The fallout from the U.S. Securities and Trade Fee (SEC) lawsuits towards main cryptocurrency exchanges Binance and Coinbase is beginning to play out available in the market.

The authorized motion despatched shockwaves all through the crypto market, affecting many tokens within the lawsuits as proof that the exchanges have been buying and selling crypto securities. Analyzing the efficiency of those tokens towards Bitcoin for the reason that circumstances had been introduced produces the next chart.

On June 6, the tokens talked about within the lawsuits started to say no, with the sell-off accelerating for many of them approaching June 10.

Gaming-related tokens resembling CHZ, SAND, MANA, FLOW, and AXS all noticed double-digit drawdowns of as much as 28%.

The one token to keep away from the June 10 collapse was Nexo’s native token.

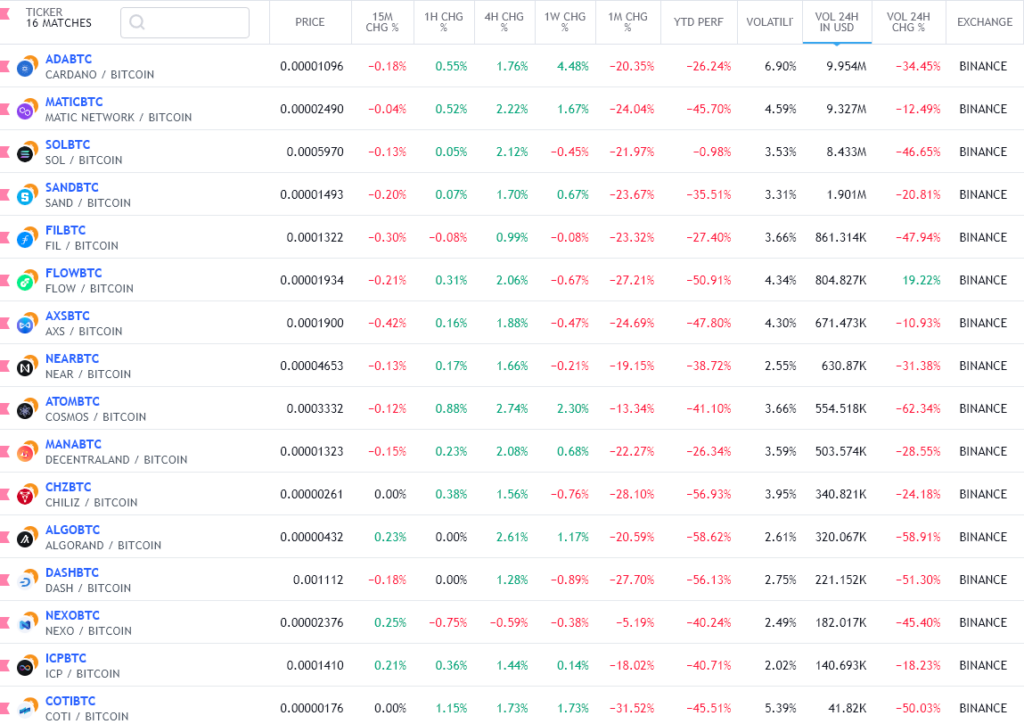

Tokens talked about in a single or each of the fits included SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, NEXO, ATOM, SAND, MANA, ALGO, and COTI. The beneath chart exhibits a screener of the tokens and their efficiency all through 2023.

Potential safety token efficiency

Of all tokens listed within the lawsuits, Nexo’s native token seems to have outperformed others by some margin when denominated in Bitcoin.

The token used on the Nexo trade to unlock increased yields and different options is down simply 5.19% over the previous month. Moreover, it’s down 40% for the reason that begin of the yr, rating sixth within the year-to-date (YTD) rankings of tokens talked about within the lawsuits.

Nexo pulled out of the U.S. in 2022, citing “a scarcity of regulatory readability” as the principle cause behind the choice. The transfer doesn’t essentially imply Nexo could be proof against prosecution by the SEC, because the regulatory physique can nonetheless pursue authorized actions towards the corporate for previous actions or ongoing violations involving US-based prospects.

Nonetheless, it seems NEXO has prevented the identical downturn impacting different tokens.

Cardano (ADA) additionally demonstrated resilience within the face of adversity, with a weekly improve of 4.48%, indicating a slight restoration for the reason that lawsuit. Nonetheless, in comparison with its month-to-month and yearly efficiency, Cardano suffered a decline of -26.24%.

Moreover, Polygon(MATIC), Sandbox (SAND), Cosmos (ATOM), Decentraland (MANA), Algorand (ALGO), and Coti have all managed to claw again some market share previously seven days.

Notably, tokens with increased buying and selling quantity on Binance, resembling ADA and MATIC, appear to have weathered the storm higher than tokens with decrease buying and selling quantity, resembling FLOW.

Solana (SOL) skilled a weekly change of -0.65% as the worth struggled to recuperate after the market-wide sell-off. Nonetheless, its total efficiency this yr stays comparatively secure, with solely a -1.18% decline in worth.

Solana was additionally struck by the collapse of FTX as a consequence of its affiliation with the trade’s founder, Sam Bankman-Fried which prompted SOL to fall over 70% earlier than recovering considerably. When the SEC lawsuits had been launched, SOL’s value was down 91% from its all-time excessive and subsequently fell an additional 21.9%.

As well as, tokens like FLOW, AXS, and NEAR have confronted a extra vital impression, struggling to recuperate, with weekly modifications of -1.08%, -0.89%, and -0.34%, respectively. These tokens have skilled substantial declines each of their month-to-month and yearly efficiency.

Reviewing the information, it’s clear that the lawsuits undoubtedly impacted the efficiency of talked about tokens. Whereas some tokens have proven indicators of restoration, others have been extra severely affected and struggled to regain prior value ranges.

Broader implications

All through the broader crypto market, the SEC’s lawsuits have had vital repercussions on the cryptocurrency market, impacting tokens labeled as securities and resulting in large liquidations, with over $200 million wiped off inside one hour from merchants holding positions available on the market.

The full market cap of digital belongings declined by 2.87% to $1.12 trillion. Moreover, the cryptocurrency market noticed internet outflows of over $40 billion over the primary 24 hours after the lawsuits’ launch, with all high 10 cryptocurrencies posting losses.

Because the cryptocurrency trade continues to debate the subsequent steps, the result of the SEC lawsuits towards Binance and Coinbase will play a vital function in shaping future market dynamics. Regulatory measures and their results on numerous tokens and exchanges stay unsure, capturing the eye of traders and trade professionals.

Regardless of the preliminary turbulence, some tokens have demonstrated resilience, highlighting the adaptability inside the market. The long-term affect of the lawsuits on the cryptocurrency panorama is but to be decided.

*All figures are in keeping with information from TradingView on June 12.

Disclaimer: Nexo has been an promoting companion of CrytoSlate.