For the Bitcoin and crypto market, the upcoming week guarantees to be a pivotal one. Whereas the US Shopper Worth Index (CPI), Jobless Claims, Producer Worth Index (PPI) and Michigan Shopper Sentiment are all on the horizon, three occasions stand out as notably: the July launch of the CPI and PPI knowledge, in addition to the much-anticipated Bitcoin ETF resolution for ARK Make investments.

Shopper Worth Index (CPI) On Thursday (8:30 am EST)

The CPI, a key measure of inflation, has been below the microscope because the US grapples with fluctuating inflation charges. The headline CPI is anticipated to rise from 3% to three.3% YoY in July, a notable shift as useful base results from the earlier 12 months start to fade. The Cleveland Fed’s Inflation Nowcast mannequin even forecasts a 3.42% headline CPI, barely above the consensus.

After the Federal Reserve raised rates of interest one other 25 foundation factors in July, 84.5% of the market at the moment assumes there will likely be no additional fee hikes on the subsequent FOMC in September, based on the CME FedWatch Instrument. Nevertheless, a re-acceleration in inflation knowledge may flip expectations solely round. Remarkably, there will likely be two CPI knowledge releases earlier than the following FOMC assembly from September 19-20. If each occasions inflation picks up after peaking at 9.1% and 13 consecutive months with a drop in headline CPI, this is able to be a worst-case situation for the monetary markets.

A particular focus will likely be on core CPI, which excludes unstable meals and vitality costs. With final month’s determine at 4.8%, predictions for July trace at a slight deceleration to 4.7%.

Nevertheless, with oil costs surging – as identified by Peter Schiff’s current tweet highlighting its potential affect on CPI – the trail of inflation stays unsure. Schiff remarked on Twitter:

Oil closed the week above $82, the sixth consecutive weekly achieve. The value is now up 30% from the Might low. Momentum is constructing and the oil value will seemingly exceed $100 quickly. This may put upward stress on the CPI, pushing the Fed additional away from its 2% inflation goal.

A rising CPI may sign to the Federal Reserve that additional rate of interest hikes could also be obligatory, a transfer that might have ripple results throughout the Bitcoin and crypto market.

Producer Worth Index (PPI) On Friday (8:30 am EST)

The PPI, which measures the typical change in promoting costs obtained by home producers for his or her output, is usually seen as a number one indicator for the CPI. Final month’s PPI YoY was a mere 0.1% (YoY), teetering getting ready to unfavourable territory. Nevertheless, forecasts for July counsel a rebound to 0.7%.

On a month-to-month foundation, the PPI rose 0.1% in June (0.2% was anticipated). It’s anticipated to rise once more by 0.2% in July. A rising PPI may foreshadow re-accelerating CPI knowledge as producers are passing on elevated prices to customers, probably resulting in a subsequent rise within the CPI. For the Bitcoin and crypto market, a higher-than-expected PPI may stoke fears of a second wave of inflation, influencing investor sentiment and techniques.

Bitcoin ETF Choice For ARK Make investments On Friday

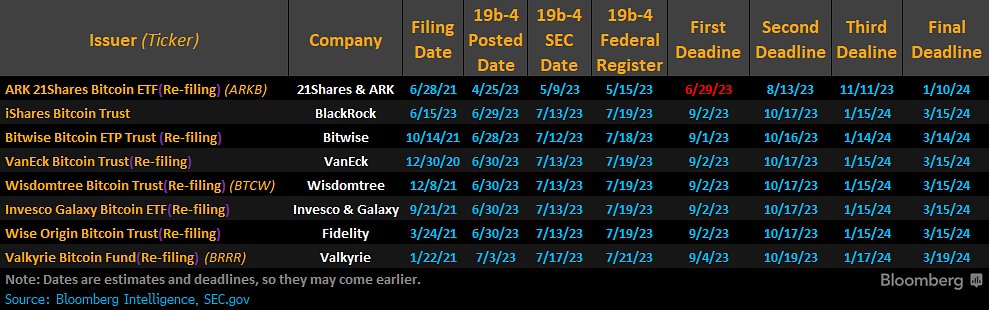

One the most important catalysts for the market may undoubtedly be the approval of a Bitcoin spot ETF and the race for a bitcoin spot ETF is slowly heating up. At the least by way of deadlines, Cathie Wooden’s Ark Make investments is the primary to get a choice.

Whereas BlackRock, Constancy, Invesco and the opposite monetary giants anticipate an preliminary response from the SEC, Ark Make investments is already one step forward. The US Securities and Change Fee (SEC) has already delayed Ark’s submitting as soon as. On Sunday, August 13, the SEC’s second deadline expires.

The SEC should resolve whether or not to approve the applying, reject it or prolong the overview interval once more. In complete, the SEC can do that 4 occasions, for a complete of 240 days. Nearly all of consultants assume that the SEC will once more push again Ark’s software. Nevertheless, given the brand new tones of SEC Chairman Gensler, a shock can’t be dominated out.

Late Friday night may due to this fact maintain some large information. Nevertheless, if the SEC postpones the Ark submitting, Bitwise could be subsequent, on September 1, earlier than the primary deadline for BlackRock, VanEck, WisdomTree, Invesco and Constancy on September 2.

At press time, the Bitcoin value stood at $29,079.

Featured picture from Brendan Church / Unsplash, chart from TradingView.com