As 2024 involves a detailed, Bitcoin buyers are eagerly eyeing the ultimate quarter of the 12 months, historically recognized for constructive worth motion. With many speculating {that a} bullish rally could also be on the horizon, let’s break down the historic knowledge, analyze developments, and weigh the probabilities of what BTC’s worth motion may appear to be by the tip of this 12 months.

Historic Efficiency of Bitcoin in This autumn

Trying on the previous decade on the Month-to-month Returns Heatmap, This autumn has ceaselessly delivered spectacular positive factors for Bitcoin. Knowledge exhibits that BTC usually finishes the 12 months robust, as evidenced by three consecutive inexperienced months in 2023. Not yearly follows this pattern nevertheless, 2021 and 2022 had been much less favorable, with Bitcoin ending the 12 months on a extra bearish be aware. But, years like 2020 and 2015 by to 2017 noticed great worth surges, highlighting the potential for a bullish end in This autumn.

Analyzing Potential This autumn 2024 Outcomes Primarily based on Historic Knowledge

To higher perceive potential outcomes for This autumn 2024, we will examine earlier This autumn performances with the present worth motion. This can provide us an concept of how Bitcoin may behave if historic patterns proceed. The vary of potential outcomes is broad, from vital positive factors to minor losses, and even sideways worth motion. The projection strains are rainbow shade coded going from 2023 in crimson again to 2015 in a lightweight violet shade.

For instance, in 2017 (purple line), Bitcoin skilled a big enhance, suggesting that in an optimistic situation, Bitcoin might attain costs as excessive as $240,000 by the tip of 2024.

Nevertheless, extra conservative estimates are additionally attainable. In a extra average This autumn, Bitcoin might vary between $93,000 and $110,000, whereas in a bearish situation, costs might drop as little as $34,000, as seen in 2018 (blue line).

The median final result primarily based on this knowledge appears to be across the $85,000 worth level. Though that is primarily based on the 12 months finish worth from these projections, years akin to 2021 (yellow line) resulted in significantly greater worth earlier than notable pullbacks to finish the 12 months.

Is The Median Consequence A Chance?

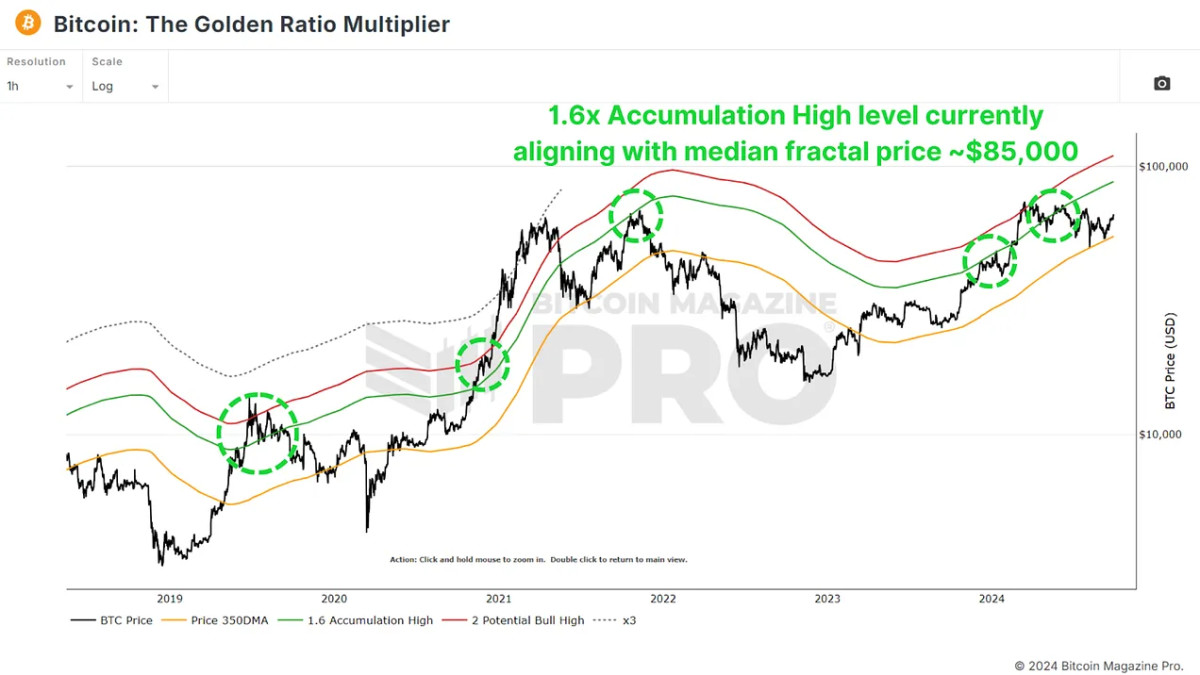

While an $85,000 in round three months time could appear optimistic, we solely must look again to February of this 12 months to see a single month during which BTC skilled a 43.63% enhance. We are able to additionally look to metrics akin to The Golden Ratio Multiplier that are displaying confluence round this stage as a possible goal with its 1.6x Accumulation Excessive stage.

