PEPE has noticed a formidable 60% rally lately. Right here’s what on-chain knowledge says relating to whether or not this rise can proceed.

PEPE Has Seen Some On-Chain Metrics Mild Up Just lately

In a brand new post on X, the market intelligence platform IntoTheBlock has mentioned how PEPE is wanting by way of its on-chain indicators at the moment. The primary metric of curiosity right here is the revenue/loss breakdown of the memecoin’s consumer base.

The distribution of the PEPE holders based mostly on whether or not they're in loss or revenue | Supply: IntoTheBlock on X

As displayed above, about 35% of the holders/addresses of the cryptocurrency are carrying their cash with some internet unrealized revenue proper now. However, the loss buyers quantity to 51% of the community’s consumer base, which means that almost all of the holders are within the purple at the moment.

The remaining 14% of the addresses are breaking even on the present worth ranges of the asset. Usually, the buyers carrying earnings usually tend to promote their cash to reap their good points, which signifies that if there are numerous holders in revenue, important promoting strain might come up out there.

Within the present state of affairs, nevertheless, greater than 50% of the buyers are nonetheless carrying their cash at a loss regardless of the current 60% surge that PEPE has loved. Thus, the potential promoting strain within the sector is probably not an excessive amount of but. This might definitely be a optimistic signal for the rally’s sustainability.

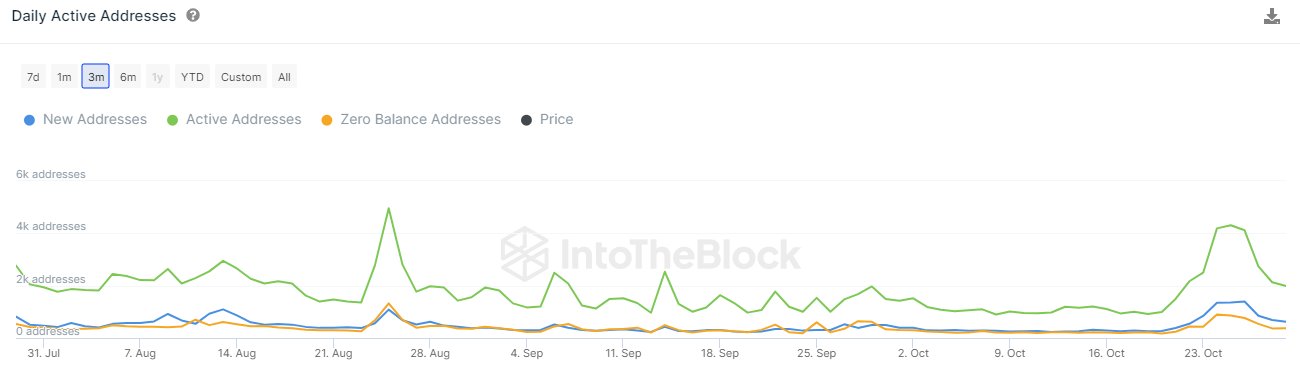

Subsequent, IntoTheBlock has identified how the tackle exercise associated to PEPE has noticed a big enhance lately.

Appears just like the metrics have registered excessive values in current days | Supply: IntoTheBlock on X

In keeping with the analytics agency, the lively addresses jumped 372% between October nineteenth and twenty fifth, whereas the brand new addresses elevated by 440% in the identical interval.

The “lively addresses” metric retains observe of the day by day variety of addresses taking part in some transaction exercise on the blockchain. In distinction, the brand new addresses indicator measures the day by day variety of wallets coming on-line on the community for the primary time.

The sharp development in these indicators would indicate that community exercise has been excessive lately, each by way of utilization and adoption. Traditionally, rallies have thrived in such situations, as numerous lively merchants is what such strikes require to be sustainable.

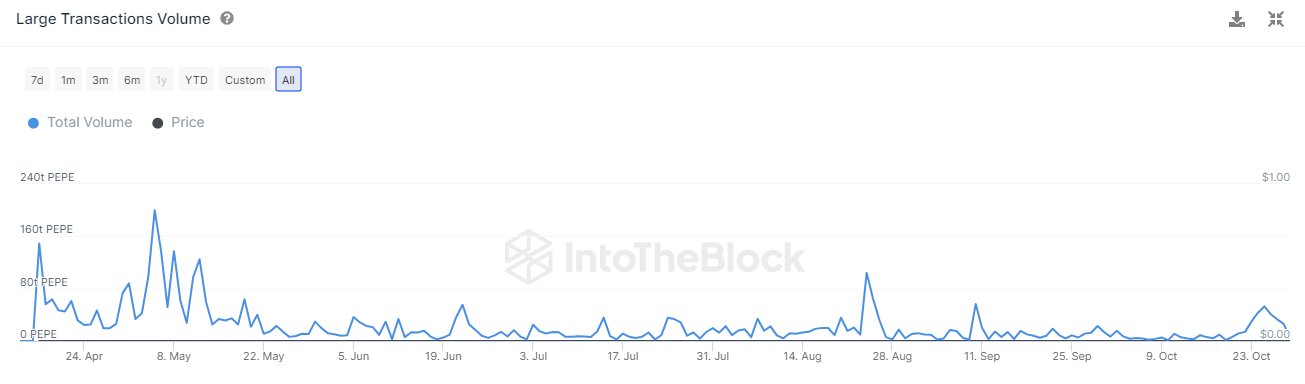

Lastly, IntoTheBlock has identified that whereas the PEPE whales haven’t proven concrete indicators of accumulation but, they’ve been doubtlessly changing into lively lately.

The metric has seen some uptick lately | Supply: IntoTheBlock on X

From the chart, it’s seen that the “massive transactions quantity” has noticed some rise lately. The big transactions consult with transactions price at the very least $100,000 in worth, often made by the whales and institutional entities.

Whereas the uptick within the exercise of those humongous buyers hasn’t been that a lot, it’s nonetheless an optimistic signal that these buyers have been exhibiting at the very least some curiosity in PEPE throughout this rally.

PEPE Worth

Since its sharp rise, PEPE has gone stale in the previous couple of days as its worth continues to commerce round $0.0000011672.

The memecoin has been buying and selling sideways up to now week | Supply: PEPEUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com