A multisig pockets is a particular kind of pockets for securely storing your Bitcoin. 3-5 signatures are sometimes required to entry the saved Bitcoin.

What’s a MultiSig pockets?

A multisig pockets is a pockets that gives customers with additional safety as a result of it requires a number of distinctive signatures (therefore multi-signature) to authorize and execute a transaction. A standard — or single-sig — Bitcoin pockets incorporates a Bitcoin deal with, every with one related non-public key that grants the keyholder full management over the funds.

With bitcoin multisignature addresses, you’ll be able to have a Bitcoin deal with with three or extra related non-public keys, such that you simply want any two of them to spend the funds. A pockets’s non-public key grants entry to a person’s funds. It proves possession of your bitcoin and is critical to execute transactions together with a public key. If a non-public secret’s misplaced, all funds are misplaced, and there’s no solution to get well them. Spreading entry to a pockets throughout a number of keys is a safer measure.

Multisig just isn’t native to Bitcoin. The idea has been used within the banking sector for years and former to that it had been used for hundreds of years to guard the safety of crypts holding the dear relics of saints. The superior of a monastery would give monks solely partial keys for getting access to the dear relics. Thus, no single monk may achieve entry to and probably steal the relics.

Single-key vs Multisig

Most Bitcoin wallets use a single signature setup. One of these setup solely requires one signature to signal a transaction. Single-key addresses are simpler to handle as entry to funds is quicker. Nonetheless, additionally they signify a single level of failure growing dangers in your safety since hackers and malicious actors may extra simply entry them.

Single-key wallets are good choices for small and quicker transactions — like face-to-face funds — however should not beneficial for people and companies who have to retailer appreciable quantities of bitcoin. Like with money, should you lose entry to your single-key pockets, your funds are gone and there’s nothing you are able to do to get well them.

A multisig pockets, alternatively, is configured in a means that requires a mixture of keys from totally different sources to be operational — for instance, 2-of-3, which means that transactions can solely be executed if no less than 2 keys out of three are used.

Completely different variations exist, with a mixture of signatures required to entry funds and execute transactions. Some options demand that each one the non-public keys are used to create the signature and authorize a transaction for optimum safety.

Multisig options should not new to bitcoin. The idea was first pioneered and formalized into the usual Bitcoin protocol as early as 2012 however solely began getting traction in 2014 after the shutdown of the Silk Street and the collapse of the bitcoin trade Mt.Gox. The 2 hostile occasions urged builders to advertise a greater solution to receive most safety towards hacks and confiscation by authorities.

Why use a multisig pockets?

There may be an growing observe amongst companies to retailer their bitcoin as a reserve asset in multisig wallets, as solely counting on one particular person to protect the non-public key may develop into a regrettable mistake for the safety of the funds. By utilizing a multisig pockets, customers can stop the issues brought on by the loss or theft of a non-public key. So even when one of many keys is compromised, the funds are nonetheless secure.

A number of signatures required to authorize a transaction make it harder for somebody to steal your bitcoin since they would want entry to your whole non-public keys to pay money for your funds.

Think about any particular person or enterprise entity making a 2-of-3 multisig deal with and storing every non-public key in a unique bodily place and system, like a cell phone, a laptop computer and a pill. If one of many places is accessed by malicious actors, the system situated there may be stolen, and even when the pockets is compromised, the attackers received’t be capable to spend the funds utilizing solely that one key they discovered.

In the identical means, phishing and malware assaults are extra simply prevented as a result of the attackers can’t do a lot with one single key at their disposal.

Moreover malicious assaults of any nature, customers can nonetheless entry their bitcoin utilizing their different 2 keys in the event that they lose their non-public key. Multisig wallets are certainly a passport to extra peace of thoughts together with your funds.

How does a multisig pockets work?

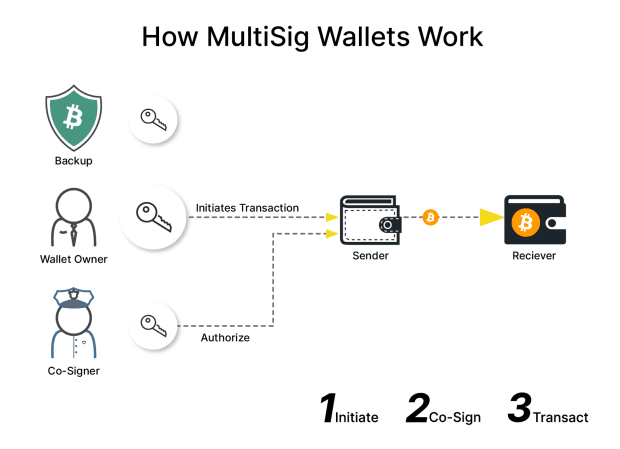

The method to provoke a transaction with a multisig pockets follows the identical steps no matter the kind of answer chosen. The person will enter the transaction’s particulars within the pockets and enter their non-public key to signal it. The transaction can be pending and solely finalized — and the funds despatched to the right deal with — as soon as all of the required keys are submitted.

Instance:

Step 1: Join the {hardware} system to an present pockets or create a brand new one;

Step 2: Await the pockets to acknowledge the {hardware} system and signal;

Join a second {hardware} and proceed as above;

Join the third pockets and signal as with the earlier gadgets.

Step 3: To execute a transaction you’ll solely want two of the three setup wallets above.

There’s no hierarchy within the non-public keys, solely the quantity required to signal the transaction in no explicit order issues. There is no such thing as a expiration date in multisig transactions, which can stay pending till all of the required keys are supplied.

