On-chain knowledge reveals yesterday’s Bitcoin crash from $27,300 to $25,800 alone despatched 6.5% of the availability right into a state of loss.

Bitcoin Provide In Revenue Shrunk Down To 62.5% Following The Value Plunge

Based on knowledge from the on-chain analytics agency Glassnode, an additional 1.26 million cash have been misplaced after the most recent worth plummet. The related indicator is the “% provide in revenue,” which measures the proportion of the full circulating Bitcoin provide at the moment being held at a revenue.

The metric calculates this worth by going by means of the on-chain historical past of all of the cash on the community to see what worth they have been final moved at. If the earlier promoting worth for any coin was lower than the present spot worth of the asset, then that particular coin is counted contained in the revenue provide.

The counterpart indicator for the % provide in revenue is the “% provide in loss,” which naturally tracks the lack of provide. This metric’s worth may be discovered by subtracting the % provide in revenue from 100.

Now, here’s a chart that reveals the pattern within the Bitcoin % provide in revenue during the last couple of days:

The worth of the metric appears to have noticed some decline lately | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin % provide in revenue noticed a large plunge because the crash within the cryptocurrency from the $27,300 mark to the $25,800 degree happened.

The impetus behind this worth plunge was the US Securities and Alternate Fee (SEC) suing the cryptocurrency change Binance and its CEO, Changpeng Zhao, over alleged fraud.

Although despite the fact that the worth noticed a 5.8% plunge throughout this crash, the proportion of the full circulating Bitcoin provide that was despatched right into a state of loss measured to round 6.5%.

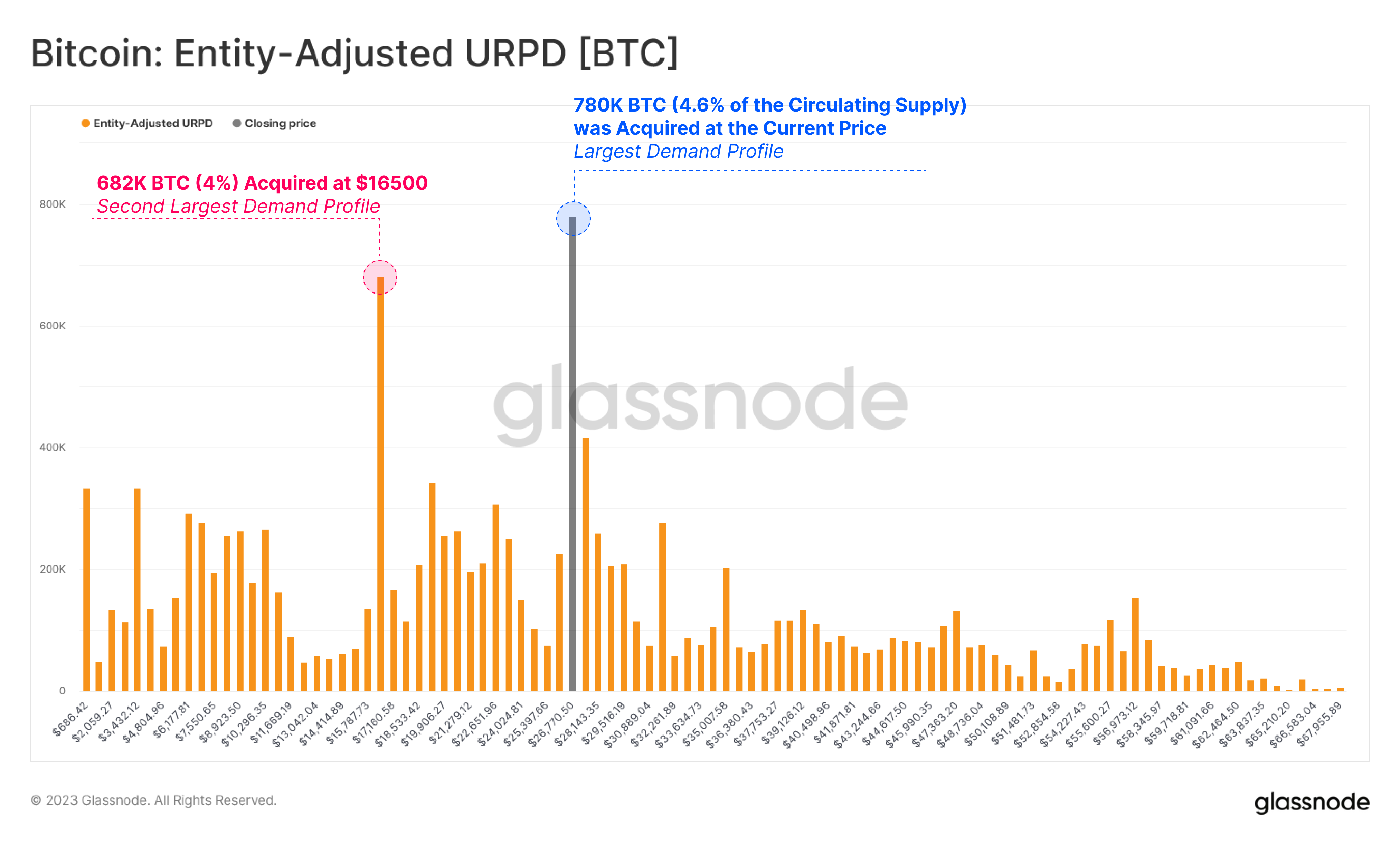

The analytics agency additionally defined the rationale behind this discrepancy; the worth vary that the asset had beforehand been buying and selling in was host to many buyers’ value foundation (that’s, the acquisition/shopping for worth).

Seems like the costs that BTC had been buying and selling at earlier than have been the middle of the most important demand profile | Supply: Glassnode on Twitter

Since a comparatively excessive share of the availability had been purchased at these ranges, it is smart {that a} sharp worth transfer under it could ship a big variety of cash right into a loss.

When Bitcoin had been buying and selling across the $25,800 degree, the % provide in revenue had dropped to simply 62.5%, whereas previous the crash, the indicator had a worth of about 69%. This may indicate that 37.5% of the availability had been misplaced after the plunge.

Since Glassnode posted the chart, nonetheless, the cryptocurrency has recovered, pushing again above the $26,000 degree. Naturally, because of this some cash would have returned to a revenue state.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,100, down 4% within the final week.

BTC has sharply risen throughout the previous couple of hours | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com