https://x&interval;com/GuerillaV2

Earlier immediately on the Plan B Convention in El Salvador, Tether made an announcement that has been years within the making. USDT is again on Bitcoin utilizing Taproot Property.

The subsequent steps can be for Tether to mint the asset, which can be out there initially through Bitfinex.

Tether’s return to the Bitcoin ecosystem through Taproot Property isn’t just a easy re-entry; it is a strategic pivot that would herald a brand new period for each Bitcoin’s Lightning Community (LN) and the broader stablecoin panorama.

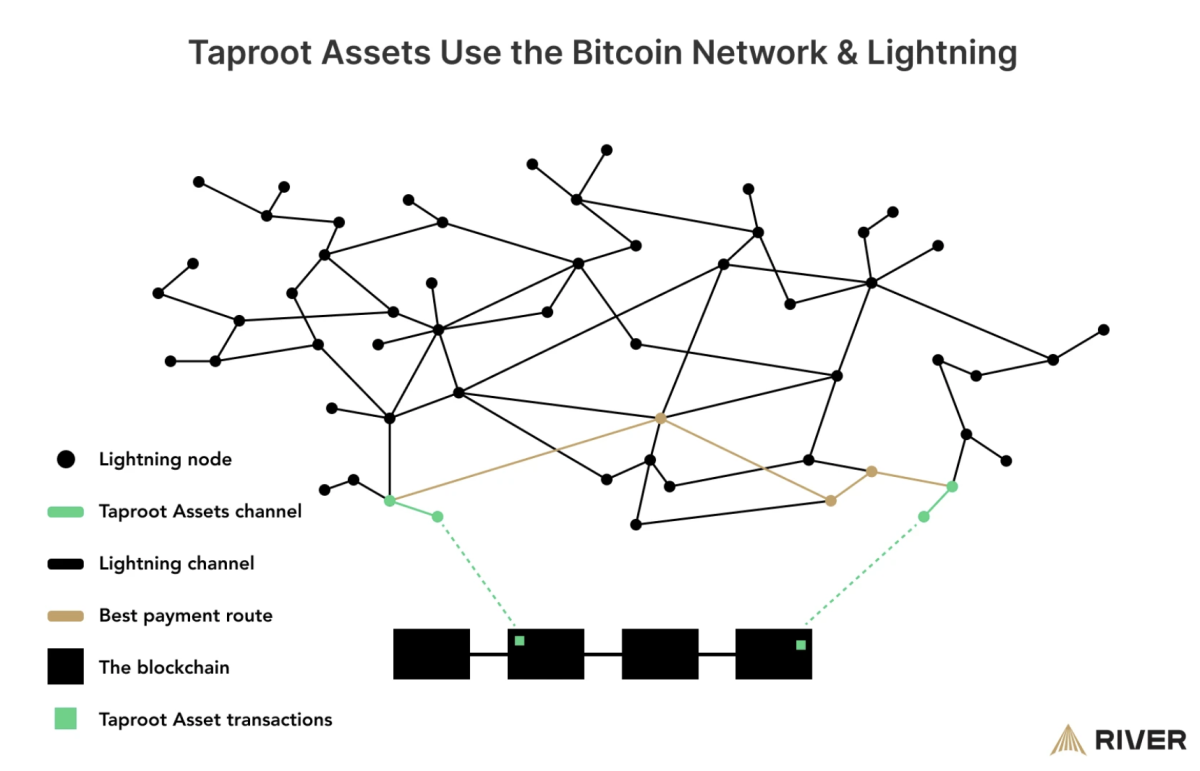

With USDT now returning to the Bitcoin community in a method that is additionally interoperable with Lightning (it has no direct affect on bitcoin the asset – besides that it’s massively bullish), customers can get pleasure from the advantages of near-instant, low-fee transactions, that are vital for the sensible use of stablecoins in on a regular basis commerce or remittances. The combination is especially useful in areas the place monetary infrastructure is both missing or prohibitively costly.

