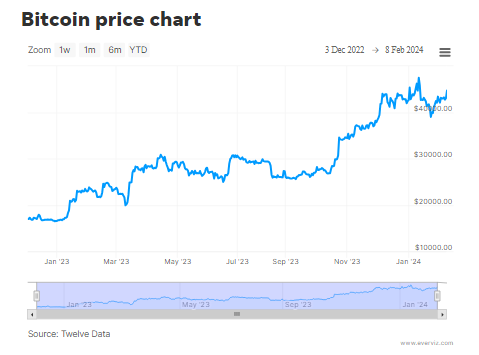

For the primary time because the spot ETFs’ debut commerce on January 11, Bitcoin (BTC) has surpassed $46,000. In response to knowledge from Coingecko, BTC had elevated 3.4% in the day before today to $46,075 on the time of publication, sustaining a 6% improve over the earlier seven days.

Bitcoin Flexes Muscle tissues, Reclaims $46K Stage

Regardless of the approval of a number of eagerly awaited exchange-traded funds that had been meant to strengthen its institutional legitimacy, Bitcoin’s 2024 has had a tough begin. Nonetheless, issues are enhancing as Bitcoin is now once more buying and selling above the $46k territory.

Laurent Ksiss, a specialist in crypto Alternate-Traded Merchandise (ETPs) at CEC Capital, talked about that if the present upward pattern continues, breaking the $45,000 mark might convey early traders within the BTC ETF near being worthwhile. He additionally recommended that this momentum would possibly result in some traders taking earnings, probably triggering a reversal and testing the $42,000 to $40,000 stage.

After the introduction of 10 ETFs in January, the worth of BTC skilled an unanticipated decline. The worth plunged after momentarily touching $49,000 when one of many funds, Grayscale, started transferring important parts of their cryptocurrency to Coinbase.

BTCUSD at present buying and selling at $46,165 on the each day chart: TradingView.com

This was on account of the truth that, earlier than Grayscale transformed the Bitcoin Fund ETF to an open-ended fund, traders needed to maintain their shares for no less than six months earlier than they might money out. Lots of the traders had been wanting to money out and redeem their shares when it grew to become an ETF in January.

Whale Urge for food Up For BTC

In consequence, Grayscale bought huge portions of Bitcoin, which dropped in value. It was buying and selling beneath $39,000 at one level. Nonetheless, it seems that the sell-off is ended, and Bitcoin is rising as soon as extra, partly on account of giant holders buying the asset.

In the meantime, Markus Thielen, head of analysis at Matrixport and founding father of 10x Analysis, says that Bitcoin (BTC) is headed in the direction of $48,000 within the close to future following its breakout pushed by a stable monitor report of good points through the Chinese language New Yr competition.

Since bitcoin usually rises by greater than 10% round Chinese language New Yr, starting on February 10, the next few days are extraordinarily necessary statistically, in response to Thielen’s analysis from Thursday.

Each time merchants acquired bitcoin three days previous to the beginning of the Chinese language New Yr and bought it 10 days later, the worth of bitcoin has elevated through the earlier 9 years, in response to Thielen.

Bitcoin Seen Hitting $50K

In a associated growth, LMAX Digital said that it anticipates bitcoin to proceed rising, perhaps hitting the $50,000 mark.

In response to LMAX Digital, technically talking, bitcoin has damaged out of a spread and could also be aiming for a surge to a brand new yearly excessive via $50,000.

Utilizing Elliott Wave idea, a technical examine that presupposes that costs transfer in repeating wave patterns, Thielen projected higher upside for bitcoin sooner or later.

The idea states that value developments evolve in 5 phases, with waves 1, 3, and 5 serving as “impulse waves” that point out the first pattern. Retracements between the impulsive value motion happen in waves two and 4.

Thielen stated Bitcoin has began its remaining, fifth impulsive stage of its rally, aiming to succeed in $52,000 by mid-March, after finishing its wave 4 retracement and correcting to $38,500.

Featured picture from Adobe Inventory, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site fully at your personal danger.