Bitcoin is lastly seeing some inexperienced after buying and selling at a loss over the previous two weeks. The cryptocurrency continues to commerce inside a decent vary, however exercise within the choices market might trace at a possible run towards new highs.

As of this writing, Bitcoin (BTC) trades at $27,900 with a 2.5% revenue within the final 24 hours. Over the past week, the cryptocurrency has seen twice the income recording a 4.4% efficiency. Different cryptocurrencies within the high 10 by market cap are experiencing related momentum.

Bitcoin Choices Trace At Recent Rally?

Knowledge from crypto choices buying and selling platform Deribit indicates a drop in Implied Volatility (IV). This metric measures the expectation of future worth actions by market individuals.

IV has been buying and selling sideways over the previous month, with a bent to the draw back. Deribit claims that rising uncertainty within the crypto market and the macroeconomic panorama is fueling the present dynamic on this metric, which interprets into gradual worth motion for BTC and crypto.

As the value of Bitcoin retraces, possibility consumers have been promoting their contracts. When the alternative occurs, and BTC sees an uptick, choices sellers dump their contracts.

This dynamic has put “fixed promoting stress” on the IV and contributed to suppressing the BTC spot sector. Nonetheless, the upcoming U.S. debt ceiling, the date this nation might default on its nationwide monetary commitments, might change the established order.

The narrative round this occasion hints at an extra appreciation for BTC and risk-on belongings. In the present day, equities and crypto rallied as key political factions within the North American nation reached a tentative settlement that might avert a disaster throughout the monetary world.

Over the weekend and into immediately’s growth, Deribit famous that maturity for BTC choices turned worthwhile. The change additionally noticed aggressive calls shopping for because the panorama indicators income for the cryptocurrency and costs return north of $27,000.

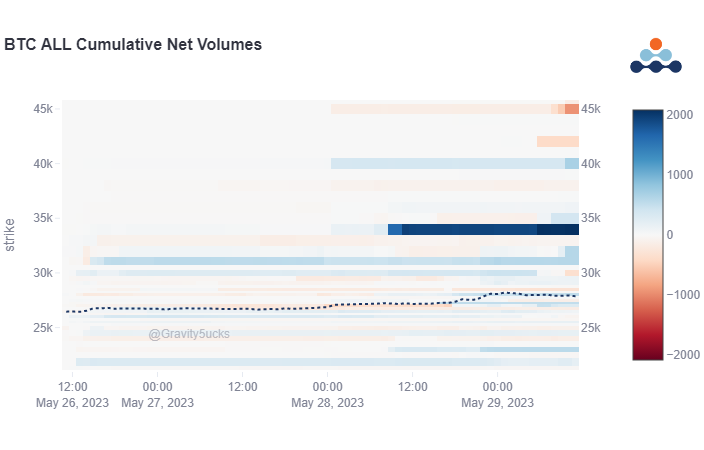

This massive participant purchased calls (purchase orders), betting that BTC might hit $34,000 someplace in July/August 2023, as seen on the chart beneath.

Deribit said in a market replace:

Sub 7day ATM-28k Calls + July 31k Calls purchased bravely forward of the lengthy weekend Theta turned worthwhile as Debt-ceiling talks progressed and a big DSOB purchaser of July+Aug 34k Calls aggressively collected at larger costs simply previous to Spot slicing via 27.3k and now 28k

Cowl picture from Unsplash, chart from Tradingview