After a value decline of practically 20%, sentiment round Cardano (ADA) has begun shifting from a downtrend to an uptrend attributable to its bullish value motion sample. Since July 2024, every time the ADA value falls to the present degree, it tends to expertise shopping for strain leading to an upside rally.

ADA’s Good Shopping for Stage

Based mostly on ADA’s day by day chart, that is the fourth time previously 4 months that the worth has reached this help degree, which we are able to take into account a shopping for degree.

At present, ADA is buying and selling close to $0.333 and has registered a 2.25% value drop previously 24 hours. Throughout the identical interval, its buying and selling quantity jumped by 26%, indicating robust participation from merchants and buyers, seemingly as a result of present degree which acts as a shopping for degree.

ADA Technical Evaluation and Upcoming Ranges

Based on the professional technical evaluation, ADA seems bullish and is presently at a powerful help degree of $0.31. This degree has offered vital help for ADA since July 2024. Nevertheless, it has additionally been noticed that when the asset reaches this degree, it typically witnesses a value surge of over 20%.

Based mostly on the current value motion, there’s a robust risk that ADA might expertise a notable value surge of over 20% to achieve the $0.40 degree within the coming days.

Regardless of this bullish outlook, the ADA day by day chart has additionally shaped a descending triangle sample. If ADA soars by 20% this time, then this sample will probably be breached, and we could witness a notable upside rally to the $0.45 degree.

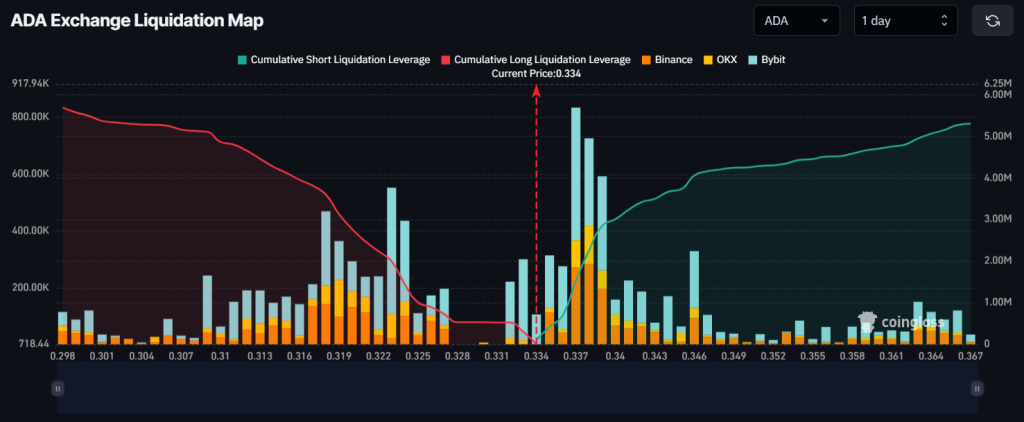

Main Liquidation Ranges

As of now, the main liquidation ranges are at $0.323 on the decrease aspect and $0.337 on the higher aspect, with merchants over-leveraged at these ranges, based on the on-chain analytics agency Coinglass.

If the sentiment stays bullish and the worth rises to $0.337, practically $1.53 million price of brief positions will probably be liquidated. Conversely, if the sentiment shifts and the worth drops to the $0.323 degree, roughly $1.99 million price of lengthy positions will probably be liquidated.

Combining the liquidation knowledge with the technical evaluation, it seems that bulls are presently dominating the asset, additional suggesting a possible upside rally and a shopping for alternative.