized foundation, there may be ample proof {that a} “greater for longer” coverage stance is required for the Fed. This seems to be to be precisely what’s getting priced in.

Printed on February 18, Bloomberg reiterated the stance of disinflation flipping again towards a reacceleration within the article “Fed’s Most well-liked Inflation Gauges Seen Operating Sizzling.”

“It’s gorgeous that the decline in year-over-year inflation has stalled utterly, given the favorable base results and provide setting. Meaning it received’t take a lot for brand new inflation peaks to come up.” — Bloomberg Economics

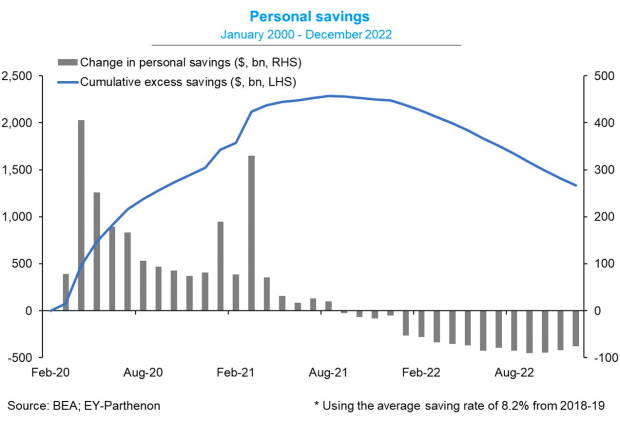

This comes at a time when shoppers nonetheless have roughly $1.3 trillion in extra financial savings to gas consumption.

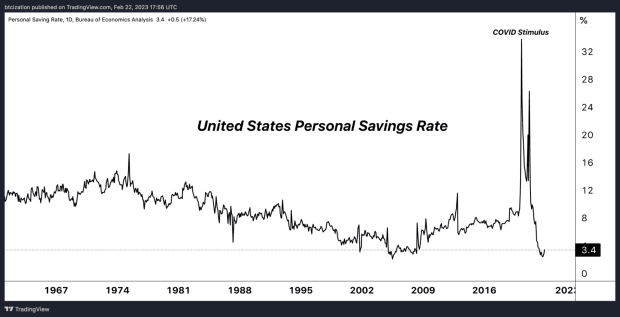

Whereas the financial savings charge is extraordinarily low and combination financial savings for households is dwindling, the proof suggests that there’s loads of buffer to proceed to maintain the financial system piping sizzling in nominal phrases in the interim, stoking inflationary pressures whereas the lag results of financial coverage filter by way of the financial system.

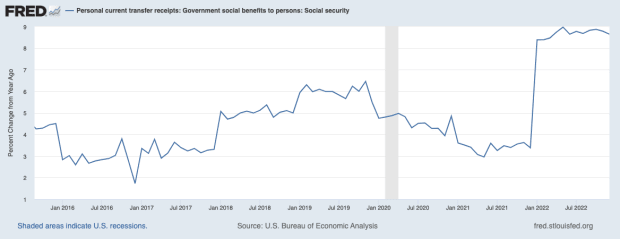

Additionally it is essential to recollect that there’s a part of the financial system that’s far much less rate-sensitive. Whereas the financialized world — Wall Road, Enterprise Capital corporations, Tech corporations, and so on. — are reliant on zero interest-rate coverage, there may be one other part of the U.S. financial system that may be very a lot insensitive to charges: these depending on social advantages.

Those that are depending on federal outlays are enjoying a big half in driving the nominally sizzling financial system, as cost-of-living changes (COLA) have been totally carried out in January, delivering a 8.3% nominal enhance in shopping for energy to recipients.

Social safety recipients are literally not in possession of any elevated shopping for energy in actual phrases. The psychology of a nominal enhance in outlays is a strong one, notably for a era not used to inflationary strain. The additional cash in social safety checks will proceed to result in nominal financial momentum.

Core PCE Comes In Sizzling

In Core PCE information from February 24, the month-over-month studying was the biggest change within the index since March 2022, breaking the disinflationary pattern noticed over the second half of the yr which served as a brief tailwind for threat belongings and bonds.

The recent Core PCE print is vitally essential for the Fed, as Core PCE notably carries a scarcity of variability within the information in comparison with CPI, given the exclusion of power and meals costs. Whereas one could ask in regards to the viability of an inflation gauge with out power or meals, the important thing level to know is that the risky nature of commodities of mentioned classes can distort the pattern with elevated ranges of volatility. The true concern for Jerome Powell and the Fed is a wage-price spiral, the place greater costs beget greater costs, lodging itself into the psychology of each companies and laborers in a nasty suggestions loop.

