Knowledge from Glassnode reveals that the construction of the present Bitcoin rally is trying just like the genesis factors of historic uptrends.

Bitcoin Restoration Since November Lows Is Reminiscent Of Previous Rallies

In its newest weekly report, the on-chain analytics agency Glassnode has appeared into how the present Bitcoin rally strains up towards comparable rallies that the cryptocurrency noticed through the earlier cycles.

To make this comparability, the analytics agency has taken the info for the efficiency of the coin ranging from the all-time excessive in every cycle.

Here’s a chart that reveals how the previous bear market rallies have appeared like by way of this metric:

The bear market rally efficiency all through the totally different cycles | Supply: Glassnode's The Week Onchain - Week 28, 2023

Word that solely the upwards efficiency of Bitcoin is being thought of right here, and the drawdown has been excluded. From the chart, it’s seen that in all of the cycles, good points after the ATH was set disappeared in time because the bear market went into full gear.

Quickly after the bear backside formation came about, these cycles noticed the asset experiencing a restoration rally. Within the present cycle to this point, it’s not fully sure but if the November 2022 low seen after the FTX crash was certainly the cyclical backside.

Nevertheless, if it’s assumed that this low was certainly the underside, then the rally that has been occurring up to now few months would take the function of the restoration rally within the present cycle.

Curiously, to this point, the cryptocurrency has seen an uplift of 91% for the reason that aforementioned backside, which could be very comparable in scale to the restoration rallies of the previous cycles.

“Except 2019, all prior cycles which skilled an analogous magnitude transfer off the underside, have been in actual fact the genesis level of a brand new cyclical uptrend,” explains Glassnode.

The rationale 2019 was totally different is that the April 2019 rally (which can have usually acted because the restoration rally from the bear market backside) ran out of steam earlier than lengthy and the value subsequently declined.

The drawdown was then prolonged in March 2020 because the crash because of the emergence of COVID-19 came about. It’s the restoration rally from this crash that ended up resulting in the 2021 bull market.

Naturally, if the sample of the primary two Bitcoin cycles is something to go by, the present restoration rally construction might imply that the asset is now on its means towards a cyclical uptrend.

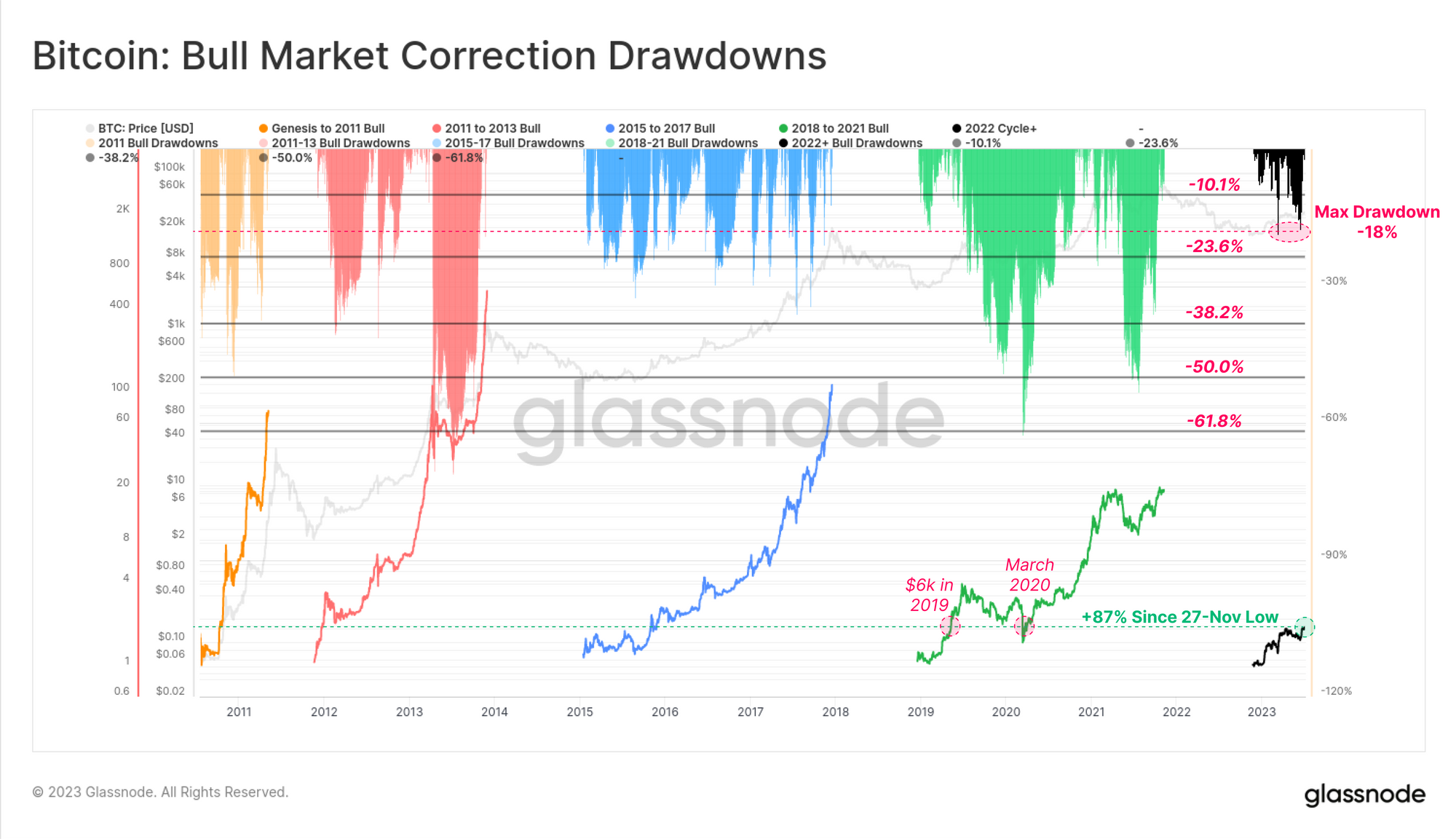

The analytics agency has additionally appeared on the rally from one other angle: this time by way of the drawdown (that’s, the adverse efficiency).

The drawdowns throughout the bull markets | Supply: Glassnode's The Week Onchain - Week 28, 2023

As displayed within the graph, the Bitcoin rally has seen a peak drawdown of simply 18% to this point, which is clearly a lot lower than what the earlier bull markets noticed. “This maybe suggests a comparatively sturdy diploma of demand underlies the asset,” suggests Glassnode.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,400, down 2% within the final week.

BTC has continued its sideways motion not too long ago | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com