Dogecoin (DOGE), the favored and largest crypto meme coin by market capitalization is poised for a value decline as sentiment begins to shift. For the previous few days, the general cryptocurrency market has been fairly complicated, elevating issues about whether or not the worth will rally or decline.

Nonetheless, at this second it’s unpredictable for forecasting value, though the DOGE day by day chart has shaped a bearish value motion.

Dogecoin (DOGE) Technical Evaluation and Upcoming Degree

In response to CoinPedia’s technical evaluation, DOGE is presently at an important assist stage of $0.383, after breaking out from an ascending triangle value motion sample. With the current ups and downs, together with important volatility, DOGE has efficiently retested the breakdown stage and is presently receiving assist.

Primarily based on the current value motion and historic momentum, if DOGE fails to carry this assist stage and closes a day by day candle under the $0.38 stage, there’s a robust risk it might decline by 15% to achieve the $0.31 stage within the coming days.

Nonetheless, DOGE’s Relative Energy Index (RSI) presently stands at 50, which is much from the overbought area, indicating a possible value reversal within the coming days.

83.68% DOGE Merchants Holds Lengthy Positions

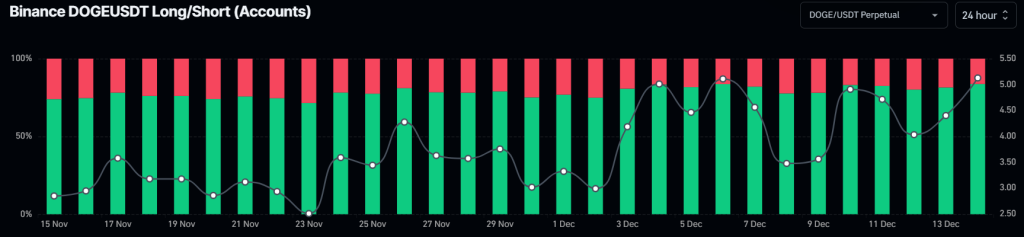

Apart from the bearish technical evaluation, it seems that merchants are those maintaining DOGE on the $0.383 assist stage, as reported by the on-chain analytics agency Coinglass. Knowledge from the Binance DOGEUSDT Lengthy/Quick ratio presently stands at 5.13, indicating robust bullish market sentiment amongst merchants.

Moreover, knowledge reveals that presently, 83.68% of prime Binance merchants maintain lengthy positions, whereas 16.32% maintain quick positions.

When combining these on-chain metrics with the technical evaluation, it seems that bulls are presently attempting to maintain the worth above the essential assist stage and forestall additional value decline.

DOGE Present Value Momentum

At press time, DOGE is buying and selling close to $0.39 and has skilled a value decline of over 2.65% prior to now 24 hours. Throughout the identical interval, its buying and selling quantity dropped by 26%, indicating decrease participation from merchants and traders as sentiment turns bearish.