Having mentioned that, the Lightning Community might be not able to dealing with the exercise and consumer circulate occurring on competing chains like Solana or Tron. There’s additionally the query of how properly the Lightning Community will deal with the elevated load of stablecoin transactions with out degrading efficiency or resulting in centralization of node operations because of the want for greater liquidity.

The reply to this lies in a single easy variable: Good infrastructure – and that is the place Joltz is available in.

Additionally current on the Plan B convention, Joltz’s early wager on Taproot Property now appears prescient. Joltz introduces some notable developments within the Bitcoin infrastructure ecosystem with its distinctive options. It is one of many solely self-custodial cellular wallets supporting Taproot Property, enabling customers to handle multi-asset funds and swaps straight on Bitcoin. Past the standalone pockets, Joltz gives a software program growth package (SDK) that may very well be built-in by different builders, decreasing the time and price concerned in including help for these property, in addition to Bitcoin on-chain and Lightning transactions. This may very well be useful for current crypto wallets, asset issuers, stablecoin platforms, fintechs, fee apps, and exchanges, providing them a pathway to reinforce their providers with much less growth effort. Builders who need early entry to the Joltz SDK can enroll right here.

Just like how Trump promised to free Ross on Day 1, we should always demand that USDT be supported in all places on Day 1, with good UX. Joltz will ship on that – hopefully main the way in which for others to see the size of the chance that lies forward for Bitcoin.

Now: Why do you have to even need stablecoins on Bitcoin?

The current surge in meme coin exercise on Solana has led to vital community congestion, pushing transaction charges to file highs. Solana’s each day price income hit almost $78 million in late 2024, a direct results of the meme coin increase, however this got here at the price of greater transaction charges and occasional community congestion, difficult the consumer expertise. Equally, Tron has confronted its personal challenges with transaction charges. Tron’s each day price income has been reported to surpass $5 million, reflecting its vital position in dealing with stablecoin transactions but in addition highlighting the strain on its closely centralized community. We wish these charges on Bitcoin, for miners and routing operators.

LN gives almost infinite scalability by permitting transactions to happen off-chain, solely deciding on Bitcoin when obligatory. This method contrasts starkly with the scalability struggles of single-layer blockchains like Solana and Tron.

Moreover, with LN, there’s potential for brand new monetary merchandise. Locking Bitcoin inside Lightning channels can open up yield-generating alternatives like liquidity provision (leasing) or much more advanced monetary devices associated to routing, offering customers with new methods to generate NATIVE Bitcoin Yields not based mostly on questionable practices. (Additionally see my current report on Bitcoin Stablecoins.)

The announcement immediately underscores a broader lesson within the crypto house: whereas particular chains like Solana and Tron have made strides in velocity and price, true scalability requires time and a whole lot of funding into infrastructure to ensure decentralization and trustless exit: in any other case what’s the purpose? Centralized chains lead on Stablecoins is momentary – Bitcoin is perpetually.

Tether’s return to Bitcoin by Taproot Property signifies a vote of confidence in Bitcoin’s evolving capabilities. It is a testomony to the innovation inside the Bitcoin house and a reminder of how foundational applied sciences like Bitcoin can adapt and increase to satisfy new calls for regardless of the yapping of high-time choice critics of LN centered on chasing distractions as a substitute of true utility (meow).

This transfer might very properly set the stage for additional improvements in decentralized finance (DeFi) on Bitcoin (BTCfi), reshaping how we take into consideration Bitcoin as the last word Settlement Layer for all sorts of financial exercise.

Welcome again Tether! <3

This text is a Take. Opinions expressed are fully the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Articles Guillaume particularly might focus on matters or corporations which might be a part of his agency’s funding portfolio (UTXO Administration). The views expressed are solely his personal and don’t characterize the opinions of his employer or its associates. He’s receiving no monetary compensation for these Takes. Readers mustn’t contemplate this content material as monetary recommendation or an endorsement of any specific firm or funding. All the time do your personal analysis earlier than making monetary selections.