“That’s the priority for Powell and his colleagues, sitting some 600 miles away in Washington, and making an attempt to determine how a lot greater they have to increase rates of interest to tame inflation. What Farley’s describing comes uncomfortably near what’s recognized in economist parlance as a wage-price spiral – precisely the factor the Fed is set to keep away from, at any value.” —- “Jerome Powell’s Worst Concern Dangers Coming True in Southern Job Market”

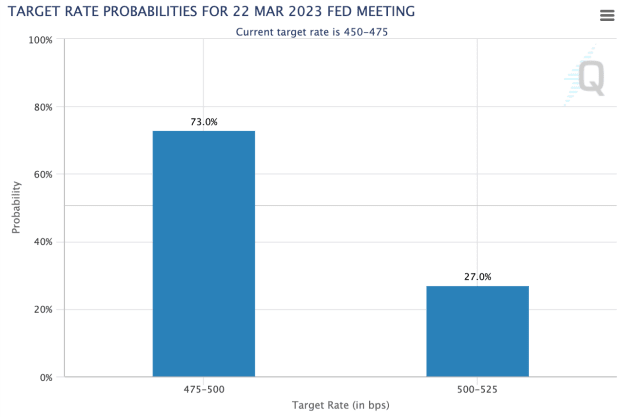

The Fed’s subsequent assembly is on March 21 and 22, the place the market has assigned a 73.0% chance of a 25 bps charge hike on the time of writing, with the remaining 27% leaning towards a 50 bps hike within the coverage charge.

The rising momentum for a better terminal charge ought to give market members some pause, as fairness market valuations more and more look to be disconnected from the reductions within the charges market.

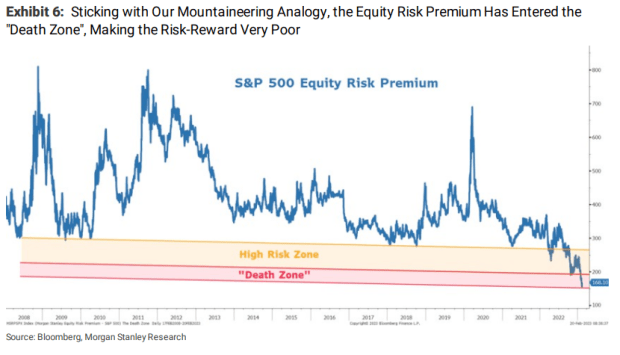

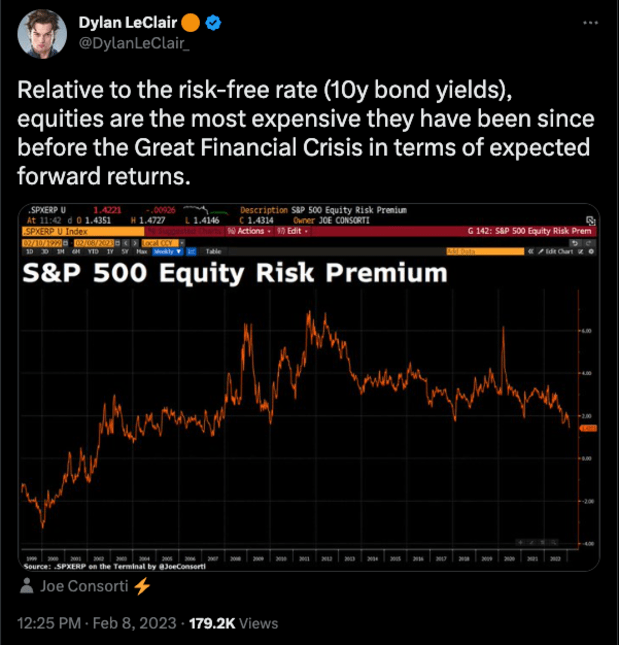

A lead Morgan Stanley strategist just lately expressed this very concern to Bloomberg, citing the fairness threat premium, a measure of the anticipated yield differential given within the threat free (in nominal phrases) bond market relative to the earnings yield anticipated within the fairness market.

“That doesn’t bode effectively for shares because the sharp rally this yr has left them the most costly since 2007 by the measure of fairness threat premium, which has entered a stage often known as the ‘dying zone,’ the strategist mentioned.

“The danger-reward for equities is now ‘very poor,’ particularly because the Fed is way from ending its financial tightening, charges stay greater throughout the curve and earnings expectations are nonetheless 10% to twenty% too excessive, Wilson wrote in a notice.

“‘It’s time to go again to base camp earlier than the following information down in earnings,’ mentioned the strategist — ranked No. 1 in final yr’s Institutional Investor survey when he accurately predicted the selloff in shares.” — Bloomberg, Morgan Stanley Says S&P 500 May Drop 26% in Months

Ultimate Be aware:

Inflation is firmly entrenched into the U.S. financial system and the Fed is set to lift charges as excessive as wanted to sufficiently abate structural inflationary pressures, which can seemingly require breaking each the labor and inventory market within the course of.

The hopes of a mushy touchdown that many subtle buyers had firstly of the yr look to be dissipating with “greater for longer” being the important thing message despatched by the market over latest days and weeks.

Regardless of being practically 20% beneath all-time highs, shares are pricier as we speak than they have been on the peak of 2021 and the beginning of 2022, relative to charges supplied within the Treasury market.

This inversion of equities priced relative to Treasuries is a major instance of the Large Flip in motion.

Like this content material? Subscribe now to obtain PRO articles straight in your inbox.

Related Previous Articles:

- No Coverage Pivot In Sight: “Larger For Longer” Charges On The Horizon

- Decoupling Denial: Bitcoin’s Threat-On Correlations

- A Story of Tail Dangers: The Fiat Prisoner’s Dilemma

- A Rising Tide Lifts All Boats: Bitcoin, Threat Belongings Leap With Elevated International Liquidity

- On-Chain Information Exhibits ‘Potential Backside’ For Bitcoin However Macro Headwinds Stay

- PRO Market Keys Of The Week: 2/20/2023