On January 25, market information supplier Kaiko revealed that the 60-day correlation between Bitcoin (BTC) and the Nasdaq 100 has averaged near zero since June 2023. This means that the 2 asset courses have change into much less correlated in current months, probably exhibiting that their costs are more and more decoupling.

Bitcoin Decoupling with Nasdaq 100?

Traditionally, Bitcoin has been extremely correlated with conventional asset courses, notably the Nasdaq 100, as a consequence of its affiliation with risk-on sentiment and speculative buying and selling. Nevertheless, this current divergence may sign a shift of their relationships.

A number of elements may very well be behind this decoupling. The rise of institutional traders within the crypto market has led to a extra various set of individuals and a broader vary of funding methods. Consequently, this might cut back reliance on conventional market indicators as a driver of Bitcoin worth actions.

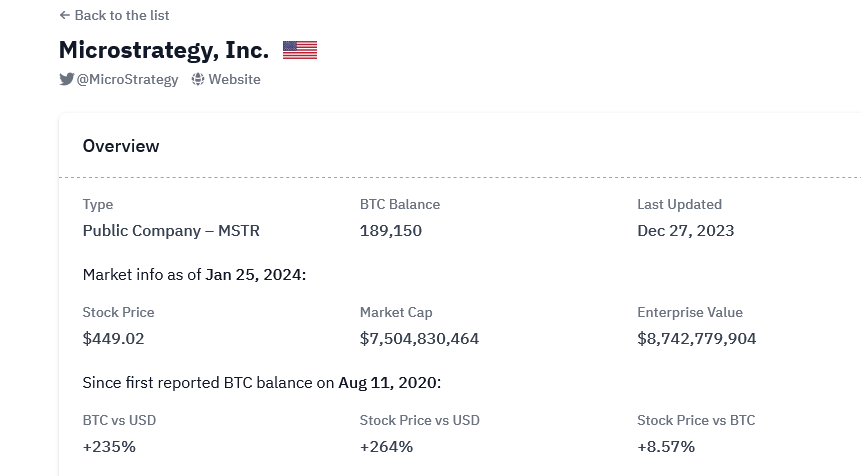

The rising adoption of Bitcoin as a retailer of worth and a medium of alternate may make it much less prone to the identical market forces as conventional belongings. For example, Microstrategy, a enterprise intelligence agency whose shares commerce on NASDAQ, has quickly gathered Bitcoin through the years, studying from Bitcoin Treasuries information.

In response to its former CEO, Michael Saylor, one key characteristic advising this transfer is its borderlessness and, principally, deflationary design. This characteristic makes Bitcoin an choice as a retailer of worth when inflation rages.

Moreover, Bitcoin has been adopted as an choice for remittance, serving to transfer worth throughout borders cheaply and conveniently. El Salvador, a rustic in South America, has already permitted Bitcoin as authorized tender, which means it may be used to pay for items and providers and settle taxes.

These essential developments and bettering crypto rules throughout main financial hubs like the US and Europe counsel that Bitcoin could also be maturing right into a extra impartial asset class with its distinctive funding traits.

What This “Decoupling” Means For Merchants And Traders

The weakening correlation between Bitcoin and the Nasdaq 100 may have implications for traders and merchants. It may enable traders to diversify their portfolios and cut back their publicity to conventional market dangers.

For merchants, it may create new alternatives for arbitrage and hypothesis. That is notable contemplating the thrill that the current approval of spot Bitcoin exchange-traded funds (ETFs) would doubtless set off a bull market in 2024.

Bitcoin stays beneath strain, trending at round $40,000. Whereas on-chain information means that spot Bitcoin ETF issuers have been gobbling up hundreds of cash, this hasn’t translated to positive aspects for probably the most priceless cryptocurrency. The medium-term resistance stays at $50,000.

Characteristic picture from Canva, chart from TradingView