Inside the subsequent decade, the U.S. greenback will play a a lot much less dominant function than it’s at the moment, based on Jeffrey Sachs. The famend economist listed a couple of elements for the diminishing standing of the dollar reminiscent of its use as a political weapon by Washington, the introduction of currencies just like the digital yuan, and America’s shrinking share of the worldwide financial system.

United States’ Smaller Share in World Economic system to Have an effect on the Greenback

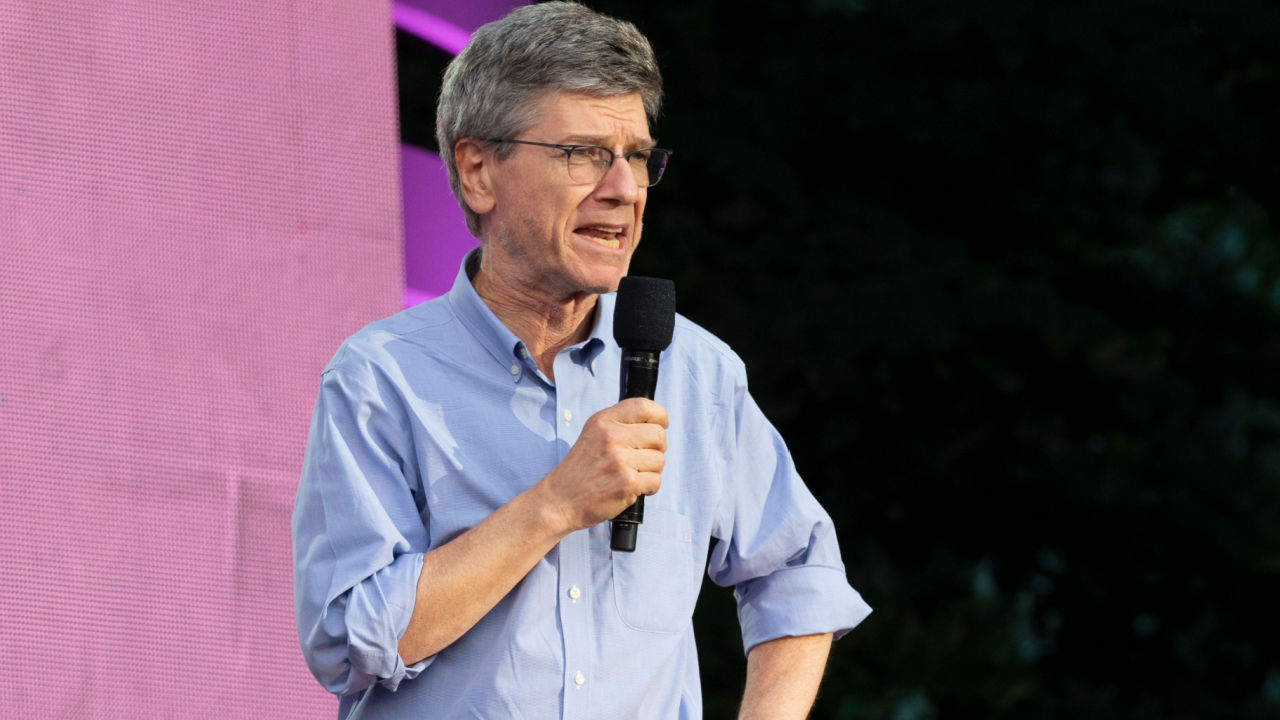

The function of the U.S. greenback will naturally lower because the share of america within the planet’s financial system turns into smaller and settlements in different currencies take maintain, economics professor and Director of the Middle for Sustainable Growth at Columbia College Jeffrey Sachs predicted.

Talking at an internet session of the most recent Annual Columbia China Summit on Friday, Sachs famous that the worldwide fee system is presently primarily based on the greenback, with as much as 60% of international commerce settlements performed or denominated within the U.S. fiat, and round half of foreign money reserves primarily based on it.

On the identical time, the U.S. share of the worldwide financial system is round 15%, in buying phrases. So the function of the greenback is way bigger than the function of the U.S. financial system, Sachs defined. He described the function of the dollar as “type of historic” and reflecting the ability of america within the twentieth century.

Quoted by the Chinese language Xinhua information company, Jeffrey Sachs additionally identified that with the U.S. turning its foreign money right into a political weapon, by confiscating international alternate reserves of Russia, Venezuela, and Iran, many international locations don’t need to maintain their cash in {dollars} anymore. He elaborated:

They don’t belief america they usually suppose the U.S. goes to confiscate their foreign money, particularly in the event that they get in some type of international coverage disagreement with america.

Position of Currencies Like Renminbi, Rupee, Ruble to Rise in Future

The economist additional remarked that the present function of the U.S. foreign money is essentially because of the dollar-based industrial banking system because the funds are often settled by industrial banks. Nonetheless, Sachs is satisfied that sooner or later, funds are going to be settled by central financial institution digital currencies (CBDCs).

The digital yuan (e-CNY), the digital model of the renminbi issued by the Individuals’s Financial institution of China, is now present process trials on the retail degree throughout the nation, however Sachs believes that it’ll finally change into a world fee system for cross-border settlements.

Russia, China, Saudi Arabia, India, and South Africa have been searching for different funds as they don’t need to use the U.S. dollar-based banking system and, based on Sachs, that’s comprehensible. The function of the U.S. greenback will diminish and the function of the renminbi, the rupee, the ruble, and different currencies will enhance sooner or later, he concluded.

Jeffrey Sachs is understood for his work as an financial adviser to governments from Latin America to Japanese Europe, the place he supported the transition to market economies. Two years in the past, Sachs criticized bitcoin for providing “nothing of social worth” however acknowledged a number of the advantages of utilizing digital currencies, together with extra environment friendly transactions.

Tags on this story

Do you agree with the predictions made by U.S. economist Jeffrey Sachs? Share your ideas on the topic within the feedback part under.

Lubomir Tassev

Lubomir Tassev is a journalist from tech-savvy Japanese Europe who likes Hitchens’s quote: “Being a author is what I’m, relatively than what I do.” Moreover crypto, blockchain and fintech, worldwide politics and economics are two different sources of inspiration.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, lev radin / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.