On June 5, the U.S. Securities and Change Fee (SEC) filed intensive costs in opposition to main cryptocurrency alternate Binance and associated events, alleging securities legislation violations.

The submitting represents some of the complete units of costs filed by the SEC in opposition to a cryptocurrency firm up to now. Beneath are an important allegations and details.

1. BNB and BUSD are securities

The SEC declared Binance’s cryptocurrencies, together with the BNB alternate token (BNB) and the Binance USD stablecoin (BUSD), as securities.

The regulator said that Binance’s BNB Vault, Binance’s Easy Earn program, and Binance.US’s staking providers are securities as properly. It mentioned the corporate’s choices and gross sales had been all performed illegally and with out registration.

The SEC extra broadly mentioned that Binance and its U.S. counterparts did not register as an alternate, broker-clearer, or clearing company although they had been required to take action.

2. A number of third-party tokens are securities

The SEC mentioned that a number of tokens listed by Binance are securities, together with Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Algorand (ALGO), Axie Infinity (AXS), and Coti (COTI).

These tokens had been “offered as an funding contract and, subsequently, [were] a safety” from their first sale, the SEC mentioned. Although Binance didn’t situation the above tokens, the SEC complained that Binance didn’t prohibit the buying and selling of the belongings on its platform.

3. SEC desires Zhao, others enjoined

The SEC mentioned that Binance CEO Changpeng Zhao, Binance, Binance.US father or mother BAM agency Buying and selling, and related events needs to be completely enjoined — or prevented — from violating related sections of the Securities Act and Change Act. It additionally mentioned these events needs to be ordered to pay disgorgement and civil penalties.

The regulator added that Zhao needs to be barred from sure management roles. It said that Binance and its associated corporations needs to be barred from dealing in securities, crypto asset securities, and interesting in associated enterprise.

4. Binance evaded U.S. laws

The SEC mentioned that Binance explicitly marketed its providers to U.S. prospects after its 2017 launch and covertly after nominally proscribing U.S. entry in 2019.

One advisor advised Binance to create a “Tai Chi” entity within the U.S. tasked with publishing stories and interesting with the SEC “solely to pause potential enforcement efforts.” The advisor additionally inspired Binance to dam U.S. customers on its essential alternate whereas privately telling a few of these customers methods to bypass restrictions.

Binance and its executives didn’t settle for the Tai Chi plan completely, however many expressed curiosity in persevering with to work with the advisor.

5. Executives had been conscious of the scenario

Binance’s CCO — unnamed by the SEC — made statements indicating that he was conscious of wrongdoing. In 2018, the CCO mentioned: “We’re working as a fking unlicensed securities alternate within the USA, bro.” In 2020, he mentioned that Binance “[does] not need [Binance].com to be regulated ever” and mentioned this led to the creation of native entities.

Zhao and others had been additionally concerned in discussions of the Tai Chi plan. Zhao acknowledged that there have been “safer” alternate options however proceeded with a lot of the plan regardless. Zhao personally directed Binance to create a plan advising customers to bypass geo-block VPNs; he additionally advised Binance to encourage VIP customers to bypass KYC checks.

The SEC mentioned that Zhao and Binance had been conscious of the alternate’s massive variety of U.S. customers, as evidenced by inner shows estimating the agency had 1.47 million American customers in 2019.

6. CZ-owned corporations, managed U.S. funds

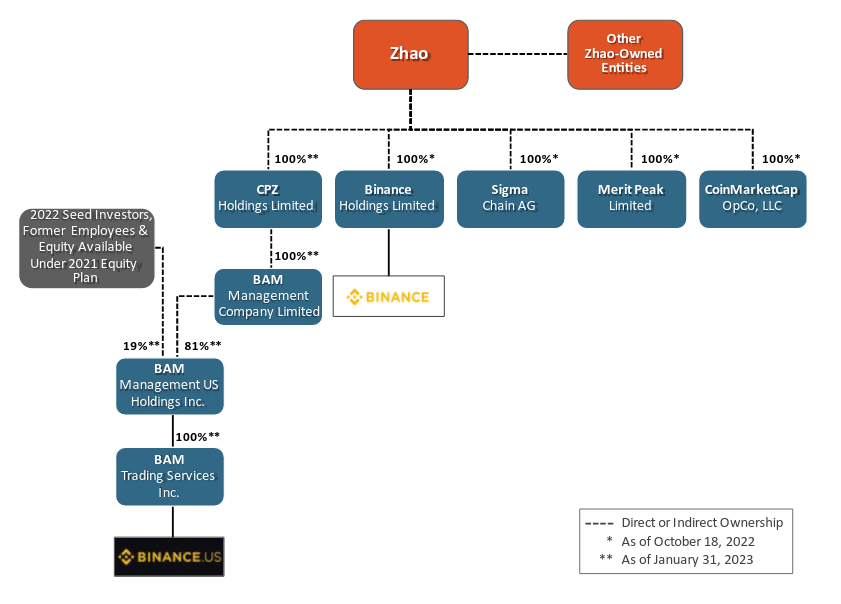

The SEC mentioned that Binance CEO Changpeng Zhao, together with different entities owned by Zhao, had 100% possession of a number of Binance-related corporations.

Although Zhao didn’t have 100% possession of U.S. corporations beneath BAM, he and Binance had vital management over their financial institution accounts and consumer crypto deposits. Moreover, Zhao’s Benefit Peak and Sigma Chain “had been used within the switch of tens of billions of U.S. {dollars}” between Binance and its U.S. counterparts, the SEC mentioned.

Zhao and Binance had been additionally concerned within the design, launch, hiring, buying and selling actions, and operations of U.S.-based corporations, based on the regulator.

7. Wash buying and selling ran rampant

Lastly, the SEC mentioned that Binance’s U.S. corporations misled customers by overstating protections in opposition to wash buying and selling and the accuracy of buying and selling volumes.

Important wash buying and selling passed off attributable to Sigma Chain’s function as a market maker, the SEC mentioned. At one level, Sigma Chain accounts wash-traded 48 of 51 of the newly listed belongings; at one other level, these accounts wash-traded 51 out of 58 listed belongings.

Despite earlier guarantees that the function existed, Binance’s U.S. corporations had no commerce surveillance mechanisms till at the least February 2022. Executives had been allegedly conscious of wash buying and selling however took no motion to cease the exercise.

The SEC mentioned that buying and selling information is materials info for customers and fairness traders and that Binance’s U.S. corporations profited from these deceptive statements. Subsequently, the corporations’ actions represent fraud and deceit, the regulator declared.