Varieties of multi-signature wallets

Relying on the variety of non-public keys and signatures required to authorize a transaction, several types of multisig wallets can serve the aim, that are highlighted beneath.

- 1-of-2 Signatures: multisig wallets can be utilized to share funds amongst a number of customers, with every social gathering in a position to entry the funds while not having one other social gathering to authorize the transaction.

- 2-of-3 Signatures: when 2 out of three non-public keys are wanted to authorize transactions, the pockets’s safety is enhanced. One of these multisig pockets is often utilized by cryptocurrency exchanges to safe their scorching wallets. They normally maintain one non-public key on-line and one offline, with a safety firm storing the third one.

- 3-of-5 Signatures: one of these custody requires two keys — ideally geographically separated — for use to entry funds and authorize a transaction, with a 3rd social gathering normally being a safety firm’s key that can also be essential to entry the funds.

- Collaborative Custody vs Self Custody: a collaborative custody answer is used when a separate firm retains custody of your funds whereas leaving you management over your non-public keys. Nonetheless, additionally they possess a unique non-public key to entry the funds for enhanced safety. A self custody answer that means that you can management your whole non-public keys, the place you’ll be able to unfold the non-public keys throughout totally different gadgets and places as you see match.

Benefits of Multisig Wallets

Moreover common recommendations on how one can shield your cash — any cash — on-line, it is best to use extra precaution on the subject of bitcoin as a result of malicious actors will exploit any vulnerability in your system to pay money for it. .

Elevated Safety

Firstly, multisig options stop a single level of failure from occurring in order that should you lose your non-public key, you received’t lose your funds since you depend on a secure backup of separate non-public keys saved on totally different gadgets and places for straightforward entry.

Multisig wallets guarantee you might be extra shielded from cyber-attacks, making it a lot tougher for malicious actors to interrupt your safety that depends on a number of security factors, making them almost not possible to compromise.

Escrow Transactions

When utilizing a multisig pockets, you’re principally utilizing an arbitrator — a trustless escrow — to finalize transactions. Though this may increasingly sound like having an middleman, in distinction with Bitcoin’s true ethos, there are a couple of variations to think about.

Firstly, this may be a voluntary alternative that you simply make solely by personally selecting the escrow, which could be modified each time.

Secondly, the belief within the middleman could be minimal because the chosen safety entity can’t entry your funds or pay money for them with out your non-public key activation.

Two-Issue Authentication (2FA)

A number of signatures act as the everyday 2FA we use to entry totally different companies. Until no less than one other signature authorizes the transaction, the funds can’t be accessed and spent. This answer can also be acknowledged as a 2-of-2 multisig protocol, with the non-public keys saved on two totally different gadgets.

Co-operation between two events

Multisig options are perfect for companies as a result of totally different people or teams can view balances, however to entry and switch the funds, they’ll want no less than two sources — two non-public keys — to authorize the transactions.

Disadvantages of Multisig Wallets

Though multisig wallets signify an improved answer to safety points, they may very well be higher. They’ve dangers and limitations, together with a grey space within the events’ obligation in case one thing goes mistaken.

Transaction Velocity

As a result of reliance on a number of events to authorize a transaction, one of many multisig wallets’ essential drawbacks is low transaction velocity. Such a problem is definitely overcome if a person retains the funds wanted for fast transactions in quicker options like single-key scorching wallets and leaves a lot of the bitcoin holdings that have to be higher protected in multisig wallets.

Technical Information

Though there may be loads of academic materials on-line that will help you purchase the proper expertise for a clean multisig expertise, many individuals are intimidated by the technical data required to configure a multisig answer. Bitcoin custodial firms that supply multisig wallets are normally very proactive in serving to their clients arrange their options shortly and successfully.

Fund Restoration and Custodial

Restoration of funds in multisig wallets is likely to be tedious and intimidating for non-techie bitcoiners, because it requires the import of every restoration phrase on every totally different system, which can signify a problem to even essentially the most technically expert customers. Nonetheless, this shouldn’t discourage individuals from utilizing multisig because the prospect of dropping their funds extra simply from a single-key answer is extra daunting.

Ultimate Phrases

Whereas multisig is a good way to guard your bitcoin and gives a higher sense of safety and peace of thoughts, it may very well be higher. It is best to perceive bitcoin and wallets totally earlier than taking this subsequent step of buying your personal multisig. It’s possible you’ll discover our greatest multisig wallets information useful in your analysis.

In case you get previous the inconvenience of organising a multisig pockets and the technical studying required, multisig may also help you obtain higher peace of thoughts together with your bitcoin by including an additional layer of safety to your holdings.

With an general determine of roughly 4 million bitcoin endlessly misplaced to hacks, malicious assaults and poor private upkeep, it’s extra necessary than ever to guard your funds with the right instruments and data. Regardless of a couple of disadvantages, multisig wallets supply cheap options to companies and people by requiring a couple of signature to entry and switch funds.

The expertise behind multisig has improved massively since its early utilization and can probably see an elevated software sooner or later, particularly contemplating that dangers of hacks and lack of funds are a number of the points that discourage individuals from investing in bitcoin. With higher safety, extra adoption is more likely to observe.

Whether or not or not you have to be utilizing multisig options is determined by your wants and preferences. If slightly inconvenience, sluggish transactions and technical necessities put you off, then a multisig pockets may not go well with you. Nonetheless, people, teams, firms and establishments that possess funds they will’t afford to lose, ought to use multisig with out hesitation for superior safety.