Is $240,000 Even Attainable?

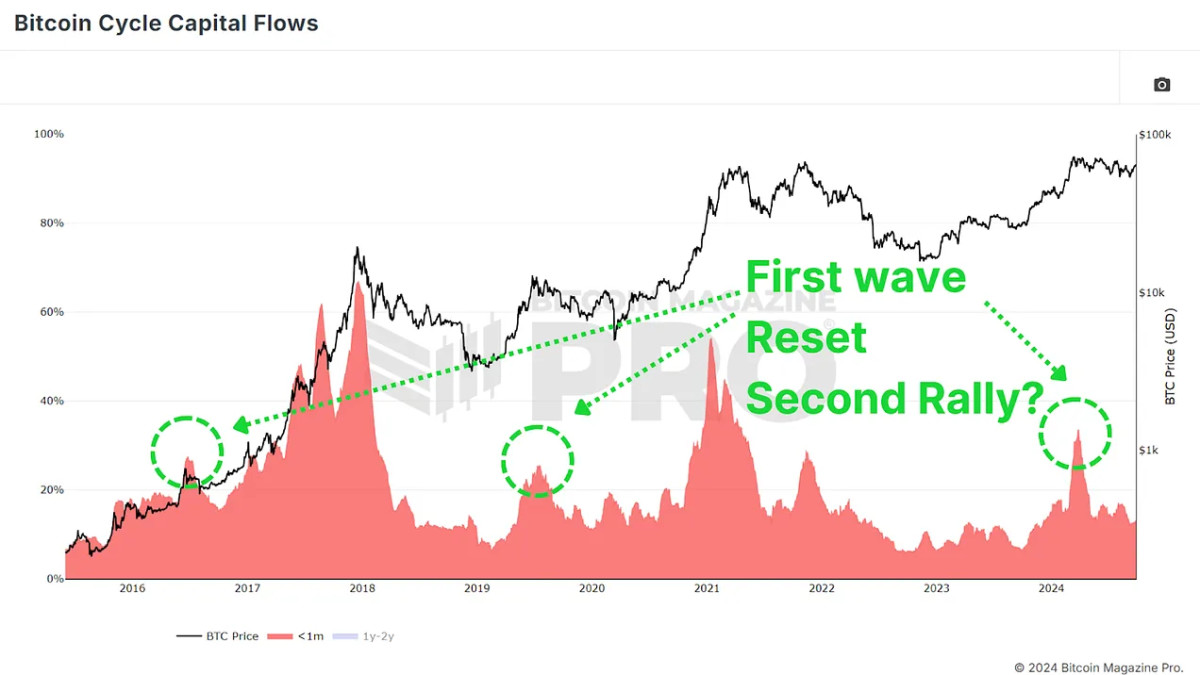

Whether or not Bitcoin can obtain such excessive values will depend upon varied components. A rise in demand coupled with restricted provide might propel Bitcoin to new all-time highs. Moreover, developments akin to Bitcoin ETFs, institutional investments, or main geopolitical occasions might additional increase demand. We’re additionally seeing an identical sample on this cycle as now we have seen within the earlier two, with a primary wave of huge scale market inflows earlier than a cool-off interval; doubtlessly establishing a second rally within the close to future.

That is in all probability over-ambitious, Bitcoin’s market cap has grown tremendously since 2017 and we’d require tens of billions of cash pouring into the market. However Bitcoin is Bitcoin, and nothing is out of the query on this house!

Conclusion

Finally, whereas historic knowledge suggests optimism for This autumn, predicting Bitcoin’s future is all the time speculative. A 3rd of all of those projections resulted in sideways worth motion, with one forecasting a big scale decline. As all the time, it’s vital for buyers to stay unbiased and react to, quite than predict Bitcoin knowledge and worth motion.

For a extra in-depth look into this subject, try our latest YouTube video right here:

Bitcoin This autumn – A Optimistic Finish To 2024?