The entire crypto market cap fell $53 billion as information of the U.S. Securities and Alternate Fee (SEC) submitting in opposition to Binance got here by means of.

On June 5, the SEC charged Binance, its CEO Changpeng Zhao, and associated entities with 13 violations, together with wash buying and selling, evasion of laws, and providing unregistered securities.

Binance mentioned it was disenchanted with the grievance and had at all times labored cooperatively with regulator’s inquiries. Nonetheless, it disputed the enforcement motion and meant to “vigorously” defend the fees.

A key part of Binance’s protection facilities on the SEC’s purported unwillingness to offer regulatory readability. It additional claimed that the corporate was a sufferer of the continuing “regulatory tug-of-war,” during which authorities companies search to “declare jurisdictional floor from different regulators.”

“Sadly, the SEC’s refusal to productively have interaction with us is simply one other instance of the Fee’s misguided and aware refusal to offer much-needed readability and steerage to the digital asset trade.“

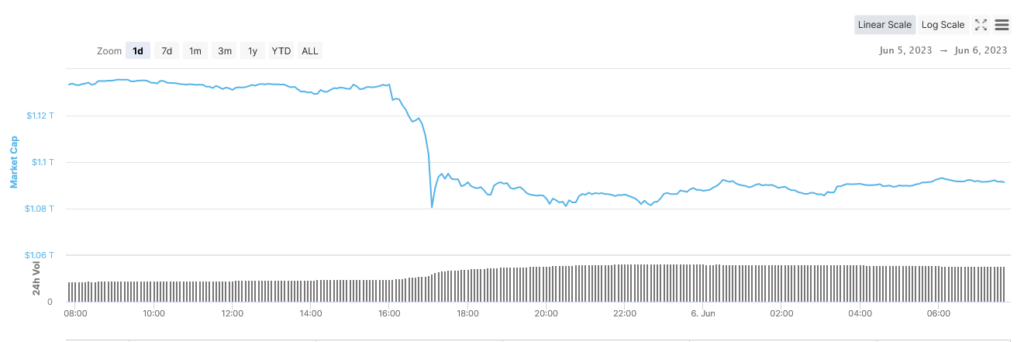

Crypto markets crash

Markets tanked on the information of the SEC submitting in opposition to Binance.

On June 5, at 16:00 BST, simply earlier than the information broke, the overall crypto market cap was valued at $1.13 trillion. As phrase unfold, the following dump bottomed at $1.08 trillion roughly an hour later – equating to a $52.7 billion, or 4.7%, drawdown.

A bounce adopted to high out at $1.1 trillion. The market has since traded flat as individuals contemplate the gravity of the state of affairs, significantly the allegations that a number of third-party tokens had been named as securities within the SEC submitting, together with ADA, SOL, and MATIC.

Largest winners and losers

Of the highest 100, the most important losers over the past 24 hours had been Pepe, The Sandbox, and Sui, which misplaced 15.2%, 14.8%, and 12.7%, respectively. The Sandbox was named as an unregistered safety within the SEC submitting.

Kava was the one high 100 token (excluding stablecoins) to remain inexperienced over the interval, which grew 9.6%.

Market chief Bitcoin suffered a peak-to-trough lack of 5% to seek out help at $25,400. It has since peaked at $25,890 however is shaping to retest $25,600 help.