The cryptocurrency market just lately witnessed vital liquidations, totaling over $200 million, as Bitcoin surged previous the $69,000 mark.

The Bitcoin worth surge led to many brief positions being liquidated, inflicting notable monetary repercussions throughout numerous buying and selling platforms.

Bitcoin’s Sudden Rebound And Liquidations

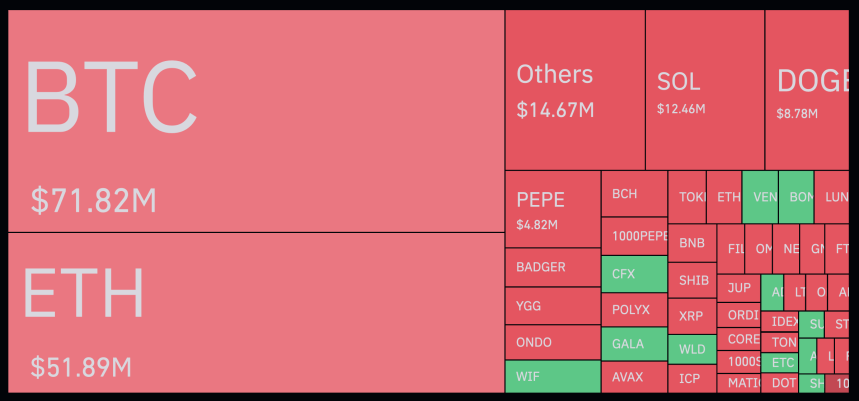

The information from Coinglass present a clearer image of the affect, displaying that round 60,388 merchants and counting confronted losses exceeding $200 million in simply 24 hours.

The distribution of those liquidations various among the many main exchanges, with OKX merchants experiencing the very best losses at $81.19 million, narrowly surpassing Binance’s $80.40 million in liquidations.

Bybit and Huobi additionally reported vital figures of $18.98 million and $17.05 million in liquidations, highlighting the widespread impact of Bitcoin’s surprising rally.

The resurgence of Bitcoin to over $69,000 was significantly noteworthy, given its place under $66,000 within the early hours of Monday. Whereas the precise catalyst for this abrupt rise stays unsure, it places Bitcoin a couple of {dollars} in worth away from reclaiming its earlier all-time excessive of $73,000.

Analysts and merchants are actually intently watching the marketplace for indicators of Bitcoin’s subsequent transfer, with hypothesis in regards to the potential for brand spanking new document highs within the close to time period.

Trying Forward: Bitcoin Bullish Prospects

Crypto analyst Cryptoyoddha has supplied an optimistic outlook for Bitcoin’s future, suggesting that the cryptocurrency is on the cusp of coming into a brand new section of its cycle that would see it reaching unprecedented heights.

In accordance with Cryptoyoddha, Bitcoin’s historic sample of accumulation, adopted by a parabolic surge, units the stage for what he phrases “Cycle IV,” a interval that would probably elevate Bitcoin’s worth to $150,000 or extra.

In accordance with the analyst, elements reminiscent of elevated institutional funding, evolving regulatory readability, and rising public acceptance of digital belongings are key drivers of this bullish sentiment.

The true pump will begin after the halving subsequent month. pic.twitter.com/eV5FWkzkxX

— Yoddha (@CryptoYoddha) March 23, 2024

In the meantime, Bernstein analysts Gautam Chhugani and Mahika Sapra just lately up to date their forecast for Bitcoin’s year-end worth, elevating it from an preliminary $80,000 to $90,000.

This adjustment was prompted by notable elements such because the sturdy influx into Spot Bitcoin ETFs and earnings from mining actions, which have contributed to a extra optimistic outlook on Bitcoin’s valuation.

Moreover, they maintained that Bitcoin is on observe to achieve $150,000 by mid-2025, attributing this anticipated progress to a number of parts, together with the affect of Spot Bitcoin ETFs, which they anticipate to drive a big upswing within the cryptocurrency’s worth.

Equally, Normal Chartered has revised its prediction for Bitcoin’s end-of-year worth. Transferring past their unique estimate of $100,000, the establishment now means that Bitcoin might ascend to $150,000 by yr’s finish, citing the catalytic position of Bitcoin ETFs in fostering their optimistic outlook on the asset’s future efficiency.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site completely at your individual threat.